Pradhan Mantri Fasal Bima Yojana which will be implemented in every state of India, with association with the respective State Governments. This crop insurance scheme will be administered under the Ministry of Agriculture and Farmers’ Welfare, Government of India.

Previous Crop Insurance Schemes

Note: Subscribe to the ClearIAS YouTube Channel to learn more.

- 1985- Comprehensive Crop Insurance scheme

- 1999- National Agricultural Insurance Scheme

- 2007- Weather based crop insurance scheme

- 2010- Modified National Agricultural Insurance Scheme

Need for PMFBY

Indian agriculture is reeling at the menace of twin droughts following El-Nino phenomenon and untimely Rabi season rains and hailstorms. It is against this backdrop, that a crop insurance scheme to deal with risks associated with weather fluctuation is imperative for alleviating the distress caused to the farmers. Also, at present, only 23 % of cropped area in India have access to insurance. According to sources, Pradhan Mantri Fasal Bima Yojana will increase the insurance coverage to 50 per cent of the total crop area of 194.40 million hectare from the existing level of about 25—27 per cent crop area. The expenditure is expected to be around Rs 9,500 crore.

Features of Pradhan Mantri Fasal Bima Yojana

Some of the innovative features of the scheme are:

- Lower premiums compared to existing insurance schemes.

- Insuring income of the farmer and not crop per se.

- In PMFBY, there will not be a cap on the premium and reduction of the sum insured.

- Promises to provide prompt and easy settlement of claims through the use of technology like GPS, smart phones, remote sensing and drones to access actual crop damage.

- 25 per cent of the likely claim will be settled directly on farmers account.

- There will be one insurance company for the entire state.

- The scheme also provides for coverage of post-harvest losses.

- Covers localised crop losses like hailstones.

Objectives of Pradhan Mantri Fasal Bima Yojana

- To provide insurance coverage and financial support to the farmers in the event of failure of any of the notified crop as a result of natural calamities, pests & diseases.

- To stabilise the income of farmers to ensure their continuance in farming.

- To encourage farmers to adopt innovative and modern agricultural practices.

- To ensure flow of credit to the agriculture sector.

Implementing Agency (IA) of PMFBY

Implemented by multiple insurance companies but under overall control of Ministry of Agriculture & Farmers Welfare. The Ministry designated/empanelled Agriculture Insurance Company of India (AIC) and some private insurance companies presently to participate in the Government sponsored agriculture /crop insurance schemes. The choice of which private company is left to the states. There will be one insurance company for the whole state.

Management of the scheme

The existing State Level Co-ordination Committee on Crop Insurance (SLCCCI), Sub-Committee to SLCCCI, District Level Monitoring Committee (DLMC) already overseeing the implementation & monitoring of the ongoing crop insurance schemes like National Agricultural Insurance Scheme (NAIS), Weather Based Crop Insurance Scheme (WBCIS), Modified National Agricultural Insurance Scheme(MNAIS) and Coconut Palm Insurance Scheme(CPIS) shall be responsible for proper management of the Scheme.

Unit of Insurance

The Scheme shall be implemented on an ‘Area Approach basis’. For major crops, the Unit of Insurance shall ordinarily be Village/Village Panchayat level and for minor crops may be at a higher level depending upon the requirement.

Farmers to be covered

All farmers growing notified crops in a notified area during the season who have insurable interest in the crop are eligible.

Compulsory Coverage

The enrollment under the Pradhan Mantri Fasal Bima Yojana scheme, subject to possession of insurable interest on the cultivation of the notified crop in the notified area, shall be compulsory for following categories of farmers:

- Farmers in the notified area who possess a Crop Loan account/KCC account (called as Loanee Farmers) to whom credit limit is sanctioned/renewed for the notified crop during the crop season.

- Such other farmers whom the Government may decide to include from time to time.

Risks to be covered

Following risks leading to crop loss are to be covered under the scheme :-

(1) YIELD LOSSES (standing crops, on notified area basis): Comprehensive risk insurance is provided to cover yield losses due to non-preventable risks, such as

- (i) Natural Fire and Lightning

- (ii) Storm, Hailstorm, Cyclone, Typhoon, Tempest, Hurricane, Tornado etc.

- (iii) Flood, Inundation and Landslide

- (iv) Drought, Dry spells

- (v) Pests/ Diseases etc.

(2) PREVENTED SOWING (on notified area basis): In cases where majority of the insured farmers of a notified area, having intent to sow/plant and incurred expenditure for the purpose, are prevented from sowing/planting the insured crop due to adverse weather conditions, shall be eligible for indemnity claims up to a maximum of 25% of the sum-insured.

(3) POST-HARVEST LOSSES (individual farm basis): Coverage is available up to a maximum period of 14 days from harvesting for those crops which are kept in “cut & spread” condition to dry in the field after harvesting, against specific perils of cyclone / cyclonic rains, unseasonal rains throughout the country.

(4) LOCALISED CALAMITIES (individual farm basis): Loss / damage resulting from occurrence of identified localized risks i.e. hailstorm, landslide, and Inundation affecting isolated farms in the notified area.

Sum Insured/Limits of Coverage

In case of Loanee farmers under Compulsory Component, the Sum Insured would be equal to Scale of Finance for that crop as fixed by District Level Technical Committee (DLTC) which may extend up to the value of the threshold yield of the insured crop at the option of insured farmer. Where value of the threshold yield is lower than the Scale of Finance, higher amount shall be the Sum Insured.

Multiplying the Notional Threshold Yield with the Minimum Support Price (MSP) of the current year arrives at the value of sum insured. Wherever Current year’s MSP is not available, MSP of previous year shall be adopted.

The crops for which, MSP is not declared, farm gate price established by the marketing department / board shall be adopted.

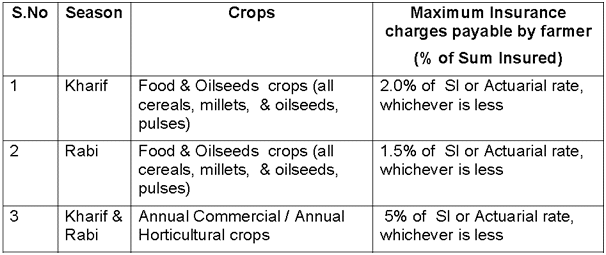

Premium Rates

The Actuarial Premium Rate (APR) would be charged under PMFBY by insurance agencies. Govt. of India/States will monitor (and not fix) the premium rates considering

- the basis of Loss Cost (LC) i.e. Claims as % of Sum Insured (SI) observed in case of the notified crop(s) in notified unit area of insurance during the preceding 10 similar crop seasons (Kharif / Rabi)

- expenses towards management including capital cost and insurer’s margin

- taking into account non-parametric risks and reduction in insurance unit size etc..

The difference between the premium paid by the farmers and the premium fixed by the insurance companies will be subsidised and there will be no cap on the maximum subsidy paid by the Government. The subsidy will be borne equally by central and the respective state Government. Currently, farmers pay around as high as 15 % of the sum insured as premium under the existing National Agricultural Insurance scheme and the modified National Agricultural Insurance scheme. The new scheme will replace all these existing crop insurance schemes.

Service Tax

PMFBY is a replacement scheme of NAIS / MNAIS, and hence exempted from Service Tax liability of all the services involved in the implementation of the scheme.

Use of Innovation Technology

There is a need to have good quality, timely and reliable yield-data. For addressing this problem, video/image capture of crop growth at various stages and transmission thereof on a real time basis utilizing mobile communication technology with GPS time stamping, can improve data quality, / timeliness and support timely claim processing and payments. States and insurance companies shall utilise this technology for the purpose. Authorities shall carry out pilots in select areas, in collaboration with various States/UTs, national and international research organisations / institutes, IMD, insurance companies, reinsurers etc. to make use of available technology in the fields of remote sensing, aerial imagery, satellites etc. that can help in acreage estimation, crop health / loss estimation, quicker yield estimation etc. with reduced manpower & infrastructure.

Constraints

- Increased subsidy bill on the state.

- No cover against wild animal attacks.

- No protection extended to share-croppers as payments are linked to land records usually.

Article by: Jishnu J Raju

Nice article…keep writing, also you can visit http://www.gkduniya.com for current affairs and gk.

Thanks

very useful…thanks alot ..

PMFBY KE BARE ME MERI ID PR VISTAR SE BTANA PLZ …..sir g

Comprising in this scheme the against wild animal losses so is better results are coming in related agriculture field or rural society or agriculture farmers

Read about car insurance:

https://www.autocurious.com/2020/06/car-insurance.html?m=1

प्रधान मंत्री फसल बीमा योजना कहाँ से करवायें जानकारी चाहिए