Operation Twist is an unconventional monetary policy of the Central Bank. Recently, the Reserve Bank of India tried ‘Operation Twist’ in India.

Operation Twist is an unconventional monetary policy of the Central Bank. Recently, the Reserve Bank of India tried ‘Operation Twist’ in India.

Originally, ‘Operation Twist’ was the name given to the US Federal Reserve monetary policy operation. This operation involved the purchase and sale of government securities to boost the economy by bringing down long-term interest rates.

In 2019 and 2020, the Reserve Bank of India conducted its version of ‘Operation Twist’ through simultaneous purchase and sale of government securities under Open Market Operations (OMOs).

What is Operation Twist?

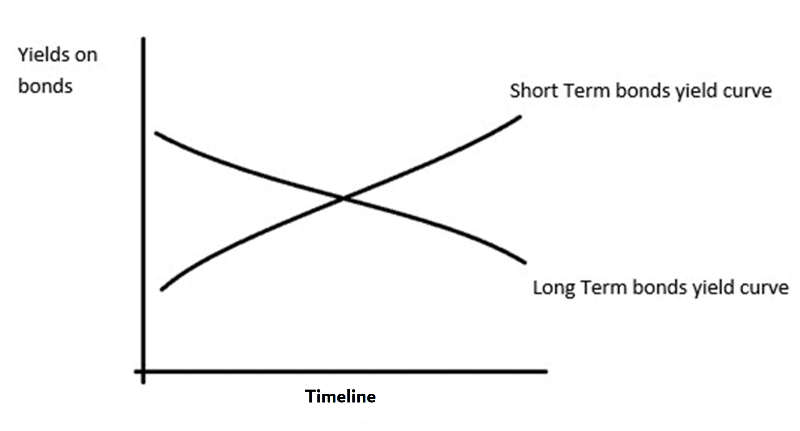

Operation Twist is the operation by which the Reserve Bank of India twists the ‘yield of government securities’ – particularly the yield of long-term government securities with respect to short term government securities.

Under Operation Twist, the RBI will buy long term bonds of the government and at the same time sell short term securities of the government.

Buying long term securities and selling short term securities will reduce the yield of long term securities compared to that of the short term ones. This yield impact is the objective of Operation Twist.

What is the Yield of Government Securities?

The term yield denotes the benefit or interest-rate a Government Security (Eg: Government Bonds or Treasury Bills) provide.

For example, a Government Bond of Rs.1000 provides an interest of Rs.100 per year, it’s yield percentage is 10%.

What happens when RBI goes for bulk buying of long-term government bonds?

When RBI goes for bulk purchase of long-term government bond, it will create a big demand in the market.

As a result, the price of long-term bonds will increase.

When the price of bonds increases, the yield (interest rate) of the long-term bonds decrease. This is because the price of the bonds and yield of the bonds are inversely proportional.

Thus, with simultaneous buying of long-term bonds and selling of short-term securities, RBI can bring down the interest rates of long-term government securities.

Explanation of the ‘Yield of Bonds’ with an example

The purpose of operation twist is to bring down the interest rate of long-term government securities.

Suppose that, before undertaking Operation Twist, the yield of long term government securities with an original price of Rs.1000 was 10%.

Now, as RBI is buying this long-term bond in bulk, there is a huge demand for it.

When the demand increases, the price will also increase.

Imagine that the price of the government bond increases to Rs.1200 in the secondary market for bonds. This means that people are ready to sell the bond only at a higher price.

Now, if a person is buying this bond, he will get only a 10% interest rate on the original price (Rs.1000) – which means only Rs.100 per year as interest. The new owner of the bond spent Rs 1200, but he will get an interest of Rs 100 and not Rs.120.

What does this mean? The effective interest rate of the bond has decreased.

Instead of the original 10% rate, the yield of the bond is now only 8.3%.

Rs.100 gain for a Rs.1200 investment is 8.3%. Even though the original interest rate is 10%, as the price of the bond increased the yield decreased.

This is one side of the story. The reverse happens when the Government sells short-term securities.

Thus by simultaneous buying and selling of government securities (Operation Twist), the RBI can bring down the long-term interest rates.

Benefits of bringing down the long term interest rates

- The public can borrow at a lower interest rate so that credit, consumption, and investment will go up.

- The government can borrow at a lower interest rate to finance the fiscal deficit.

Why Operation Twist is necessary? Why Can’t RBI directly reduce the interest rates?

The Monetary Policy Transmission Mechanism is not fine-tuned in India.

For example, the RBI slashed key interest rate — the repo rate — by 1.35 per cent in 2019, but banks passed on only part of it.

The one-year median marginal cost of funds based lending rate (MCLR) has declined only 0.5 per cent.

Thus we can see that the conventional methods were not effective enough.

As interest rates remained high, most of the businesses were not taking loans. The credit growth was extremely sluggish.

As the Indian GDP growth rate fell below 5 per cent, to revive the economy (by attracting investment), reduction in the effective interest rate was necessary. This necessitated RBI to adopt the unconventional monetary policy of ‘Operation Twist’.

7 Key Points to Understand about Operation Twist

- Operation Twist is a monetary policy of the Reserve Bank of India.

- This is an unconventional monetary policy of the RBI.

- Operation Twist is part of the Open Market Operation (OMO) of RBI.

- Under Operation Twist, RBI does the simultaneous buying and selling of government securities.

- RBI buys long-term government securities while RBI sells short-term government securities.

- The purpose of Operation Twist is to reduce the interest rate of long-term government bonds.

- As the rate of interest gets reduced, both the public and the government can borrow at a cheaper rate. This is supposed to revive the economy.

Which topic do you want ClearIAS to prepare the next concept explainers?

Hope you liked the video and notes. Subscribe to ClearIAS YouTube channel for more interesting videos.

Let us know which topic you want us to prepare the concept explainer next. We shall prepare videos/online notes based our your inputs.

Mention your requirements in the comment section. Thanks in advance.

🙂

Are you preparing for IAS

helpful!

Can you please help with concept clearing for balance of payments? Different types of accounts (with special focus on capital, financial accounts). Effect of ECBs and other such transactions like dollar purchase by RBI, or any other resent operation on BOP. Thanks

Twin balancesheet problem

All technologies, medicines ,therapies which are using COVID19 should be discussed as next topic

sir weekly hindu analysis .

Interest rate has to be reduced by commercial bank like sbi . So how reducing the long term interest rate on govt. security causes sbi to reduce its lending interest rate ?

Make me diplomat because I want to be a IFS officer,I want your guidance what should I study?