The Economic Survey 2024-25, presented by the Government of India, provides a comprehensive assessment of the nation’s economic health, key sectoral developments, and future projections. Read here to know more.

The finance minister Nirmala Sitharaman tabled the Economic Survey 2024-25 in Parliament. It provides a roadmap for reforms and growth, setting the stage for the Union Budget 2025.

The Economic Survey is an annual report presented by the government before the Union Budget to assess India’s economic condition.

Prepared by the Economic Division of the Ministry of Finance under the Chief Economic Adviser’s supervision, it is tabled in both houses of Parliament by the Union Finance.

Economic Survey 2024-25

The global economy grew by 3.3 per cent in 2023. The International Monetary Fund (IMF) projects global growth to average around 3.2 per cent over the next five years, which is modest by historical standards.

- As per the Survey, the global economy exhibited steady yet uneven growth across regions in 2024.

- A notable trend was the slowdown in global manufacturing, especially in Europe and parts of Asia, due to supply chain disruptions and weak external demand.

- In contrast, the services sector performed better, supporting growth in many economies.

- Inflationary pressures eased in most economies.

- However, services inflation has remained persistent, notes the Survey.

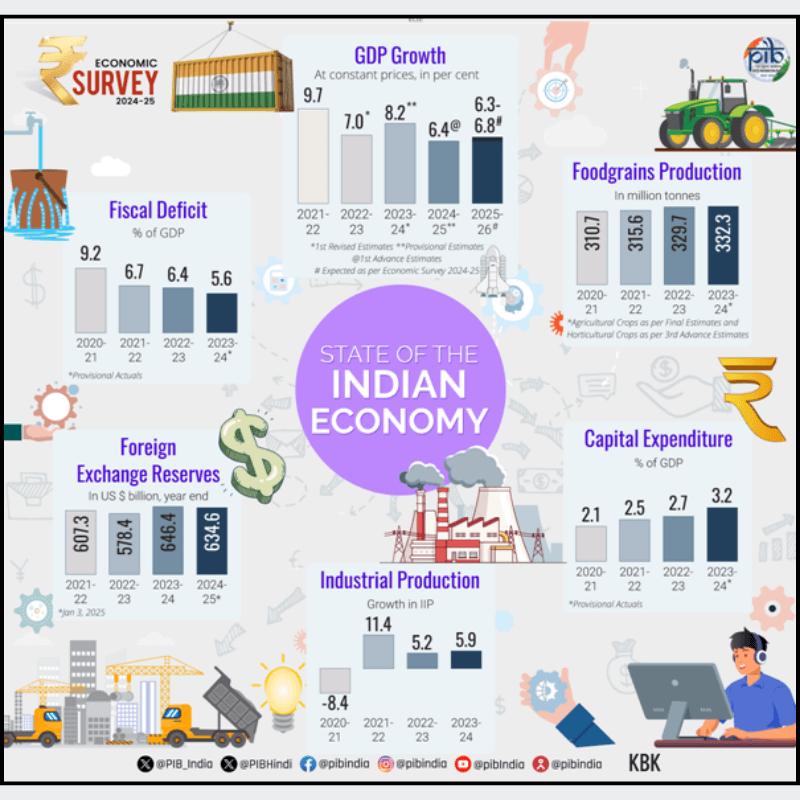

- The Survey highlights that, despite global uncertainty, India has displayed steady economic growth. India’s real GDP growth of 6.4 per cent in FY25 remains close to the decadal average.

- From an aggregate demand perspective, private final consumption expenditure at constant prices is estimated to grow by 7.3 per cent, driven by a rebound in rural demand.

- The real gross value added (GVA) is estimated to grow by 6.4 per cent on the supply side.

- The agriculture sector is expected to rebound to a 3.8 per cent growth in FY25.

- The industrial sector is estimated to grow by 6.2 per cent in FY25. Strong growth rates in construction activities and electricity, gas, water supply and other utility services are expected to support industrial expansion.

- Growth in the services sector is expected to remain robust at 7.2 per cent, driven by healthy activity in financial, real estate, professional services, public administration, defence, and other services.

GDP Growth and Economic Performance

- Projected GDP Growth: India’s GDP is expected to grow between 6.3% and 6.8% in FY26.

- Real GDP Growth: Estimated at 6.4% for FY25, closely aligned with the decadal average.

- Real GVA Growth: Projected at 6.4% for FY25.

Capital Expenditure and Investments

- Capital Expenditure Growth: Capex grew at 8.2% between July and November 2024 and is expected to accelerate further.

- Gross FDI Inflows: Increased by 17.9% year-on-year, reaching USD 55.6 billion in the first eight months of FY25.

Inflation and Trade Performance

- Retail Headline Inflation: Softened to 4.9% during April-December 2024.

- Consumer Price Inflation: Expected to align with the target of around 4% in FY26.

- Export Growth: Overall exports grew by 6.0% year-on-year during April-December 2024.

- Services Export Growth: Surged to 12.8% during April-November FY25 from 5.7% in FY24.

- Forex Reserves: Stood at USD 640.3 billion as of December 2024, covering 10.9 months of imports and 90% of external debt.

Energy and Stock Market Developments

- Renewable Energy: Capacity addition in solar and wind power increased by 15.8% year-on-year in December 2024.

- Stock Market Capitalisation: The BSE market capitalisation-to-GDP ratio was 136% at the end of December 2024, significantly higher than China (65%) and Brazil (37%).

Sectoral Insights

Agriculture

- Growth Projection: Expected at 3.8% in FY25.

- Kharif Foodgrain Production: Estimated at 1,647.05 LMT, an increase of 89.37 LMT over the previous year.

- Growth Drivers: Horticulture, livestock, and fisheries remain key contributors.

- Kisan Credit Cards (KCC): 7.75 crore accounts.

- PM Fasal Bima Yojana (Crop Insurance): 4 crore farmers enrolled, covering 600 LMT hectares in FY24.

- e-NAM platform: Linked 1.78 crore farmers, and 2.62 lakh traders (Oct 2024) for better price discovery.

- Food Security & Processing: Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) provides free food grains to 80 crore people.

Industrial and Social Sector

- Industrial Growth: Estimated at 6.2% for FY25.

- Social Services Expenditure: Registered an annual growth rate of 15% between FY21 and FY25.

Health and Employment

- Government Health Expenditure: Increased from 29% to 48% of total health expenditure between FY15 and FY22.

- Out-of-Pocket Expenditure: Declined from 62.6% to 39.4% during the same period.

- Unemployment Rate: Dropped to 3.2% in 2023-24 from 6.0% in 2017-18.

- Artificial intelligence: India’s AI market is set to grow at 25-35% CAGR by 2027 (NASSCOM), making workforce upskilling, regulatory oversight, and human-AI collaboration crucial for a balanced transition.

Climate & Environment

- Climate adaptation spending: Rose from 3.7% to 5.6% of GDP (FY16-FY22).

- The Lifestyle for the Environment (LiFE) initiative promotes sustainability, with potential global savings of USD 440 billion by 2030 through reduced consumption and lower prices.

- Renewable Energy & Emissions:8% of India’s power capacity is non-fossil (target 50% by 2030).

- Forest carbon sink increased by 2.29 billion tonnes CO₂ (2005-2023).

- Climate Finance & International Cooperation: Conference of Parties 29 failed to secure adequate climate funds, with a USD 300B annual goal vs. USD 5.1 to 6.8T needed by 2030.

- Sovereign Green Bonds: India issued USD 20,000 crore in FY24 to fund green projects.

- Sustainable Development & Resilience: Mangrove Initiative for Shoreline Habitats & Tangible Incomes (MISHTI) initiative restoring 22,560 hectares of mangroves across 13 states and UTs.

- Water conservation via AMRUT 2.0 (3,078 water body rejuvenation projects approved).

- PM Surya Ghar (7 lakh rooftop solar systems installed; goal: 1 crore households).

Key Policy Recommendations and Initiatives

- Self-Reliant India Fund: A new fund worth ₹50,000 crore was launched to provide equity funding to MSMEs.

- Infrastructure Investments: Continued step-up of infrastructure investment is required over the next two decades.

- Collaborative Efforts: Emphasis on government, private sector, and academia collaboration to mitigate adverse societal effects of AI.

- Social sector: India’s social sector spending grew at 15% CAGR (FY21-FY25), reaching Rs 25.7 lakh crore in FY25.

Economic Challenges According to the Economic Survey 2024-25

Global Economic Challenges

- Geopolitical Risks: Ongoing conflicts, including the Russia-Ukraine war and disruptions in the Red Sea region, continue to affect global trade, energy prices, and supply chains.

- Global Trade Slowdown: Protectionist measures and realignments in global supply chains negatively impact India’s export competitiveness.

- Financial Market Volatility: Interest rate fluctuations in the US and European Union may lead to capital outflows, affecting India’s foreign exchange reserves and currency stability.

Inflationary Pressures

- Persistent Food Inflation: Despite stable core inflation, food prices remain a significant concern, driven by supply chain issues and production challenges.

- Climate Impact: Erratic monsoons, droughts, and extreme weather events pose threats to food security and farm incomes.

Investment & Infrastructure Bottlenecks

- Investment Challenges: While public capital expenditure (Capex) grew at a CAGR of 38.8% from FY20 to FY24, private investment remains cautious due to global uncertainties and regulatory concerns.

- High Logistics Costs: Logistics expenses account for 13-14% of GDP, limiting industrial competitiveness despite initiatives under the National Logistics Policy.

- Urbanization Issues: Poorly planned urbanization leads to traffic congestion, inadequate public transport, and rising housing costs in major cities. Smart City and urban transport projects face execution delays due to regulatory hurdles and financing gaps.

Employment & Skilling Gaps

Jobless Growth Concerns:

- Economic growth is outpacing job creation, largely due to a focus on high-skill, low-employment sectors and premature deindustrialization.

- Skill mismatches further exacerbate employment challenges.

Low Labour Force Participation Rate (LFPR):

- Female LFPR in India stands at 41.7% (FY25), still below the global average of over 50%.

Fiscal & Financial Sector Risks

State Debt Burdens: Several states face high debt levels due to rising subsidies, limited revenue growth, and dependency on central transfers.

Lending Risks:

- Rising unsecured lending poses challenges for NBFCs and fintech lenders, requiring better regulation and monitoring.

- Cybersecurity threats remain a persistent concern.

Credit Penetration: Slow credit access for MSMEs hinders small business expansion despite the growth of digital lending.

External Sector Challenges

- Foreign Direct Investment (FDI): Although FDI inflows grew by 17.9% YoY, higher repatriation and disinvestment are areas of concern.

- Export Dependency: Heavy reliance on IT and business services (70% of services exports) makes India vulnerable to global demand shocks.

Climate Change & Energy Transition

Energy Transition Challenges:

- Grid stability issues, high storage costs, and slow adoption of renewable energy impede progress toward clean energy goals.

- India remains heavily dependent on coal, delaying the shift to sustainable energy sources.

Climate Risks: Extreme weather events and inadequate global climate finance hinder sustainable growth.

Ease of Doing Business (EoDB) Reforms

- Regulatory Challenges: Despite EoDB reforms, challenges related to labour laws, land acquisition, and tax complexity persist, hindering MSMEs and startups.

- R&D Spending: India’s R&D spending remains low at 0.64% of GDP, affecting innovation and technological competitiveness.

Impact of Artificial Intelligence (AI)

- AI Reliability Concerns: AI adoption faces challenges due to unproven reliability, biases in hiring, predictive policing, and automation failures.

- Energy Demand: AI data centres may consume as much electricity as India’s total current consumption (1,580 terawatt-hours) according to Bloomberg (2024).

- Sectoral Disruption: Indian IT, business process outsourcing (BPO), and banking sectors are particularly vulnerable to AI-driven disruptions, especially in low-value service jobs.

Conclusion

The Economic Survey 2024-25 underscores India’s steady economic trajectory, supported by robust investment, export growth, and sectoral performance.

It emphasizes the need for sustained reforms, infrastructure development, and collaborative efforts across sectors to maintain high growth rates and achieve long-term economic stability.

The Survey advocates for deregulation measures to accelerate and sustain economic growth.

For the detailed economic survey document, click here

Related articles:

Leave a Reply