Economic Survey 2025-26 is themed ‘From Strategic Resilience to Strategic Indispensability’. Read here to know all about it.

The Economic Survey 2025-26, tabled by the Union Finance Minister ahead of the Union Budget, offers a comprehensive diagnosis of India’s economic performance and structural preparedness in a world marked by geopolitical fragmentation, climate stress, and technological disruption.

Economic Survey 2025-26 is prepared by the Economic Division of the Ministry of Finance under the Chief Economic Adviser.

The Survey positions India as a macroeconomically stable, reform-driven, and investment-ready economy, while simultaneously warning that state capacity constraints, rather than resource scarcity, pose the biggest threat to India’s long-term development ambitions.

Economic Survey 2025-26

A defining theme of the Survey is the call for India to move beyond “Strategic Resilience”, the ability to withstand shocks, towards “Strategic Indispensability”, where India becomes a critical and irreplaceable node in global supply chains, technology ecosystems, and growth networks.

State of the Economy: Sustained Growth Amid Global Turbulence

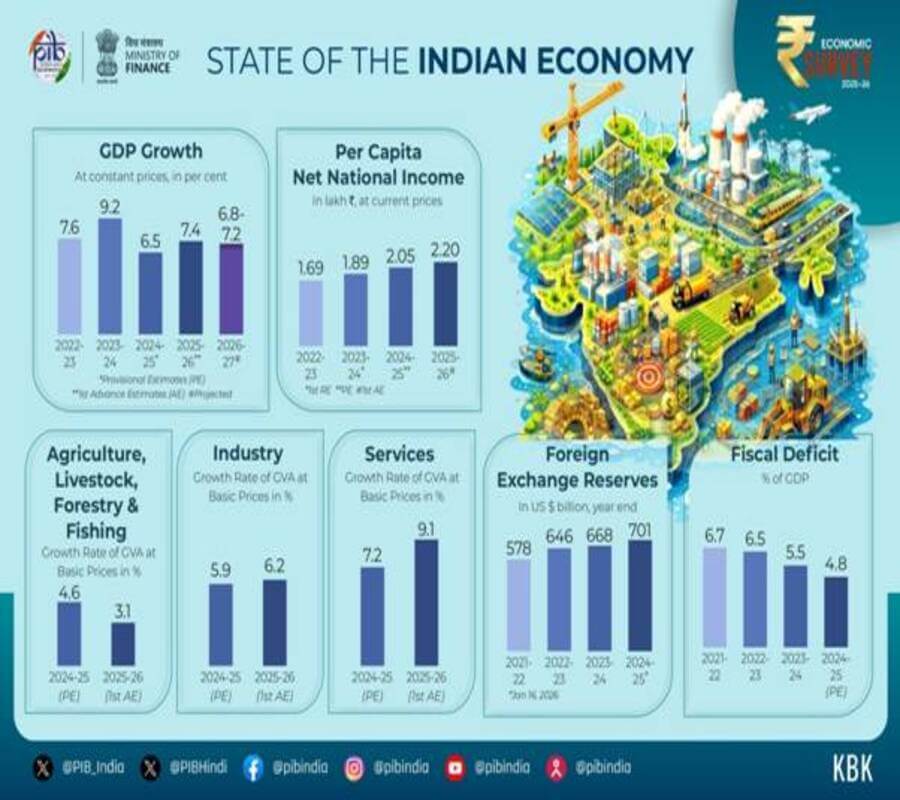

Despite a fragile global environment characterised by trade fragmentation, financial volatility, and geopolitical conflicts, India maintained strong growth momentum.

- Real GDP growth of 7.4% in FY26 reaffirms India’s status as the fastest-growing major economy for the fourth consecutive year.

- Growth is broad-based, supported by:

- Private consumption (61.5% of GDP) is aided by low inflation and rising real incomes.

- Investment revival, with GFCF sustaining a healthy 30% of GDP.

- On the supply side, services remain the dominant growth engine, reflecting India’s structural advantage in knowledge-based sectors.

India’s growth model is gradually transitioning from state-led recovery to private demand-driven expansion, a key marker of economic maturity.

Fiscal Strategy: Credibility Through Capital Expenditure

The Survey underscores prudent fiscal management as a cornerstone of macroeconomic stability.

- Revenue receipts improved structurally, driven by:

- Expansion of the direct tax base

- Improved compliance via digitalisation (GST, faceless assessments)

- Public capital expenditure emerged as the primary growth multiplier:

- Central effective capex reached ~4% of GDP

- States were incentivised through Special Assistance to States for Capital Expenditure (SASCI)

Importantly, India managed to reduce its general government debt-to-GDP ratio by ~7 percentage points since 2020, even while sustaining high investment.

This reflects a shift from consumption-heavy populism to asset-creating fiscal policy, critical for long-term productivity.

Monetary and Financial Sector: Stability with Inclusion

India’s financial system demonstrated resilience and depth:

- Banking sector health improved significantly, with GNPA falling to 2.2%, the lowest in over a decade.

- Credit growth at 14.5% YoY indicates confidence in economic prospects.

- Financial inclusion deepened through:

- PM Jan Dhan Yojana

- MUDRA, PM SVANidhi, and Stand-Up India

Capital markets witnessed a democratisation wave, with:

- Rising retail participation

- Increased women investors

- Strong non-metro penetration

The IMF-World Bank FSAP 2025 validated India’s financial architecture as well-capitalised and shock-resilient.

External Sector: Diversification as a Shield

The Survey highlights a decisive improvement in India’s external resilience:

- Record exports of USD 825.3 billion, led by services

- Trade partner diversification, reducing dependence on any single geography

- Current Account Deficit remained moderate (~1.3% of GDP), supported by:

- Strong remittances

- Robust services exports

- Comfortable forex reserves (USD 701.4 bn)

India’s diversification of crude oil imports reflects a strategic response to geopolitical risks, not merely price considerations.

This aligns with India’s ambition to hedge against “Pax Silica”, a global order dominated by control over minerals, chips, and supply chains.

Sectoral Performance: Engines of Structural Transformation

Agriculture

- Record foodgrain production supported by a good monsoon

- Rising contribution of livestock and fisheries, signalling diversification

- Strengthening of market access through e-NAM, AIF, MSP, and income support schemes

Industry

- PLI schemes catalysed investment, output, and job creation

- India’s improved rankings in patents, trademarks, and critical technologies reflect a maturing innovation ecosystem

- However, the Survey flags high logistics and energy costs as persistent competitiveness constraints

Services

- India consolidated its role as a global services powerhouse

- Expansion of Global Capability Centres (GCCs) and GenAI startups

- Services remain the backbone of urban employment

Infrastructure, Energy, and Climate Strategy

Infrastructure development remains the backbone of India’s growth strategy:

- Massive expansion in highways, railways, aviation, power, and digital connectivity

- Near elimination of the power demand-supply gap

- High rural infrastructure penetration (roads, housing, water)

On climate:

- Rapid renewable energy expansion

- Strategic emphasis on nuclear power as a reliable, clean baseload source

- The Survey advocates a development-aligned climate strategy, prioritising adaptation over premature mitigation.

The Survey cautions against “infrastructure-blind energy transitions”, drawing lessons from Europe’s grid instability.

Human Capital, Employment, and Social Progress

- Rising female labour force participation signals structural change

- Expansion of social security to gig and platform workers

- Sharp decline in extreme poverty

- Significant gains in education and health outcomes

However, the Survey controversially justifies the scrapping of MGNREGS, citing structural inefficiencies, replacing it with a legislated rural livelihoods framework.

The Binding Constraint: State Capacity

One of the Survey’s most striking contributions is its candid diagnosis of weak state capacity as India’s core challenge.

Key issues include:

- Bureaucratic risk aversion

- Fear of post-facto audits and vigilance

- Policy hysteresis (inability to roll back temporary measures)

- Over-expansion of unconditional cash transfers is crowding out capital expenditure

The Survey calls for an entrepreneurial state, regulatory experimentation, and protection for good-faith decision-making.

Conclusion

The Economic Survey 2025-26 presents India not merely as a resilient economy but as an emerging anchor of the global growth architecture.

While macroeconomic fundamentals, infrastructure expansion, and digital depth provide a strong foundation, the Survey makes it clear that execution capacity, institutional maturity, and innovation-led competitiveness will determine India’s transition from a fast-growing economy to a truly developed nation.

India’s challenge is no longer one of potential, but of performance, discipline, and state capability. If these are addressed, India’s journey from Strategic Resilience to Strategic Indispensability may well define the economic narrative of the 21st century.

Related articles:

Leave a Reply