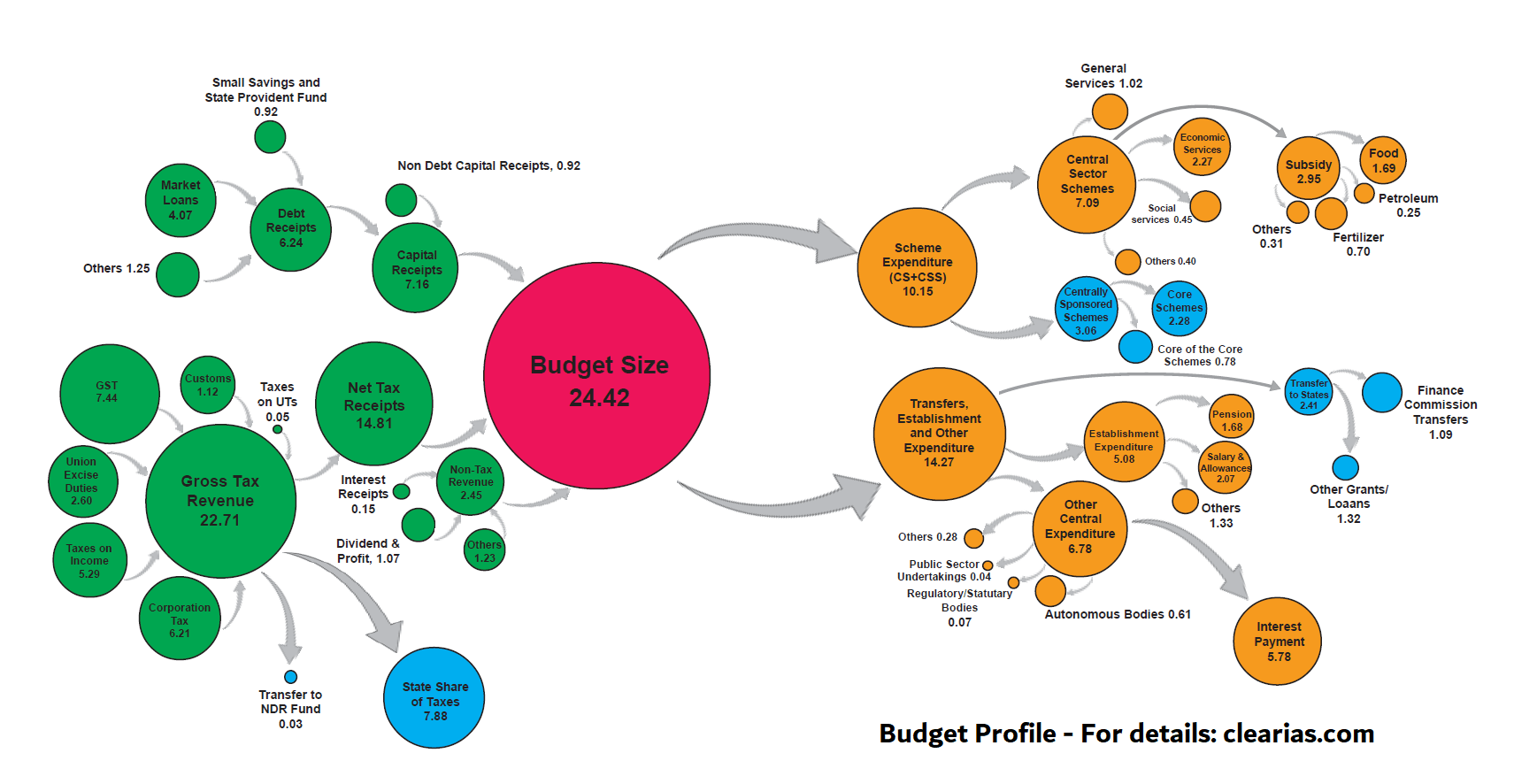

How do states get revenue from the Centre? Center-State finance is a confusing topic unless you have come across the above figure.

How do states get revenue from the Centre? Center-State finance is a confusing topic unless you have come across the above figure.

Most of the states depend on the centre for the large chunk of their revenue.

The devolution process was based on many complex formulae before. However, now things have changed. In this post, we help you understand how states get revenue from the Center.

How do States get revenue from the Center (now)?

- Devolution (States’ share of taxes): As states share of taxes from the Gross Tax Revenue. (This is extra-budgetary)

- Scheme Related Transfer: As Centrally Sponsored Schemes from the Scheme Expenditure. (Based on Budget Allocations).

- Finance Commission Grants: As Transfer to States from the Transfers, Expenditure, and Other Expenses. (Based on Budget Allocations)

- Other Transfers: Other grants or loans. (Based on Budget Allocations).

Devolution (States’ share of taxes)

As per the 15th Finance Commission Recommendations, 41% of the divisible pool should be devolved to the States. (vertical devolution)

While distributing the 41 per cent among states, the formula recommended the Finance Commission should be used – which takes into weight different parameters like Income Distance, Population of 2011, Area, Forest & Ecology, Demographic Performance and Tax Effort.

Without including in Union Budget, Center transfers states’ share of taxes from the Gross Tax Revenue. This forms a significant part of the devolution.

Scheme Related Transfer

Another major transfer from the Center to states is in the form of Centrally Sponsored Schemes (CSS). This is part of the Union Budget.

Centrally Sponsored Schemes are divided into Core of the Core Schemes and Core Schemes.

Finance Commission Grants

Based on Finance Commission recommendations, the Center also gives states – (a) Revenue Deficit Grants (b) Sectoral Grants, and (c) Performance-based Incentives.

The Finance Commission Grants will be mentioned in the Union Budget.

Other Transfers

Other transfers include grants and loans given to states – as mentioned in the Union Budget.

Understanding the Center-State Transfers: Budget Profile

The above figure is a sample Budget Profile of the Union.

The areas where you should look for Centre-State transfers are the blue circles.

As you can see the first big circle corresponds to states’ share of taxes which is extra-budgetary.

As part of the Budget, you can notice the Centrally Sponsored Schemes and Transfers to States (FC grants and other transfers)

Thanks a lot for the article. It had really become messy and I was searching for a consolidated article on this for a long time.

Happy to know that someone has benefited. All the best!

Thanks sitting for the article.

nice article …….. u should write articles more regularly….greatly beneficial………and ur mock tests r pretty good too……….keep it up………thank u for selfless initiative

Our pleasure!

Hai sir very valuable material but have a small doubt on this topic that is…how the funds allocated as per new niti ayog..

Is it by as old like planning commission..or not

NCA is applicable or not as per the new niti ayog?

what is the difference between vertical tax devolution and horizontal tax devloution? could you please clarify on this…thanks

vertical tax devolution is how much center is giving to all states as 41%.

now among the given 41% how much each state gets will be horizontal share.

Finance Commission while announcing the center-state tax share split deals only with the vertical tax devolution. This is confusing. according to article 280 FC deals with “The distribution of the net proceeds of taxes to be shared between the Center and the states,and the allocation between the states, the respective shares of such proceeds…” then how can we say that it deals with only vertical tax devolution…?

In case of grants we do not use any formula..it is money in absolute terms..(post-devolution revenue deficit grants for States)

i am searching for this type of clarity. very much thankful to clear ias for this article which is very much helpful.

Direct release under Central Plan to State/ District level autonomous bodies/implementing agencies – Not applicable now. Why this is not applicable now?

Hi ClearIAS could you please clarfiy my doubt that difference between public expenditure and public consumption. And i think goverment spending is synonym to public expenditure.

The States of Andhra Pradesh, Assam, J&K, Himachal Pradesh, Kerala, Manipur, Meghalaya, Mizoram, Nagaland, Tripura and West Bengal (a total of 11 States) have been identified for receiving these revenue deficit grants.

In this Andhra Pradesh is not a Special category state.

This is a really helpful article! Thanks a lot!

Please help me with these queries please –

1. Which all of these grants/transfers are covered as Statutory Grants (Article 275) which are decided by Finance Commission?

2. Similarly which all are Discretionary grants (Article 280) which were earlier decided by Planning Commission? Who decides these now? Finance Ministry?

3. Are any of the transfers decided by NITI Aayog right now?

4. Who decides about CSS related transfers?

fc deciding tax devolutions and non-plan grants are statutory. rest all like css,central plan assistance calculated by (gadgil mukharjee) now subsumed in revenue deficit grants of fc all are not mandatory .

Outstanding article…..Thank you….I need more detailed explanation….

Hello Mr.George, Its a good concise article and your picture of center-state. However do you intend to write any article on how FC decides on the grant allocation in general

Thanks a lot for this, this topic has been very confusing your article made it clear to me.

I was reading a NCBT Notifications informing that all the indirect revenue (taxes on retail sales of state proceeds to consumers) collected by the Centre go to the Kity of the Centre which is later on distributed as grants to the States and later on returned/refunded to the Centre. Is it correct?

Sir, I am interested to know if number of districts in a State is a factor for allocation of Central fund.

what does devolution of states tax is extra-budgetary mean