NITI Aayog recommended for privatization of Air India and the cabinet committee gave “in-principle” approval for privatising Air India.

NITI Aayog recommended for privatization of Air India and the cabinet committee gave “in-principle” approval for privatising Air India.

But should Air India be disinvested?

In this post, we discuss the Indian aviation sector, and the Air India-Indian Airlines merger, and will see if the reasons for privatization can be justified or not.

Background of Air India

- Air India: Air India, formerly named Tata Airlines was founded by JRD Tata. It was renamed Air India, primarily operating on international routes in 1946.

- Indian Airlines: Indian Airlines was a major Indian airline based in Delhi and focused primarily on domestic routes, along with several international services to neighboring countries in Asia. It was administered by the Ministry of Civil Aviation.

- Air India merged with the erstwhile Indian Airlines in 2007 based on the recommendations of Justice Dharmadhikari’s committee report.

- As part of the merger process, a new company called the National Aviation Company of India Limited (now called Air India Limited) was established, into which both Air India and Indian Airlines would be merged.

Air India-Indian Airlines Merger: A failed one?

AI and Indian Airlines had been running profitably till 2005–06. However, their future had already been compromised by then. It is commented that the merger of Air India with Indian Airlines has created woes due to a lack of effective leadership and erroneous government policies.

Also read: Disinvestment in India

Why were Indian Airlines merged with Air India (2007)?

- The merger was initiated with the aim of making profits and gaining a high market share for the airline. The major objective behind the committee formation was a rationalization of operations and restructuring of debt.

- Escalating costs of Aviation Turbine Fuel (ATF).

- Immense competition from private and low-cost airlines.

- Increased cost pressures due to the acquisition of additional aircraft Leadership crisis due to frequent changes of the chairman- cum-managing director.

- Air India could not fully use the bilateral rights, unlike foreign airlines which took maximum advantage. So it was decided to go for the merger.

- Declining passenger traffic in the premium class.

Also read: Privatisation of Air India – Should India’s Public Sector Airline be Disinvested?

Why was the Air India-Indian Airlines merge not successful?

- Air India has had four chairmen in the last six years with no one biting the bullet on tough decisions. The instability at the top has led to poor profits due to a lack of decision-making.

- The merger brought together two disparate entities and created a behemoth with 30,517 employees – 221 employees per aircraft, which is much higher than Singapore Airlines which has 161, and British Airways which has 178. The increase in the number of employees led to pressure in the form of salaries and this further led to more losses. (Reference: Business Today)

- No attempts were made to standardize hiring policies for the rank and file. Both the partners had different rules and policies which were not harmonized for a smoother run.

- During the period 1998–2004, no new planes were ordered for AI or Indian Airlines.

- Because of post-merger HR issues like compensation, career progression, salary payment, promotion issues, and employee strikes, the merger did not yield the intended objectives.

- The poor management practices and improper planning have pushed the merged entity into trouble.

- The Parliamentary Standing Committee on Transport, tourism, and Culture, in 2010 summarized the problems of the Air India merger process. It said that the first reason for the fall in the morale of the employees was changing the name of IA (Indian Airlines) which had had a good reputation in the market. The reason was not revealed either to customers or to employees by the management.

10-year Restructuring Plan for Air India (2012-2022)

- In April 2012, the government signed a 10-year restructuring plan with the AI.

- By April 2012, when the government finally signed a turnaround plan for AI, the annual operational loss of the airline had increased to around ₹5,000 crore and its accumulated debt had reached nearly ₹43,500 crore. It was then operating on a capital base of ₹3,345 crore (AI 2012).

- Repeated statements by the MCA in Parliament over the years have testified that the government is largely satisfied that the AI is progressing as per the turnaround plan (MCA 2017a).

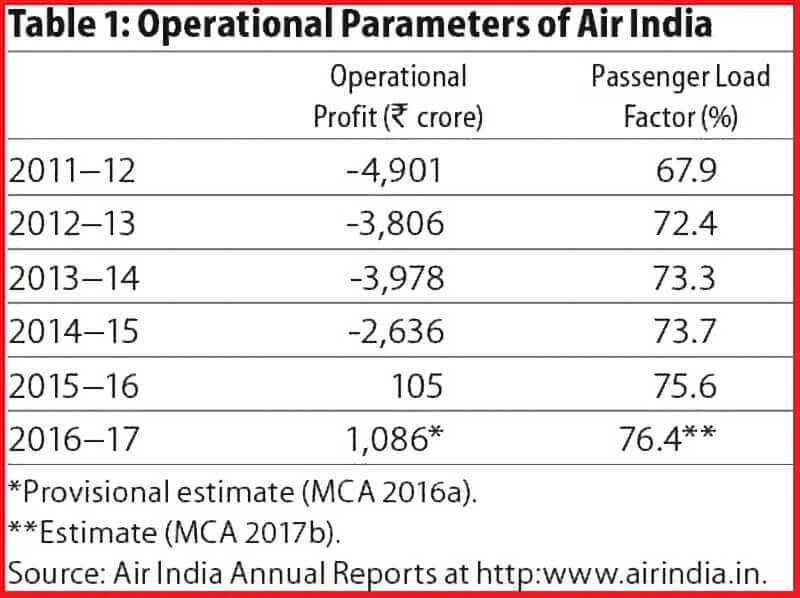

Is Air India a loss-making company?

The national carrier is one among other airlines that were struggling and is still undergoing a 10-year rehabilitation package that started in 2012.

It posted faster-than-anticipated operating profits and lower net losses in 2015–16, much before its recovery package was to begin bearing fruit, while its low-cost subsidiary Air India Express posted profits.

Both have reportedly done even better in 2016–17.

Air India’s passenger load factor (or its ability to fill seat capacity), a key indicator of airline performance, has improved steadily over the last five years.

The Indian civil aviation sector at large also reported positive results the same year, after a decade of difficulty.

With steady passenger growth, it is expected to be the third-largest civil aviation market by the end of the decade. (Reference: EPW)

Also read: Make In India Initiative

How correct is it to point fingers at the management of Air India for losses?

Air India is not the only airline that was doing badly earlier.

Private airlines too have had difficulty navigating India’s civil aviation sector.

Around 23 airlines closed or merged with others but the latter eventually shut down or ceased operations.

Many of the airlines that continued to operate have reported losses over the past decade.

Until the drop in global crude oil prices, the sector faced difficulties due to relatively higher aviation turbine fuel costs in India, excess capacity, and a limited number of high-traffic routes to vie for.

Criticisms of Privatising Air India

- The civil aviation market in India, like in many parts of the world, is oligopolistic, with a few firms controlling large market shares.

- Forcing the exit or merger of an established state-run airline – with the third largest market share which has 31% of the planes in the sector and prime slots at airports worldwide – will only aid in the undesirable concentration of market power with a few already large private airlines, and will prove anti-competitive.

- If anything, a public sector enterprise of this size in an oligopolistic sector is not only desirable but essential.

Way ahead

Instead of indulging in virulent criticism of the Maharaja, the government must allow the recovery package to bear fruit, and must not privatize in haste. All signals – fuel prices and market conditions -suggest that Air India will prove to be a profitable venture for the government like it used to be earlier.

Air India will have to cut layers of management, align staff by role, bring in lateral hires, overhaul customer-facing functions, and implement a massive training exercise. And, rein in pilots and engineers, even if it means a partial lockout. Though the process is on track to some extent, still a lot needs to be done in this regard.

Article contributed by Pooja Chaudhary and edited by ClearIAS Team

Very informative!!