The world is looking at another economic recession in 2023 according to most of the economic data released so far. According to WEF, the economic outlook for 2023 will feel different depending on where you are in the world. Read here to understand recession and the related terminologies.

Since the pandemic, barely a day has passed that we have not heard dire economic news about the United States, Europe, or Japan.

Unemployment has been rising, company profits have been falling, financial markets have been tumbling, and the housing sector has been collapsing.

Is there a single word to describe these developments? Yes, it can be explained by “recession”.

The ongoing global financial crisis has been accompanied by recessions in many countries. This pattern is consistent with the historical record. Synchronized recessions have occurred in advanced economies several times in the past four decades the mid-70s, early 80s, early 90s, and early 2000s.

What is an economic recession?

There is no official definition of recession, but there is general recognition that the term refers to a period of decline in economic activity.

Very short periods of decline are not considered recessions. Most analysts as a practical definition of recession, define it as two consecutive quarters of decline in a country’s real (inflation-adjusted) gross domestic product (GDP), the value of all goods and services a country produces.

Although this definition is a useful rule of thumb, it has drawbacks.

- A focus on GDP alone is narrow, and it is often better to consider a wider set of measures of economic activity to determine whether a country is indeed suffering a recession.

- Using other indicators can also provide a timelier gauge of the state of the economy.

In simpler terms, a recession is a significant, pervasive, and persistent decline in economic activity.

- The length of a recession is calculated by counting from the top of the previous expansion to its bottom.

- Although a few months might pass between recessions, it can take years for the economy to reach its previous high.

- Despite some forecasted recessions not occurring, an inverted yield curve has correctly predicted each of the last ten recessions.

- Many people may perceive the early phases of a comeback as a continuing recession since unemployment frequently persists at high levels far into an economic recovery.

- To reduce the dangers of a recession, countries adopt fiscal and monetary measures.

The National Bureau of Economic Research (NBER), a private research organization, which maintains a chronology of the beginning and ending dates of U.S. recessions, uses a broader definition and considers several measures of activity to decide the dates of recessions.

- Because the United States is one of the world’s largest economies and has strong trade and financial linkages with many other economies, most of these globally synchronized recession episodes also coincide with U.S. recessions.

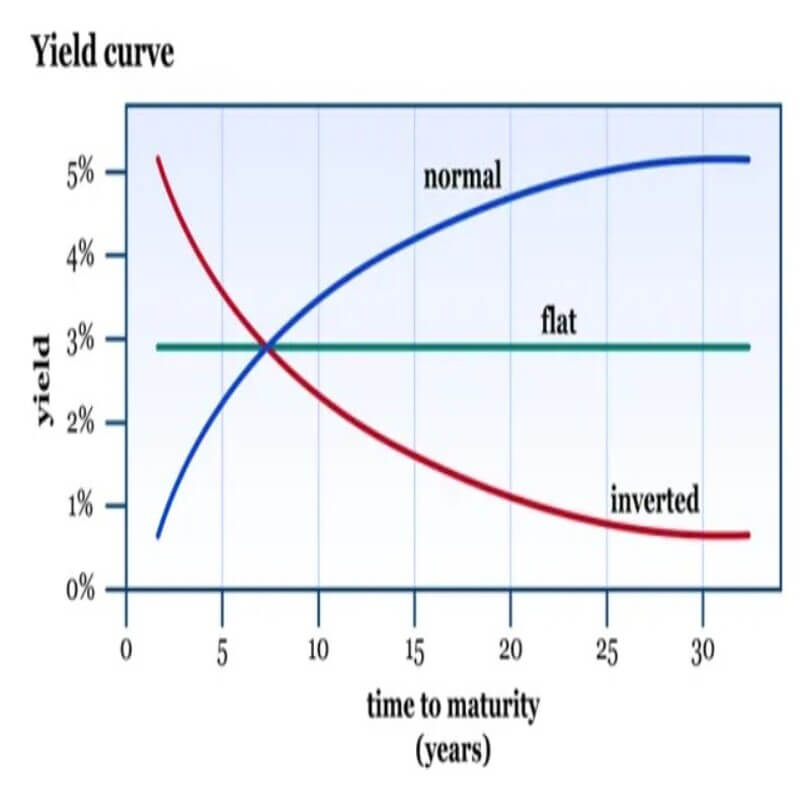

An inverted yield curve has been viewed as an indicator of a pending economic recession.

Yield curve

The link between the short- and long-term interest rates of fixed-income securities issued by the U.S. Treasury is known as the yield curve.

- When short-term interest rates are higher than long-term interest rates, the yield curve is inverted.

- In normal conditions, the yield curve is not inverted as loans with longer maturities normally carry higher interest rates than nearer-term ones.

- As inverted yield curves are unique and longer-term debt should be riskier and have higher interest rates, they have effects on both investors and consumers.

- One of the best predictors of an upcoming recession is an inverted Treasury yield curve.

The curves can be flat or steep depending on the money available in the market and the expected overall economic activity.

- Typically, short-term interest rates are lower than long-term rates, so the yield curve slopes upwards, reflecting higher yields for longer-term investments. This is referred to as a normal yield curve.

- When the spread between short-term and long-term interest rates narrows, the yield curve begins to flatten. A flat yield curve is often seen during the transition from a normal yield curve to an inverted one.

Why do economic recessions happen?

Understanding the sources of recessions has been one of the enduring areas of research in economics. There are a variety of reasons recessions take place.

- Sharp changes in the prices of the inputs used in producing goods and services.

- A recession can also be triggered by a country’s decision to reduce inflation by employing contractionary monetary or fiscal policies.

- Some recessions are rooted in financial market problems. Sharp increases in asset prices and a speedy expansion of credit often coincide with the rapid accumulation of debt.

- It can be the result of a decline in external demand, especially in countries with strong export sectors.

- A recession is an economic downturn that is not caused solely by the economic activity itself. Technological developments are also a factor in the recession.

- The imbalance between production and consumption can also trigger a recession.

- Another indication is when the value of a country’s imports is greater than its exports. This can affect the state budget deficit and a decrease in national income.

Because recessions have many potential causes, it is a challenge to predict them.

The behavioral patterns of numerous economic variables including credit volume, asset prices, and the unemployment rate around recessions have been documented.

- But although they might be the cause of recessions, they could also be the result of recessions or in economic parlance, endogenous to recessions.

- Even though economists use a large set of variables to forecast the future behavior of economic activity, none has proven a reliable predictor of whether a recession is going to take place.

Characteristics of recession

Although each recession has unique features, recessions often exhibit several common characteristics:

- They typically last about a year and often result in a significant output cost. In particular, a recession is usually associated with a decline of 2 percent in GDP. In the case of severe recessions, the typical output cost is close to 5 percent.

- The fall in consumption is often small, but both industrial production and investment register much larger declines than that in GDP.

- They typically overlap with drops in international trade as exports and, especially, imports fall sharply during periods of slowdown.

- The unemployment rate almost always jumps and inflation falls slightly because overall demand for goods and services is curtailed.

- Along with the erosion of house and equity values, recessions tend to be associated with turmoil in financial markets.

Types of economic recession

There can be several factors causing recession and concerning them and the recoveries, recession can be classified into four or five basic types:

Boom and bust recession

Most economies bounce up and down while their overall growth increases.

- An economy that “booms,” or expands faster than planned over the long term, frequently face inflation.

A central bank or other government supervisory body frequently implements measures to “cool” the economy and avoid overheating to manage inflation.

- Often, these measures involve boosting taxes, decreasing government expenditure, or increasing interest rates.

- This might limit general spending and shift consumer preferences to conserving money and paying off debts, which can produce a recession, or “bust.

Balance sheet recession

Richard Koo, an economist, coined the phrase “balance sheet recession,” which often occurs when an economy is overextended with debt.

- In typical times, financial institutions lend out the money that people and corporations save with them to other people and companies, keeping the economy moving.

- As consumer and company spending patterns change as a result of worries about debt levels, everyone starts to cut down on spending at the same time to “clean up their balance sheets.”

Depression

There is no formal definition of depression, but most analysts consider depression to be an extremely severe recession in which the decline in GDP exceeds 10 percent.

There have been only a handful of depression episodes in advanced economies since 1960.

- During the Great Depression of the 1930s, policies like the New Deal restructured how the economy functioned and many regulations from that time are still in use today.

Supply-side shock

Global events, like wars, natural disasters, or public health crises, can cause a large shock to domestic or international supply chains and push an economy into a recession.

- These sorts of recessions may not continue long if the supply is replenished soon.

- Yet if not, the impacts of the supply shock might last for years, as is the case with the ongoing supply problems brought on by the COVID-19 pandemic.

- They can also result in a long-term movement towards supply chain diversification or changing how products are utilized, such as an increase in investments in alternative fuels like natural gas or solar energy as a result of an oil crisis.

Read here: Economic recoveries

Impact of the economic recession 2023 on the world

The economic outlook for 2023 will feel different depending on where you are in the world, according to the World Economic Forum.

- The majority of chief economists expect moderate or strong growth in the Middle East and North Africa and South Asia.

- While most of them predict that the growth will be weak in the US and Europe.

In the latest International Monetary Fund (IMF) predictions, the outlook for global growth was trimmed by 0.2 percentage points, while the forecast for the eurozone was revised down dramatically to 0.5% from 1.2%.

On the other side, the Middle East and North Africa, and South Asia were seen as the strongest performers.

- Some economies in that region, including Bangladesh and India, were seen as benefiting from a global trend diversifying away from China.

While the outlook is generally gloomy and uncertain, potential bright spots include the easing of inflationary pressures and the possibility for consumer sentiment to stabilize and improve.

- Soaring food costs will disproportionately affect low-income countries, with many more people facing food insecurity.

- Weak global demand was seen as the biggest challenge for businesses to overcome in 2023, followed by the high cost of borrowing, high input costs, and talent shortages.

- The fall of the cryptocurrency sector is expected to have relatively little spillover into wider financial markets.

- The majority of chief economists do not expect further economic disruption from COVID-19.

Conclusion

The shape, length, and subsequent recoveries of recessions can be influenced by a wide range of various factors. These factors might include supply or economic shocks, natural disasters, or public health emergencies.

A firm or nation may better prepare for a specific recession by understanding the similarities and differences between the many types of recessions and their recoveries.

These variables may include consumer confidence, interest rates, pricing, and supply chain problems. These insights may help a firm plan for the recovery, whatever shape it takes.

-Article written by Swathi Satish

Leave a Reply