Foreign Direct Investment (FDI) is considered as a significant source of non-debt financial resource for economic development.

Foreign Direct Investment (FDI) is considered as a significant source of non-debt financial resource for economic development.

A non-resident entity can invest in India except in those sectors/activities which are prohibited.

A person resident outside India may hold a foreign investment in any particular Indian company either as Foreign Direct Investment (FDI) or as Foreign Portfolio Investment (FPI).

What is FDI?

‘FDI’ or ‘Foreign Direct Investment’ means investment through capital instruments by a person resident outside India –

- in an unlisted Indian company OR

- in ten percent or more of the post-issue paid-up equity capital on a fully diluted basis of a listed Indian company.

Note: ‘Person’ includes(i) an individual, (ii) a Hindu undivided family, (iii) a company, (iv) a firm, (v) an association of persons or a body of individuals whether incorporated or not, (vi) every artificial juridical person, not falling within any of the preceding subclauses, and (vii) any agency, office, or branch owned or controlled by such person.

A fully diluted basis means the total number of shares that would be outstanding if all possible sources of conversion are exercised.

What happens if the equity capital by FDI falls below 10% in a listed company?

In case an existing investment by a person resident outside India in capital instruments of a listed Indian company falls to a level below ten per cent, of the post issue paid-up equity capital on a fully diluted basis, the investment shall continue to be treated as FDI.

Also read: Foreign Portfolio Investment (FPI)

Which are the entities that can invite FDI in India?

- Indian Company

- Partnership Firm

- Proprietary Concern

- Trusts

- Limited Liability Partnerships (LLPs)

- Investment Vehicle

- Startup Companies

How can an Indian Company receive foreign investment?

In India, foreign investment can be made mainly under two routes:

- Automatic Route: Under the Automatic Route, the non-resident investor or the Indian company does not require any approval from Government of India for the investment. Reserve Bank of India is in charge of Automatic Route.

- Government Approval Route: Under the Government Approval Route, prior to investment, approval from the Government of India is required. Proposals for foreign direct investment under Government route, are considered by respective Administrative Ministry/ Department.

Note: Earlier the Foreign Investment Promotion Board (FIPB) and Secretariat for Industrial Assistance (SIA) was in charge of recommending Foreign Direct Investment (FDI) which does not come under the automatic route. However, FIPB was abolished in 2017, and its power was given to the respective Administrative Ministries/ Departments.

Note: Acquisition of shares and amount remitted through RBI’s NRI Schemes are also considered as FDI.

Examples of FDI in India

- In 2020, BYJU’s (an Indian education technology firm) raised US$ 500 million in a new round of funding led by Silver Lake, a US-based private equity company.

- In 2020, Unacademy, an Edtech platform, raised US$ 150 million from SoftBank Group (a Japanese conglomerate).

Benefits of Foreign Direct Investment (FDI)

FDI infuses long term sustainable capital in the economy.

FDI also contributes towards technology transfer, development of strategic sectors, greater innovation, competition and employment creation amongst other benefits.

FDI vs FPI

Foreign Investment means any investment made by a person resident outside India on a repatriable basis in capital instruments of an Indian company or to the capital of an LLP. It can be either Foreign Direct Investment (FDI) or Foreign Portfolio Investment (FPI).

Foreign Direct Investment (FDI) is the investment through capital instruments by a person resident outside India

- (a) in an unlisted Indian company OR

- (b) in 10 per cent or more of the post-issue paid-up equity capital on a fully diluted basis of a listed Indian company.

‘Foreign Portfolio Investment’ means any investment made by a person resident outside India through capital instruments where such investment is –

- (a) less than ten per cent of the post-issue paid-up share capital on a fully diluted basis of a listed Indian company OR

- (b) less than ten per cent of the paid-up value of each series of the capital instrument of a listed Indian company.

FDI Policy of India

FDI policy is an enabling policy which is uniformly applicable in the country across all scales of industries including micro, small and medium enterprises (MSMEs).

Government has put in place a liberal and transparent policy for Foreign Direct Investment (FDI), wherein most of the sectors are open to FDI under the automatic route.

The Government reviews the FDI policy and makes changes from time to time, to ensure that India remains an attractive and investor-friendly destination.

Sectors in which FDI is prohibited

FDI is prohibited in:

- a) Lottery Business including Government/private lottery, online lotteries, etc.

- b) Gambling and Betting including casinos etc.

- c) Chit funds

- d) Nidhi company

- e) Trading in Transferable Development Rights (TDRs)

- f) Real Estate Business or Construction of Farm Houses

- g) Manufacturing of cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco

substitutes - h) Activities/sectors not open to private sector investment e.g.(I) Atomic Energy and (II) Railway operations (other than permitted activities).

Note: ‘Real estate business’ shall not include the development of townships, construction of residential /commercial premises, roads or bridges and Real Estate Investment Trusts (REITs) registered and regulated under the SEBI (REITs) Regulations 2014. Foreign technology collaboration in any form including licensing for franchise, trademark, brand name, management contract is also prohibited for Lottery Business, Gambling and Betting activities.

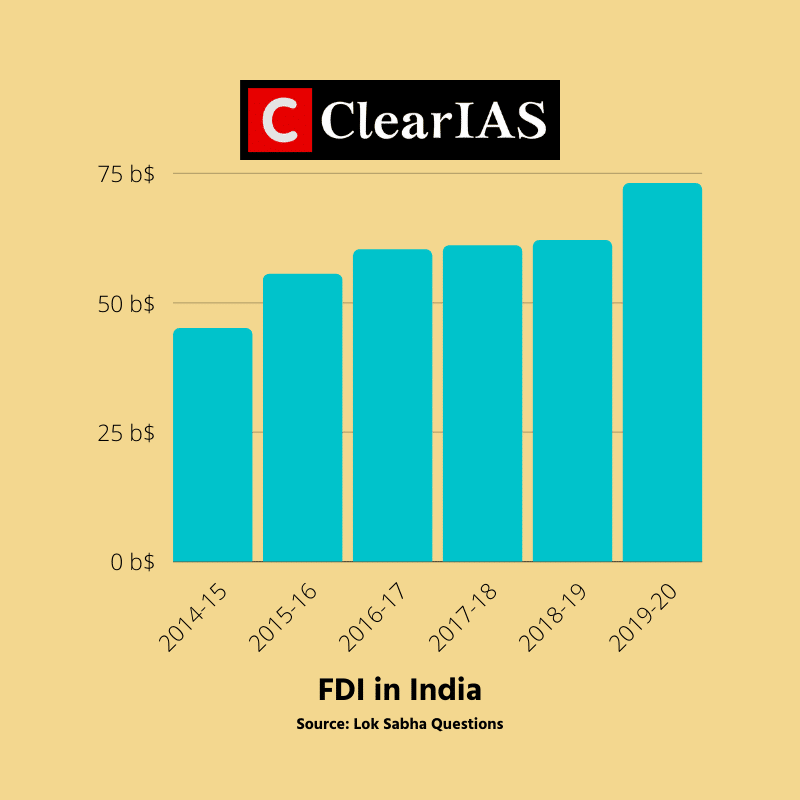

Foreign Direct Investment in India: Year-wise

S. No. |

Financial Year |

Total FDI Inflow (in US$ billion) |

1 |

2014-15 |

45.14 |

2 |

2015-16 |

55.56 |

3 |

2016-17 |

60.22 |

4 |

2017-18 |

60.97 |

5 |

2018-19 |

62.00 |

6 |

2019-20 |

73 |

FDI inflows in India increased to $55.56 bn in 2015-16, $60.22 billion in 2016-17, $60.97 bn in 2017-18, and $62.00 bn (provisional figure) in 2018-19. India has attracted around $74 bn investments across sectors during 2019-20.

Note: You may note that the above figures correspond to the total FDI inflow. The net FDI inflow is lower.

Foreign Direct Investment in India: Top Countries (2000-2019)

- Mauritius (31%)

- Singapore (20%)

- Japan (7.2%)

- Netherlands (6.7%)

- USA (6.2%)

Latest trends (2019-20): Singapore> Mauritius > Netherlands > Cayman Islands > USA

Sector-wise FDI inflows: Top Sectors (2000-2019)

- Services (17.6%)

- Computer Software and Hardware (9.5%)

- Telecommunications (8.1%)

- Trading (5.8%)

- Construction Development (5.5%)

Latest trends (2019-20): Manufacturing> Communication Services > Retail & Wholesale Trade > Financial Services > Computer Services

Government Initiatives to attract Foreign Direct Investment

- Invest India was set up in 2009 as the national investment promotion and facilitation agency. This is a non-profit venture under the Department for Promotion of Industry and Internal Trade, Ministry of Commerce and Industry, Government of India. Invest India focuses on sector-specific investor targeting and development of new partnerships to enable sustainable investments in India.

- Make in India Initiative was launched with liberal norms for FDI in manufacturing.

- FDI limit was increased in different sectors.

- The Government of India amended the FDI policy to increase FDI inflow.

- FIPB was abolished.

Also read: Masala Bonds: Concept Explained With Video

UPSC Question from this topic

[Question UPSC CSE 2020] With reference to Foreign Direct Investment in India, which one of the following is considered its major characteristic?

(a) It is the investment through capital instruments essentially in a listed company.

(b) It is a largely non-debt creating capital flow

(c) It is the investment which involves debt-servicing.

(d) It is the investment made by foreign institutional investors in the Government securities.

Answer: (b) It is a largely non-debt creating capital flow

subsidiary of foreign company is engaged in warehousing activities in India. Date of Incorporation is Feb 2022. Can this company (Foreign Subsidiary) buy agricultural land in India. If no, then can it enter into an agreement with a Indian company/LLP/Individual to provide funds for buying agricultural land and get the CLU and then purchase the land from in form of buying the company.

Please elaborate with necessary sections.

Is there any other way this company can acquire the land.