The world’s second-biggest exporter of sugar, India has emerged as the top producer, user, and exporter of sugar globally. Are you aware of the current scenario the Indian Sugar industry facing today? Read the article to know more about it.

The world’s second-biggest exporter of sugar, India has emerged as the top producer, user, and exporter of sugar globally. Are you aware of the current scenario the Indian Sugar industry facing today? Read the article to know more about it.

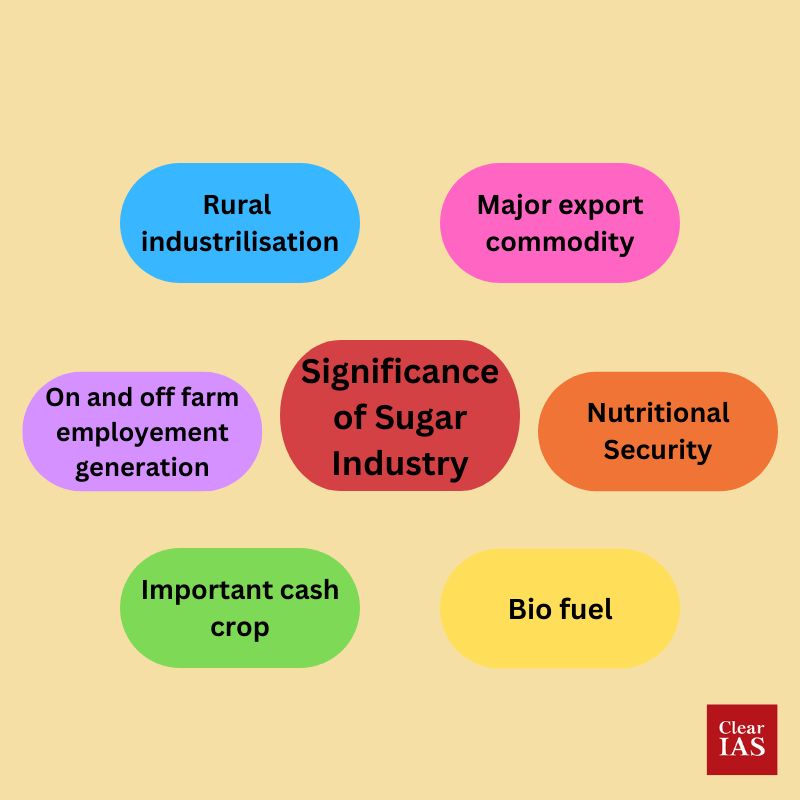

India’s second-largest agro-based business after cotton is the sugarcane and sugar industry.

50 lakh hectares or 2.57% of the total planted area are taken up by the crop.

Around 50 million farmers grow sugarcane, and there are 5 lakh workers in sugar mills.

But still, the Indian sugar industry faces many challenges. Let us discuss more on that.

Sugar industry in India

Production

India has surpassed Brazil to become both the world’s largest producer and consumer of sugar.

During the marketing year 2021–2022, 35.8 million tonnes were produced in India. It is anticipated to reach 36.5 million tonnes in the marketing year 2022–2023. Maharashtra surpassed Uttar Pradesh in 2022 to reclaim India’s top spot for sugar production.

Consumption

The cheapest sources of energy, which account for 10% of daily caloric intake, are sugar and jaggery. There are about 27 million tonnes of domestic demand annually. In addition to producing sugar, sugarcane is also used to make ethanol.

Sugar Production Areas

In India, sugarcane is mostly grown in two separate agro-climatic regions

- The tropical sugarcane region encompasses the states of Maharashtra, Andhra Pradesh, Tamil Nadu, Karnataka, Gujarat, Madhya Pradesh, Goa, Pondicherry, and Kerala. It also includes the peninsular and coastal regions.

- The subtropical sugarcane region includes Uttar Pradesh, Bihar, Haryana, and Punjab

Sugarcane, a bulky and perishable product, is the foundation of the Indian sugar industry. It cannot be kept for an extended period of time since the sucrose content is lost. Therefore, the companies are positioned close to the sugarcane growing regions to assure a steady supply of sugarcane and to lower transportation costs.

The industry is growing in part due to entrepreneurship. In UP, private sugar mill ownership is common. The remaining sugar mills are owned jointly by the farmers and operated as cooperatives. Maharashtra is home to many sugar mills with this type of ownership.

Government Efforts

Fair and Remunerative Pricing (FRP) and purchase with the assurance of price

Mills are required by law to compensate farmers for the cane they purchase at a price set by the government.

The recovery of sugar from the cane is the foundation of FRP. (Indicated as a percentage, sugar recovery is the ratio of sugar produced to cane crushed.)A few state governments also publish State Advised Prices (SAP) that are higher than FRP.

Cane Reservation Area

Farmers within a predetermined radius, known as the Cane Reservation Area, must supply their harvests to sugar mills that buy sugarcane.

Sugar Buffer Stocks

The government established a sugar buffer stock to help the industry deal with the issue of excess output and low sugar prices.

The buffer stock of sugar is collectively kept by the mills themselves, as opposed to the buffer stocks of wheat and rice, which are managed by the government through FCI.

Desegregation of the sugar industry

In 2013, the sugar industry underwent some deregulation based on the committee’s recommendations, which were made under the direction of Dr C. Rangarajan. Levy on sugar and restrictions on open market sales were subsequently eliminated.

Financial aid

Both the soft loan programme and the Scheme for Extending Financial Assistance to Sugar Undertakings (SEFASU 2014) offered working capital loans with interest subventions. To stimulate sugar export, financial aid was given to sugar mills to cover the cost of internal transportation, freight, and other expenses.

Research and development

Several institutions have been created in India to conduct research and development on new cane types and farming techniques. For instance, the ICAR-Indian Institute of Sugarcane Research is located in the subtropical region of Lucknow, and the ICAR-Sugarcane Breeding Institute is located in the tropical region of Coimbatore, Tamil Nadu.

ICT solutions

Nutrient management tools developed by ICAR-SBI, Coimbatore, such as the Cane Advisor, are available as mobile applications.

The Government of Uttar Pradesh created the Sugarcane Information System (SIS) to simplify post-harvest tasks like sales and procurement.

Program for blending ethanol

In order to promote environmentally friendly fuels (by increasing the use of ethanol) and decrease energy imports, the Ethanol Blended Petrol (EBP) programme was established. The EBP programme creates a steady market for ethanol, which injects cash into the sugarcane industry.

2018 National Biofuel Policy

By allowing the use of sugarcane juice and other sugar-containing materials like sugar beet and sweet sorghum, among others, the Policy broadens the range of raw materials available for the manufacturing of ethanol.

Challenges faced by the Sugar Industries

- Water-intensive crop: Sugarcane is a crop that requires a lot of water. 1500–2000 kg of water is typically needed to produce 1 kilogramme of sugar. However, the current pattern of water usage means that in 2030, only around half of the need will be satisfied.

- Poor water use efficiency: The amount of economic output produced per cubic metre of extracted fresh water is referred to as water productivity. In Bihar and Uttar Pradesh, sugarcane’s economic water productivity (EWP) is as high as Rs. 36 and Rs. 30 per cubic metre of irrigation water used, respectively.

- Groundwater depletion: Sugarcane and paddy use over 70% of the nation’s irrigation resources. Since groundwater provides the majority of this, it has had a significant negative impact on the water table in many areas. As in the Marathwada region of Maharashtra.

- Sugar price stagnation: In India, cane prices typically make up between 70% and 85% of the price of sugar. However, the main cause of problems for the sugar sector in recent years has been the declining/stagnant price of sugar despite the constant growth in sugarcane prices.

- Farmers of sugarcane face a problem with arrears: Sugar mills find it difficult to buy sugarcane from farmers because of the high Fair and Remunerative Price (FRP) and limitations imposed by the Cane Reservation Area (CRA). Payments are then delayed as a result, which has an impact on the succeeding crop seasons. For instance, according to data from the Food Ministry, mills purchased sugarcane worth Rs 33,023 crore in UP during the 2020–21 season, of which 15.3% was still owed on September 30, 2021, the season’s end.

- Challenges with the cane reservation area: Every designated mill is required to buy from cane farmers within the cane reservation region, and farmers are required to sell to the mill. The farmer’s ability to bargain is, however, diminished by this arrangement. Even if there are cane arrears, he must sell to a mill. Additionally, mills are constrained by the calibre of cane given by local farmers.

- Low mechanisation level: In our nation, the level of mechanisation in sugarcane cultivation is often less than 40%. Due to labour shortages and high production costs, the sector is now vulnerable.

Way forward

Sugarcane pricing

Sugarcane pricing must be connected to sugar prices in order to prevent the issue of arrears and maintain the sugar industry’s financial stability. In order to safeguard farmers from receiving prices below the FRP, the Revenue Sharing Formula (RSF) must be implemented along with a Price Stabilization Fund.

Development Fund for Sugar and Sugarcane

Charges on sugar may be used to create a special fund that would help the mills’ ability to pay their bills. Encourage the production of ethanol by providing the necessary support to help integrate and update technology and by learning from the Brazilian experience of directing raw sugarcane juice towards the blending of ethanol.

Implement the important recommendations of the Rangarajan committee

The State Governments are in charge of implementing and enacting a number of the committee’s recommendations on the CRA and the Cane Price Formula. However, the majority of states have not done anything about this. The federal government should push the states to follow these suggestions.

Expansion of Drip Irrigation in Sugarcane Cultivation

Efforts should be made to use drip irrigation in place of flood irrigation. In addition to ongoing awareness-raising efforts, farmers may benefit from several incentive programmes that grant them preferential access to infrastructure.

Diversification toward less water-intensive crops

By offering farmers the right incentives, it is necessary to change the cropping pattern in water-stressed areas where sugarcane is grown

Encourage product variety

Encourage product variety by offering sugarcane mills incentives to recycle bagasse and implement cutting-edge technology for the production of jaggery.

Revision of trade policy

In accordance with WTO rules, the Department of Food and Public Distribution should collaborate with the Department of Commerce to develop an appropriate incentive system for sugar exports.

Article Written By: Atheena Fathima Riyas

Leave a Reply