‘The Chinese Rise’ and ‘The Chinese Century’ are phrases commonly used by media these days. Is China buying the world? In this post, we bring a brief review of the current global banking scenario.

China’s increasing clout in Global financial institutions

The post world war-II global financial scene has been dominated by the World Bank and International Monetary Fund, together known as the Bretton Wood twins. But of late, the world as a whole and Eurasia, in particular, has played host to the overtures of China, especially in the financial scene. Let’s us look into some of the institutions created or revamped under the watchful eyes of The Dragon.

Asian Infrastructure Investment Bank, AIIB:

- Now 97 approved members.

- Headquartered in Beijing.

- Aimed to fund the infrastructure needs of the countries in Asia. ADB notes an $800 billion infrastructure funding gap in the region.

- The capital of the bank is $100 billion.

- China has veto power in decision making.

- India, Russia also members.

- Despite objections from the US, European countries like Britain, France, Germany and US’ allies like Australia and South Korea have decided to participate in it.

European Bank for Reconstruction and Development, EBRD:

- EBRD was created to reinforce the unipolar global world order post-1991 USSR collapse.

- The main area of its focus is Eastern Europe, which integrated and continues to get integrated (as recent Ukraine coup points) to the western institutional hub.

- The focus area now ranges from Central Europe to Central Asia.

- The biggest shareholder is the United States.

- Headquarters: London.

- Founded in 1991. Owned by 65 countries and two EU institutions.

- EBRD recently approved China’s application to join it.

- Suma Chakrabarti is the present president of the bank.

New Development Bank, NDB:

- NDB is the outcome of the Fortaleza declaration of the BRICS countries.

- Treaty in force in July 2015.

- Headquartered in Shanghai, China.

- The authorized capital of $100 billion, with an initial subscribed capital of $50 billion, equally contributed by the 5 members (Brazil, Russia, India, China, South Africa). New members can join but the share of BRICS nations can never be less than 55%.

- All 5 countries have the same voting rights.

- KV Kamath is the president of the bank.

Also read: Global Financial Innovation Network (GFIN)

African Development Bank:

- Formed in 1964.

- Headquartered at Abidjan, Ivory Coast.

- It was formed in the post-colonial period, along with the African Union.

- China recently agreed to fund the African Development Bank with $2 billion as part of Africa Growing Together Fund.

Inter-American Development Bank:

- Established in 1959.

- Headquartered at New York.

- It is the largest source of development financing in Latin America and the Caribbean for economic and social development and regional integration.

- The US has 30% shares in the $70 billion capital of the bank. Combined with European members, it can veto the decisions of the bank.

- China became the 48th member of this bank, contributing $350 million to finance development projects in the region.

International Finance Corporation (under World Bank):

- It is a member of the World Bank group.

- It was established in 1956.

- Headquartered at Washington DC.

- It mainly offers investment, advisory and asset management services to encourage private sector development in the developing countries.

- China is increasingly using the IFC route to channel its foreign exchange reserves.

Silk Road fund:

- It is a state-owned investment fund of the Chinese govt. to foster increased investment in countries along with the One Road-One Belt initiative.

- It was founded in 2014, headquartered in Beijing.

- China has pledged $40 billion for the creation of this investment fund.

SCO Development Bank:

- A new bank was proposed under the auspices of the Shanghai Corporation Organisation, SCO.

Also read: International Financial Services Centres Authority (IFSCA)

Reasons for the current investment spree in China:

- The slow pace of reforms of the Bretton Woods institutions: The United States of America literally holds a veto in the decision-making of these bodies and also in appointments of the institution heads. As such, the IMF and World Bank choose to remain as the vestiges of the old unipolar world order, and not adapt to the changing tunes of the time. Developing countries like China and India are largely disappointed with this status-quo mentality and choose to tread a new path.

- China runs a current account surplus economy and has beefed up foreign exchange reserves to the tune of around $3 trillion (though it is coming down at a brisk pace, of late). President Xi is looking for possible greenfield areas to make the foreign exchange more productive. The One Road-One Belt initiative and the setting up of the new development banks are part of this larger aim.

- China is shifting from an export-led investment model to a domestic consumption-led investment model. To aid its erstwhile export-led model, it needed to keep the Chinese currency, Renminbi, always depreciated and thus boost its exports by competitive pricing of its products. This was achieved by investing in American treasury bonds (and thus appreciating dollars & keeping Renminbi value high). Now, when the development priority is shifting to a domestic consumption-led model, it no longer needs to continue investing in American bonds, which is low-interest yielding and can be put to better use by funding investment elsewhere.

- China’s Peaceful-Growth Theory: India has always accused China of a policy of encircling, the String of Pearls Theory. Funding peaceful development projects using these investment banks can help China to nullify this posturing of India and increase its soft power credentials in the immediate neighbourhood, thus attacking the US’ Pivot to Asia strategy as well.

- As noted earlier, China is shifting to the domestic consumption-led economic growth pattern. As such, China is planning to deploy elsewhere the productive capacity garnered over the past decades, which had fuelled the export-led growth model. This is evident from Chinese companies aggressively bidding for projects in Sri Lanka (Colombo port), Pakistan (Gwadar port), Maldives (GMR airport), Africa (Djibouti port) etc. Bids are won by providing soft loans directly from sovereign funds of China set up under different names.

- The global financial crisis of 2008 significantly shook up the credibility of the established financial ecosystem centred on the IMF and World Bank. The intervention of these two had minimal implications on the global economic scenario and the world has still not escaped from the aftermath of the recession. The crisis also undermined the credibility of G7, and developing countries started looking for fresh leadership, which China was ready to provide.

- Above all, there is a massive gap in the demand and supply of infrastructure investment funds. Existing institutions including World Bank and Asian Development Banks are not able to meet this increasing gap, which China aims to fill.

Domestic Banking in China

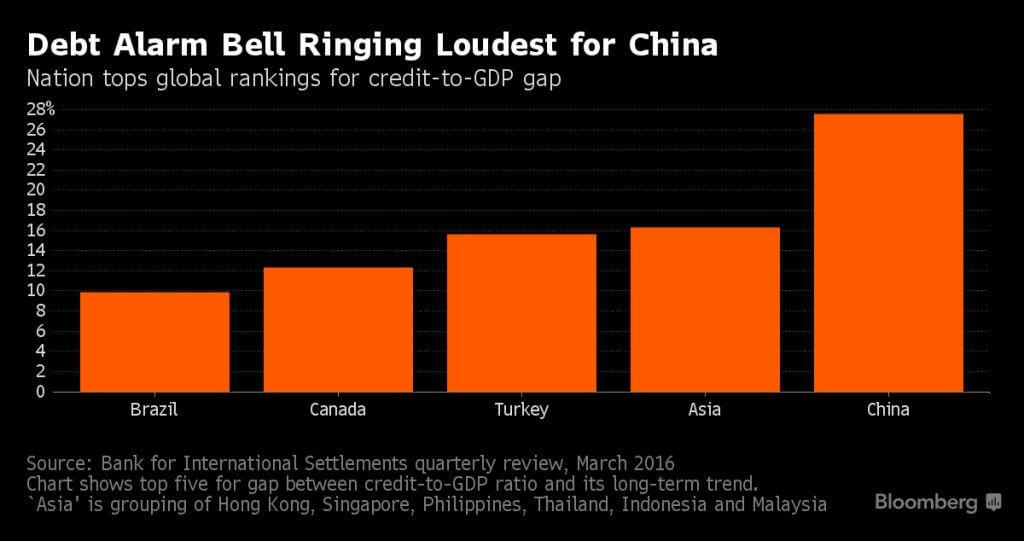

If banks in the world are arranged on the basis of their assets (loans-given), Chinese banks will grab 4 out of the first 5 positions. The largest bank in the world continues to be Beijing-based Industrial & Commercial Bank of China Ltd., with more than $3.5 trillion in assets portfolio. All four banks in the top five – ICBC, China Construction Bank, Agricultural Bank of China, and Bank of China – are state-owned. These banks are the engine of credit driving the Chinese economy, generating more than three-quarters of its total financing. Don’t buy the argument that this is yet more proof of China’s gathering economic clout. It’s not.

Chinese banks are looking down the barrel of a staggering RMB 8 trillion – or $1.7 trillion – worth of losses according to the French investment bank Societe Generale. Put another way, 60 per cent of capital in China’s banks is at risk as authorities start the dangerous process of reining in the debt-bloated and unprofitable state-owned enterprise (SOE) sector. There are many who believe China need a massive bailout package.

Also read: International Monetary Fund (IMF)

Conclusion:

As Peter Nolan had once argued, the view that China is buying the world is damaging to international relations. Chinese firms still have only a negligible presence in high-income countries. Only time can tell whether Chinese is buying the world or it is on the verge of collapse.

And from India’s perspective, the opening of the coffers of the Chinese foreign exchange is a blessing. As we are looking for more funds and investments in our flagship programs ranging from ‘Make in India’ to ‘Start-up India’, India should be open to her big brother in Asia. But as always, we need to tread with caution.

Article by: Jishnu J Raju

Sir pdf hindi me download nhi ho rhe he