What is retrospective taxation? Why is retrospective tax being scrapped? Read to know more about this topic.

What is retrospective taxation? Why is retrospective tax being scrapped? Read to know more about this topic.

Retrospective taxation allows a country to pass a rule on taxing certain products, items, or services and deals and charge companies from a time behind the date on which the law is passed.

Apart from India, many countries including the USA, the UK, the Netherlands, Canada, Belgium, Australia, and Italy have retrospective taxed companies.

Also read: Corporate Tax

History Of Retrospective Taxation In India

As a result of the Finance Amendment Act, of 2012, retrospective taxation was introduced in India to impose taxes on deals executed after 1962 which involve transfers of shares in foreign corporations with existing assets in Indian jurisdictions.

Vodafone: Hutchison Case

In 2007, Vodafone acquired Hutchison for an $11 billion deal through an overseas holding company. India sent a notice to the UK telecom company. Vodafone challenged the notice in Supreme Court and the judgment favored the company.

The Union government amended the Finance Act and introduced retrospective taxation. In September 2020, a tribunal in The Hague ruled that India’s retrospective tax bill on Vodafone breached an investment treaty between India and the Netherlands.

Cairn Energy Case

Cairn UK transferred shares of Cairn India holdings to its counterpart, Cairn India in 2007. In 2012, India’s retrospective tax amendment was introduced. Cairn received a notice from India’s Income Tax department in 2014.

Cairn Energy called the tax imposed illegitimate and initiated an international arbitration to challenge the retrospective taxation. The arbitration tribunal in The Hague ruled in 2020 that the Indian government must pay $1.2 billion plus taxes to the oil and gas firm.

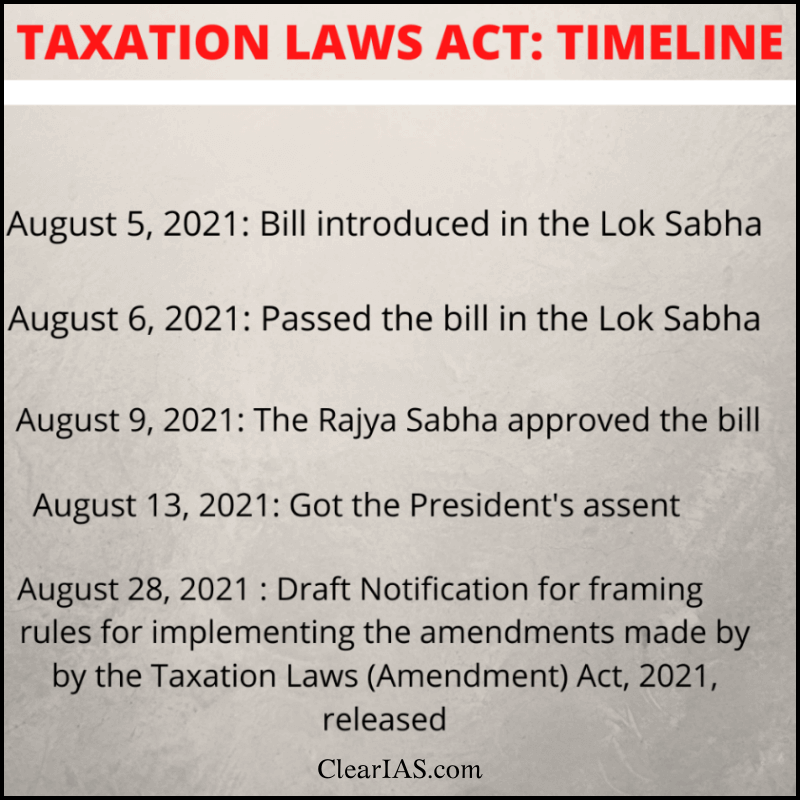

Timeline of Events for implementation of the Taxation Laws (Amendment) Act, 2021

Impacts Of Retrospective Taxation

Retrospective taxation meant that the government could impose and collect tax on a transaction or a deal that occurred in the past.

Is this an uncommon occurrence? No.

There have been many instances of retrospective amendments in tax laws.

In this case, it was pretty evident that the amendment made by the Government of India in 2012 was to overcome the judgment of the Supreme Court in the Vodafone case. This led to plenty of criticism of the Indian government on home grounds and overseas.

While it is debatable whether or not a country should impose a retrospective levy, the context of the levy, in this case, made the whole scenario entirely controversial.

- Confidence in government policy undermined: The amendment to the Income Tax Law that resulted in the retrospective taxation law was unexpected and unheard of.

- Ruin investment mechanism: It makes foreign investors fearful of investment in India.

- Put the rule of law the question: Violation of an investment treaty calls into question India’s very rule of law.

- The Credibility loss: India’s credibility suffers as a result of repeated adverse rulings against it by international arbitration mechanisms. E.g. UK oil firm Cairn Energy case, Devas Multimedia case.

- Impact on bilateral relations: The law affects the relationship between India and UK.

- Tax terrorism: Many Indian and foreign firms consider the law as tax terrorism.

- Impact on ease of doing business: Retrospective taxation severely damaged its image as an investment destination with ‘ease of doing business.

- Embarrassment to the country: Refusing to pay the deducted tax amount to the companies despite the order of an international arbitration tribunal results in the seizure of Indian assets abroad. E.g. Cairn Energy had secured a French court order to seize 20 Indian government properties in Central Paris.

Taxation Laws (Amendment) Bill, 2021

- It states that if the taxpayer agrees to withdraw all legal proceedings, all tax demand notices based on the 2012 amendment will be null and void.

- Aims to refund Rs. 8,100 crores collected under a retrospective tax law enacted in 2012.

Click here to know more about Goods and Services Tax

Significance Of Withdrawing Retrospective Tax

- Corrects the flaws of the 2012 amendment: The amendment aids in the correction of flaws committed in the name of retrospective taxation.

- To re-establish India’s credibility as an investment destination: The move assists India in re-establishing its lost credibility.

- Generate confidence in government: It portrays the government as pro-business and increases trust in government policy.

- Restore tax certainty: The new law leads to restoring tax certainty in India which is imperative for investment.

- Avoid more imminent embarrassment: The withdrawal of legal proceedings and the cessation of seizure of Indian assets assist the country in avoiding further embarrassment.

Way Forward

- India must transform from a nation where policy uncertainty to one where opportunity exists.

- The spirit of this change in the law must be translated into action.

- Before introducing a tax law, a consensus of all interested parties should be reached.

In order to promote private sector investment, it is necessary to have a stable and predictable tax regime. With the scrapping of the retrospective tax regime, India is expected to instill confidence in the regulatory and tax framework of the country among private investors.

Article Written by: Remya

Leave a Reply