Projects like Smart Cities, Dedicated Freight Corridors, High-speed railways etc require huge, long-term investment. From where does this money come from? Government of India had announced setting up of National Investment and Infrastructure Fund (NIIF) in 2015 budget. The fund was eventually set up in December 2015. The Fund aims to attract investment from both domestic and international sources.

Projects like Smart Cities, Dedicated Freight Corridors, High-speed railways etc require huge, long-term investment. From where does this money come from? Government of India had announced setting up of National Investment and Infrastructure Fund (NIIF) in 2015 budget. The fund was eventually set up in December 2015. The Fund aims to attract investment from both domestic and international sources.

Issues with infrastructure sector

- The sector needs long term finance; but banks are helpless: One of the fundamental reason why Indian infrastructure is still not up to desired level is the lack of long term finance. This is despite the fact that 10.4% of bank lending was channelled to Infrastructure in 2015.

- But of late, the banks in India especially the public sector banks are reeling under the pressure of Non-Performing Assets and Stressed assets, combing around 4.5% and 11% respectively.

- This has forced the banks to confine themselves to a shell and not commit themselves to long term financing portfolios and projects with long gestation periods.

- It is in light of this fund crunch situation that the Government of India announced setting up of National Investment and Infrastructure Fund in 2015 budget.

- The NIIF through its pass-throughs, such as the National Housing Bank and the IRFC, will fund for a longer window of 20 years or more.

National Investment and Infrastructure Fund (NIIF)

- To make it simple, National Investment and Infrastructure Fund (NIIF) is a fund created by the Government of India for enhancing infrastructure financing in the country.

- Securities and Exchange Board of India (SEBI) has already approved NIIF as an alternate investment fund.

- The National Investment and Infrastructure Fund (NIIF) Limited has been incorporated as a company under the Companies Act, 2013, duly authorized to act as investment manager of National Investment and Infrastructure Fund.

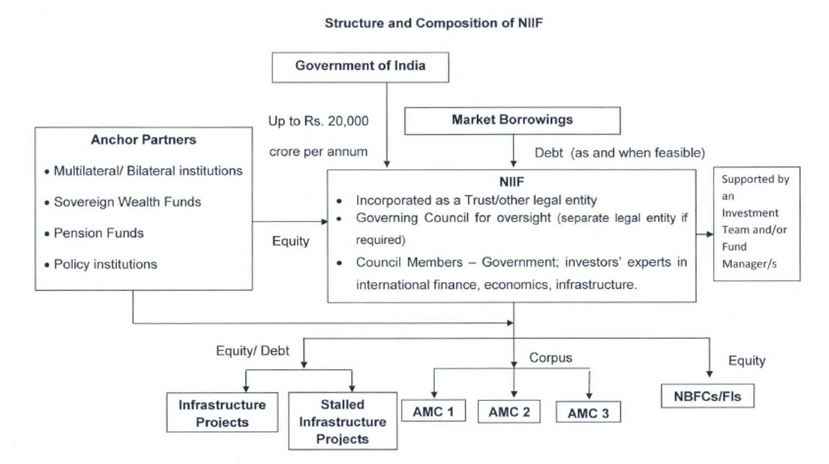

- The government will invest Rs 20,000 crore into the NIIF from the Budget, with another Rs 20,000 crore expected to come from private investors.

- The government’s share of the NIIF’s corpus is envisaged to be under 50%.

- Will NIIF invest in stalled projects? Answer: Yes

- Will NIIF invest in brownfield projects? Answer: Yes, both greenfield and brownfield, if it’s commercially viable.

Note: You should not confuse National Investment Fund (NIF) and National Innovation Foundation (NIF) with National Investment and Infrastructure Fund (NIIF). All three are different concepts.

NIIF as fund of funds

- NIIF is a fund of funds. So there will be multiple alternate investment funds underneath.

- There could be a stressed-assets fund, renewable energy fund, brownfield projects fund – sponsored by the NIIF.

How does this work?

- With the corpus of Rs 40K crore the Trust would be able to raise debt.

- NIIF would raise funds upto 10 times the corpus or up to Rs 2 lakh crore on a long-term basis.

- It can invest in equity through infrastructure finance companies such as IRFC(Indian Railway Finance Corporation) and NHB(National Housing Bank).

- The infrastructure finance companies can then leverage this extra equity, manifold.

National Investment and Infrastructure Fund (NIIF): What will it do?

- Equity (capital) to Non-Banking Financial Companies (NBFCs)/Financial Institutions (FIs) that are engaged mainly in infrastructure financing. These institutions will be able to leverage this equity support and provide debt to the projects selected.

- Invest in funds engaged mainly in infrastructure sectors and managed by Asset Management Companies (AMCs) for equity / quasi-equity funding of listed / unlisted companies.

- Provides fund directly to commercially projects, both Greenfield and brownfield, including stalled projects. A government official said some key transportation projects could be taken up initially by the NIIF for funding.

- Greenfield: a Greenfield project is one that lacks constraints imposed by prior work. Simply means: a new project.

- Brownfield: it is a term used to describe a land previously used for industrial purposes or some other uses. Brownfield project simply means: an already existing/ stalled project.

NIIF working in a nutshell:

- The fund is to be set up as a Trust. It is registered with SEBI as Category II Alternative Investment Fund (AIF) on December 28, 2015. (Read ahead on different categories of AIF)

- NIIF would raise funds by issuing offshore credit enhanced bonds and also tap into anchor investors.

- Anchor investors or cornerstone investors are marque institutional investors like sovereign wealth fund, mutual fund etc.

- Sovereign wealth fund: a state owned fund.

- The fund thus developed will be used to finance Indian infrastructure financing companies like the IRFC (Indian Rail Finance Corporation), NHB (National Housing Board) etc.

- The fund thus received by these companies is then channelled to their respective niche areas (railways and Housing respectively in this case), thus increasing the investment into these sectors manifold.

- Thus fundamentally NIIF is a Banker (NIIF) of the Banker (e.g.: NHB) of the Banker (e.g.: Housing loans).

NIIF: Objectives

- Maximize economic impact of each Rupee spent.

- Mainly through infrastructure development in commercially viable projects, both Greenfield and brownfield, including stalled projects.

- It could also consider other nationally important projects, for example, in manufacturing, if commercially viable.

Functions of NIIF

- Fund raising through suitable instruments including off-shore credit enhanced bonds, and attracting anchor investors to participate as partners in NIIF;

- Servicing of the investors of NIIF.

- Considering and approving candidate companies/institutions/ projects (including state entities) for investments and periodic monitoring of investments.

- Investing in the corpus created by Asset Management Companies (AMCs) for investing in private equity.

- Preparing a shelf of infrastructure projects and providing advisory services.

NIIF: Operational Aspects

- NIIF is not a single entity. There can be more than one fund. There could be a stressed-assets fund, renewable energy fund, brownfield projects fund, all sponsored by the NIIF.

- Thus NIIF will be established as one or more Alternative Investment funds (AIF) under the SEBI Regulations.

- Alternative Investment funds (AIF): AIF as an investment vehicle was established to pool in funds for investing in real estate, private equity and hedge funds. Till now, in India, pooling of capital was allowed only for Indian investors, and investment was done according to a pre-determined policy. However, selectively approval route for investment was used by overseas investors and non-resident Indians (NRIs). AIFs are primarily aimed at high net worth individuals, and according to the Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012, the minimum investment from an individual is Rs.1 crore. The overall corpus of the AIF should be at least Rs.20 crore and there should not be more than 1,000 investors at any point in time. Also, the fund manager or promoter should have contributed at least 2.5% or Rs.5 crore, whichever is less, to the initial capital.

- There are three categories of AIFs depending upon on their effect on the economy.

- Category-I AIFs have a positive spillover on the economy and may get concessions from the regulator or the government. These include venture funds, social venture funds and infrastructure funds, among others.

- Category-II includes private equity funds and debt funds and do not get any concessions. These cannot raise debt for investment purposes, but can do so to meet their day-to-day operational requirements.

- Category-III includes hedge funds, and are usually traded to make short-term returns.

- If set up as Category I and II AIFs, then NIIF will be eligible for a pass through status under the Income Tax Act.

- A ‘pass-through’ status means that the income generated by the fund would be taxed in the hands of the ultimate investor, and the fund itself would not have to pay tax on the same.

- In the case of category III AIF, where pass through status is not available, all income received by NIIF will be taxable at its level and any distribution made to the unit holders (investors) would be tax exempt.

- NIIF was formed as a category II AIF as a Trust under Indian Trust Act on 28 December 2015 along with the formation of

- National Investment and Infrastructure Fund Trustee Ltd. (IDBI Capital Market Services Ltd as Advisor to NIIF Trustee Ltd for one year initially)and

- National Investment and Infrastructure Fund Ltd. India (Infrastructure Finance Company Ltd (IIFCL) was appointed as Investment Advisor to NIIF Ltd for 6 months initially.)

- The government will invest Rs 20,000 crore into the NIIF from the Budget, with another Rs 20,000 crore expected to come from private investors.

- Government’s contribution/share in the corpus will be 49% in each entity set up as an alternate Investment Fund (AIF) and will neither be increased beyond, nor allowed to fall below, 49%. The whole of 49% would be contributed by Government directly. Rest is open for contribution from others.

- The contribution of Government of India to NIIF would enable it to be seen virtually as a sovereign fund and is expected to attract overseas sovereign/ quasi-sovereign/multilateral/bilateral investors to co-invest in it.

- Cash-rich Central Public Sector Enterprises (PSUs) could contribute to the Fund, which would be over and above the Government’s 49%.

- Similarly, domestic pension and provident funds and National Small Savings Fund may also provide funds to the NIIF.

- NIIF may also utilize the proceeds of monetized land and other assets of PSUs for infrastructure development.

- The NIIF will work out these details in consultation with the Ministry of Finance, to match different investors’ preferences.

- Example of non-governmental funding:

- National Investment and Infrastructure Fund (NIIF) Ltd. signed a Memorandum of Understanding (MoU) with RUSNANO of Russia on 2 February 2016 to set up the Russia-India High Technology Private Equity Fund for joint implementation of investments into projects in India. RUSNANO is a Russian development institute with interest to invest in projects in the field of high technologies and defence including the projects aimed at establishment of manufacturing industrial enterprises in India.

- International pension funds and sovereign wealth funds from countries such as Russia, Singapore have evinced interest in participating in India’s Rs 40,000-crore National Investment and Infrastructure Fund (NIIF)

- The Union Cabinet gave its ex-post facto approval for a Memorandum of Understanding (MoU) between India and the United Arab Emirates (UAE) to mobilise up to $75 billion long-term investment in the National Investment and Infrastructure Fund (NIIF).

NIIF: Governance

- There will be a Governing Council of the NIIF which will have Government representatives and experts in international finance, eminent economists and infrastructure professionals. It could include representatives from other non-Government shareholders.

- The terms and period of appointment of the Governing Council of the NIIF will be as decided by the Government.

- The Governing Council will oversee the activities of the Trust and will be constituted as a separate legal entity, if necessary.

- Governing council headed is currently by Finance Minister, Arun Jaitley and its other members include the secretaries of economic affairs and financial services, SBI Chairperson Arundhati Bhattacharya, former Infosys executive TV Mohandas Pai and Hemendra Kothari.

- NIIF would be supported by one or more Chief Executive Officers (depending upon the number of funds created) and a small investment team consisting of limited number of expert staff, at arm’s length from the Government.

- Their salaries would be market-linked.

- It would be possible for the NIIF Governing Council to appoint one or several Fund Managers.

- NIIF would have full autonomy for project selection.

- NIIF would formulate guidelines and would follow due processes for selection criteria for AMCs and Non-Banking Financial Companies (NBFCs) / Financial Institutions (FIs).

Conclusion:

Now that government has revitalized the financing arm of the infrastructure sector, it must now train its eyes on other obstacles which include an outdated labour law regime, massive dearth of skilled labour, problems in land acquisition, environment and other clearances etc. to achieve the cherished dream of transforming India as the manufacturing hub of the world through the Make in India Project.

Article by: Jishnu J Raju

very good

thanks sir