Unified Payment Interface (UPI) is recently in the news. UPI is believed to have revolutionized the way Indians do banking. In this post, we will see what UPI is and how safe is to use UPI.

Unified Payment Interface (UPI) is recently in the news. UPI is believed to have revolutionized the way Indians do banking. In this post, we will see what UPI is and how safe is to use UPI.

In February 2024, NPCI International Payments Limited (NIPL) in partnership with Lyra, a French leader in securing e-commerce and proximity payments,

announced acceptance of the UPI payment mechanism in France.

France became the first European country to accept the Unified Payment Interface.

What is UPI?

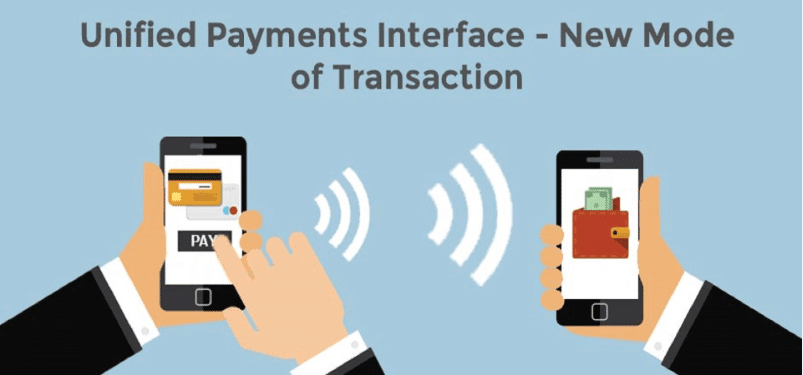

Unified Payment Interface (UPI) is a newly introduced platform to transfer money between any two bank accounts in India, by avoiding the existing complexities.

Unified Payment Interface is an indigenous payment system that works with the help of a smartphone.

But how is UPI different from netbanking (NEFT/RTGS/IMPS)?

- Unified Payment Interface is standardized across banks, which means you can initiate a bank account transfer from anywhere with a few clicks. This means that UPI will help you to pay directly from your bank account to different merchants without the hassle of typing your net banking password, credit card details, or IFSC code.

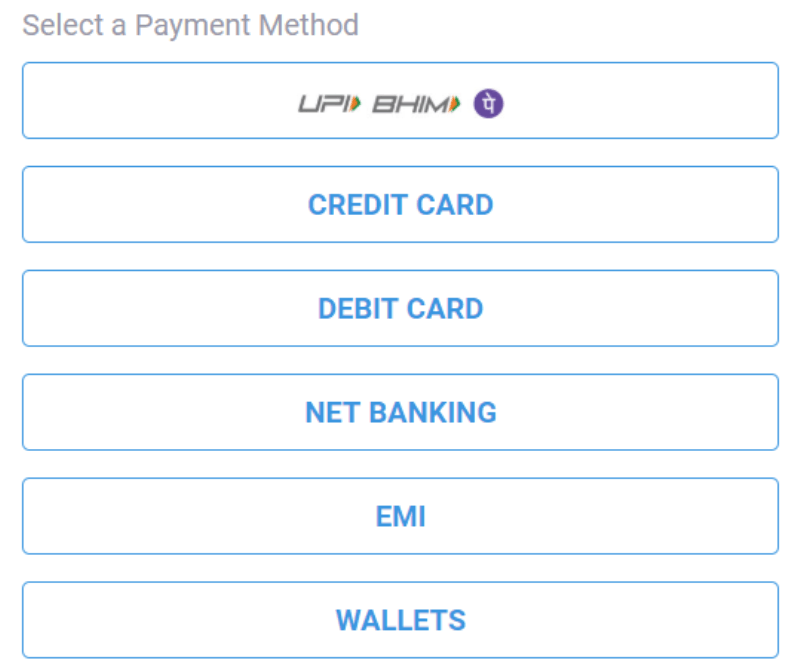

- Apart from cards, net banking, and wallets, you can now pay through UPI too.

- Unified Payment Interface allows paying someone as well as ‘collecting’ cash from someone.

Why UPI?

- Even after introducing net banking in India, the number of cash transactions happening in India is very high (almost 95% of all transactions).

- Unified Payment Interface is part of RBI’s efforts towards ‘Less Cash’ India.

Who developed the Unified Payment Interface?

Unified Payment Interface was developed by the National Payment Corporation of India (NPCI) under the guidelines of RBI. UPI is based on the Immediate Payment Service (IMPS) platform.

Also read: Paytm Payments Bank Debacle

6 Steps to Start Using UPI

Unified Payment Interface is now publicly available. Check if your bank has released an updated mobile app with UPI support already.

- Download the UPI app of your bank from Google Play Store/Apple Apps Store and install it on your phone.

- Set app login.

- Create a Virtual Payment Address (VPA). Eg: Roychoudary@icici

- Add your bank account.

- Set MPIN.

- Start transacting using UPI.

What is MPIN?

An MPIN is given to a banking customer once they register for Mobile Banking support. Chances are you have one already but have never used it.

How exactly does one make a payment transaction?

For example, consider that you are trying to book tickets online for a film via your mobile.

When you click to buy, the mobile website/ mobile app you used will trigger the UPI payment link. Now, you are taken to the pay screen of the UPI app. Here, the transaction information is verified and a click followed by entry of a secure PIN completes the purchase.

Also read: History of Banking in India

How safe is the Unified Payment Interface?

It is safe as the customers only share a virtual address and provide no other sensitive information. The ‘virtual payment address’ is an alias to your bank account.

The virtual payment addresses don’t allow your security to be compromised when a certain merchant’s account is hacked, because their database will have only a list of virtual addresses. The payment addresses are denoted by ‘account@payment_service_provider’.

It offers better security than other payment methods where details like credit card numbers are sent. While using Unified Payment Interface, all these details are hidden as only a Virtual Payment Address (VPA) is used.

What kind of transactions can be performed via UPI?

Merchant payments, remittances, and bill payments among others.

Are there any limitations regarding the amount that can be transferred in a single transaction?

The per transaction limit is Rs.1 lakh.

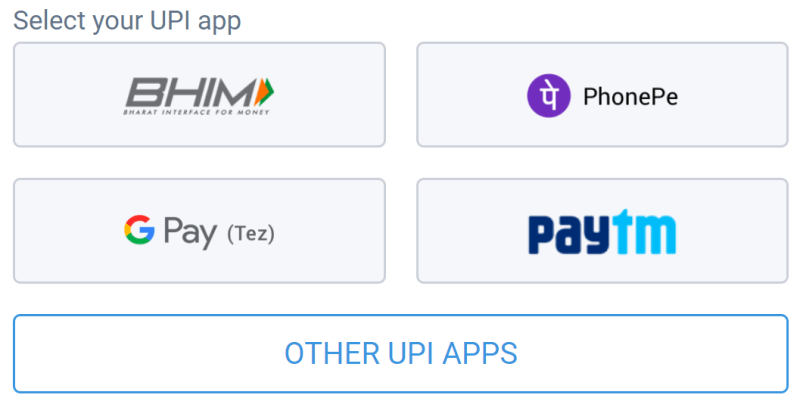

UPI Payment Service Providers: Banks vs Wallets

Currently, Unified Payment Interface has permitted only banks to be registered as Payment Service Providers (which means they can run bank accounts). But this scope can get wider and perhaps even include wallets later.

The Significance of Unified Payment Interface

- Facilitate Person-to-business (P2B) transactions via the collect payment option. This would boost business and the Indian Economy overall.

- UPI will bring down cash circulated in the economy (currently cash in circulation is 12% of GDP).

- UPI will bring down the annual cost of currency transactions (currently around Rs. 20000 crores)

Ok, so far good. Any negatives?

- The authority for all arbitration lies with NPCI.

- The introduction of a Unified Payment Interface is most likely to badly affect the Wallet Companies.

- The per transaction limit of Rs.1 lakh may not go well with all customers/businesses.

It provides multiple virtual address or single virtual address? Please clear it

multiple virtual address