The money supply is the total value of money available in an economy at a point of time.

Money Supply is also known as Money Stock.

What constitutes money?

There is no uniform definition of money.

Common public usually associate currency with money. As you know, bank deposits are also money.

For different calculations, different components are included as ‘money’.

Definition of Money Supply

Money Supply can be defined as the money circulating in an economy.

As money supply is connected with ‘circulating money’, only the highly-liquid forms of money like currency and bank deposits are usually considered.

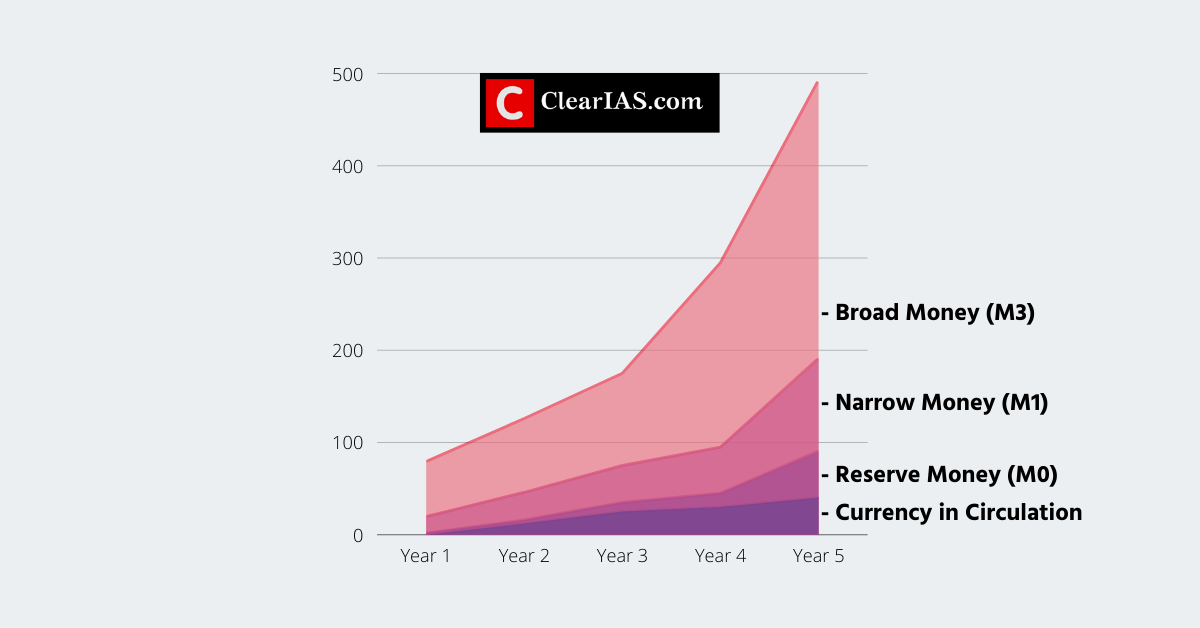

Money Supply is measured and expressed using different monetary aggregates like M1, M2, M3, M4 etc.

Terms like Narrow Money and Broad Money are also used to denote money supply.

Money Supply – In layman’s terms

The money supply is the total stock of money circulating in an economy. In the most simple language, Money Supply is Currency in Circulation plus Deposits in Commercial Banks.

Money supply consists of:

- total currency circulating in the public plus

- the non-bank deposits with a commercial bank.

Money supply includes deposits generated in the banking system resulting from a multiplier effect of movement of currency in the banking system as well as other forms of liquid assets.

What is meant by ‘currency in circulation’?

It is the total value of the currency (coins and paper currency) that has ever been issued by the Reserve Bank of India minus the amount that has been withdrawn by it.

Currency in circulation (currency with the public) comprises of:

- currency notes and coins with the public

- cash in hand with banks.

It is a major liability component of a central bank’s balance sheet.

Money Aggregates: Standard Measures of Money Supply

In short, there are two types of money.

- Central bank money (M0) – obligations of a central bank, including currency and central bank depository accounts.

- Commercial bank money (M1 and M3) – obligations of commercial banks, including current accounts and savings accounts.

In the money supply statistics, central bank money is M0 while the commercial bank money is divided up into the M1 and M3 components. M2 and M4 components also include Post-Office deposits as well.

Generally, the types of commercial bank money that tend to be valued at lower amounts are classified in the narrow category of M1 while the types of commercial bank money that tend to exist in larger amounts are categorized in M2 and M3. M3 is the largest of all money aggregates (M1-M3).

Note: In this article, we cover the Monetary Aggregates as per the old convention (M1, M2, M3, and M4). In the new convention, aggregates are represented as NM1, NM2, and NM3. This is covered in detail in the ClearIAS article on the new monetary aggregates.

Reserve Money (M0):

Reserve money is also called central bank money, monetary base, base money, or high-powered money. It is the base level for the money supply or the high-powered component of the money supply.

In the most simple language, Reserve Money is Currency in Circulation plus Deposits of Commercial Banks with RBI.

Mo

- = Currency in circulation + Bankers’ deposits with the RBI + ‘Other’ deposits with the RBI

- = Net RBI credit to the Government + RBI credit to the commercial sector + RBI’s claims on banks + RBI’s net foreign assets + Government’s currency liabilities to the public – RBI’s net non-monetary liabilities.

M1 (Narrow Money)

- =Currency with the public + Deposit money of the public (Demand deposits with the banking system + ‘Other’ deposits with the RBI).

M2:

- =M1 + Savings deposits with Post office savings banks.

M3: (Broad Money)

- = M1+ Time deposits with the banking system

- = Net bank credit to the Government + Bank credit to the commercial sector + Net foreign exchange assets of the banking sector + Government’s currency liabilities to the public – Net non-monetary liabilities of the banking sector (Other than Time Deposits).

M4:

- =M3 + All deposits with post office savings banks (excluding National Savings Certificates).

Money Multiplier (m)

A money multiplier is an approach used to demonstrate the maximum amount of broad money that could be created by commercial banks for a given fixed amount of base money and reserve ratio.

- The money multiplier, m, is the inverse of the reserve requirement, R:

- For example, with the reserve ratio of 20 per cent, this reserve ratio, R, can also be expressed as a fraction:

- So then the money multiplier, m, will be calculated as:

This number is multiplied by the amount of reserves to estimate the maximum potential amount of the money supply. For example, from Rs.100 can be multiplied by 5 to generate Rs.500 money supply if Reserve Ratio is 1/5 (20%) or when Money Multiplier is 5. When Reserve Ratio is 1/4 (25%) or when Money Multiplier is 4, that would generate only Rs. 400 as money supply.

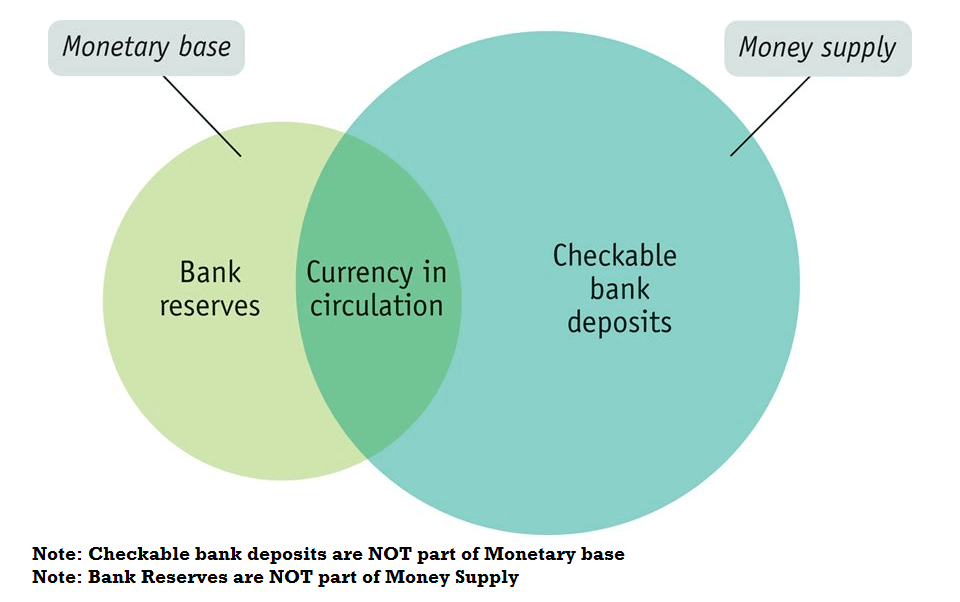

Money Supply (M3) vs Monetary Base (Mo)

Reserve Money (Mo) is also called the monetary base. As mentioned earlier, it denotes the money of RBI. Mo includes Currency in Circulation and Bank’s Reserves.

Even though the money supply can be denoted either as M1 or M3, usually when we speak of money supply, we intend M3. M3 includes Currency in Circulation and Checkable Bank’s Deposits.

Demonetisation and its effect on Money Supply (M3) and Reserve Money (Mo)

When a currency note of a particular denomination ceases to be legal tender, the central bank’s liabilities are reduced to that extent and also the amount of currency in circulation declines.

On November 8, 2016 Government of India made Rs. 500 and Rs. 1000 notes invalid. This meant that Rs. 15.41 lakh crore worth of high-value legal tender was withdrawn from circulation.

So, the entire liability of Rs. 15.41 lakh crore due to Rs.500 and Rs.1000 notes in circulation was nullified.

But the demonetisation impact is neutralised when the demonetised currency is replaced with new accepted currency notes. You may note that, even if an individual chooses to park the cash as deposits with banks, it forms a part of the overall money supply.

The RBI report after demonetisation had mentioned that 99.3% of all demonetised currency returned to the banking system. The figure was 15.31 lakh crore.

As 15.31 lakh crore again became part of the RBI, now the net-liability of RBI = Rs.15.41 lakh crore – Rs.15.31 lakh crore = Rs.0.10 lakh crore.

This figure (Rs. 10000 crore) was only a nominal reduction in liability, offset by printing and transportation cost of the new currency, which led many experts to point out that the demonetisation experiment was a failure to curb black money. Many criticised the government that it over-estimated the black money in the country.

What if the demonetisation was a success?

If there was a lot of black money in the country, and people choose not to declare and surrender their high-denomination currency notes, then RBI would have gained to the extent that its currency liabilities are lowered.

The gains it makes in the process could have been transferred to its reserves and then appropriated in its profit and loss account. This would have given it leeway to transfer higher amounts as dividends to the government.

However, this scenario didn’t happen.

Why is the currency in circulation a liability to RBI or government?

Let us examine what is the status of the currency we hold in our hands.

Section 26 of the Reserve bank of India Act 1934 (“RBI Act”) states as follows:

(1) Subject to the provisions of sub-section (2), every banknote shall be legal tender at any place in India in payment or on account for the amount expressed therein and shall be guaranteed by the Central Government.

This means that the money the public hold in hand or in the bank is a debt guaranteed by the government (to us). The currency thus represents a ‘public debt’ owed by the government to the holders of the banknotes – the public.

Nice to read on this current affair.

What a website for Upsc preparation….i love the contents and article of this website…mind blowing…really the best website…

what exactly is cash in hand with bank, under CIC section. does that mean that CIC also consists of demand deposits ?

Cic means cash/currency notes and coins with public and banks (printed notes).. where as demand deposits much more than the cic due to the multiple effect of money.. If all the depositers ask for their money at a time banks won’t able to pay them all… cic is the currency ie physically available.. I hope u got it

Yes cic includes demand deposit.

With respect m0 two different equation are given… How are they related?

M0 is sum of banks deposit..

But in other equation its RBIs credit give?

Please clarify

one rupee notes issued by the govt of india is known as?

a-reserve money

b-narrow money

c-broad money

d-fiat money

can anyone answer for this question

Option d… One rupee note has finance secretary sign… That means bearer of 1rupee note creates a liability of the signed one. It should not refused by every citizen of India hence it is a fiat money

As per my understanding, Bank reserves do not form a part of Monetary base (aka) Reserve Money (M0), because Bank reserves are Net non-monetary liabilities of RBI, which is deducted when calculating M0.

The same is also indicated in the M0 2nd formula, which is,

M0 – Net RBI credit to the government + RBI credit to Commercial sector + Net foreign currency assets of RBI + RBI claim on Banks + GOvernment’s currency liabilities to the public ‘-‘ NET NON MONETARY LIABILITIES OF RBI

Please review.

Option d… One rupee note has finance secretary sign… That means bearer of 1rupee note creates a liability of the signed one. It should not refused by every citizen of India hence it is a fiat money