In this article, we shall help you not only understand the key points of the Union Budget 2020 but also understand the key concepts like Fiscal Deficit, Primary Deficit etc.

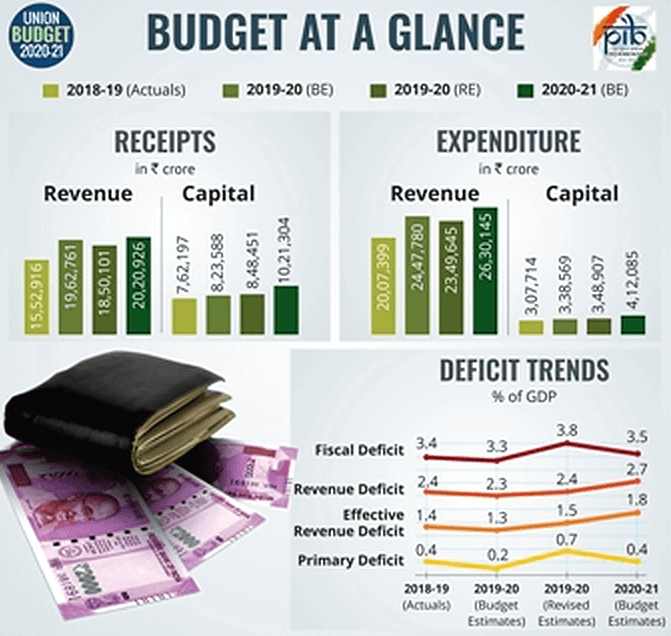

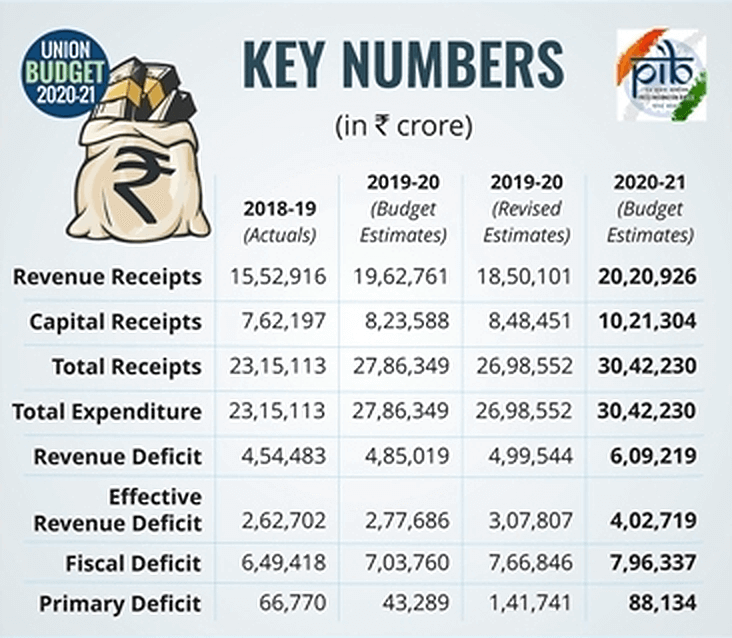

Budget 2020 provides the actual estimates for FY’2018-19, revised estimates for FY’2019-20 and budget estimates for FY’2020-21. By analysing these figures, we help you find the key areas where you should look in the budget.

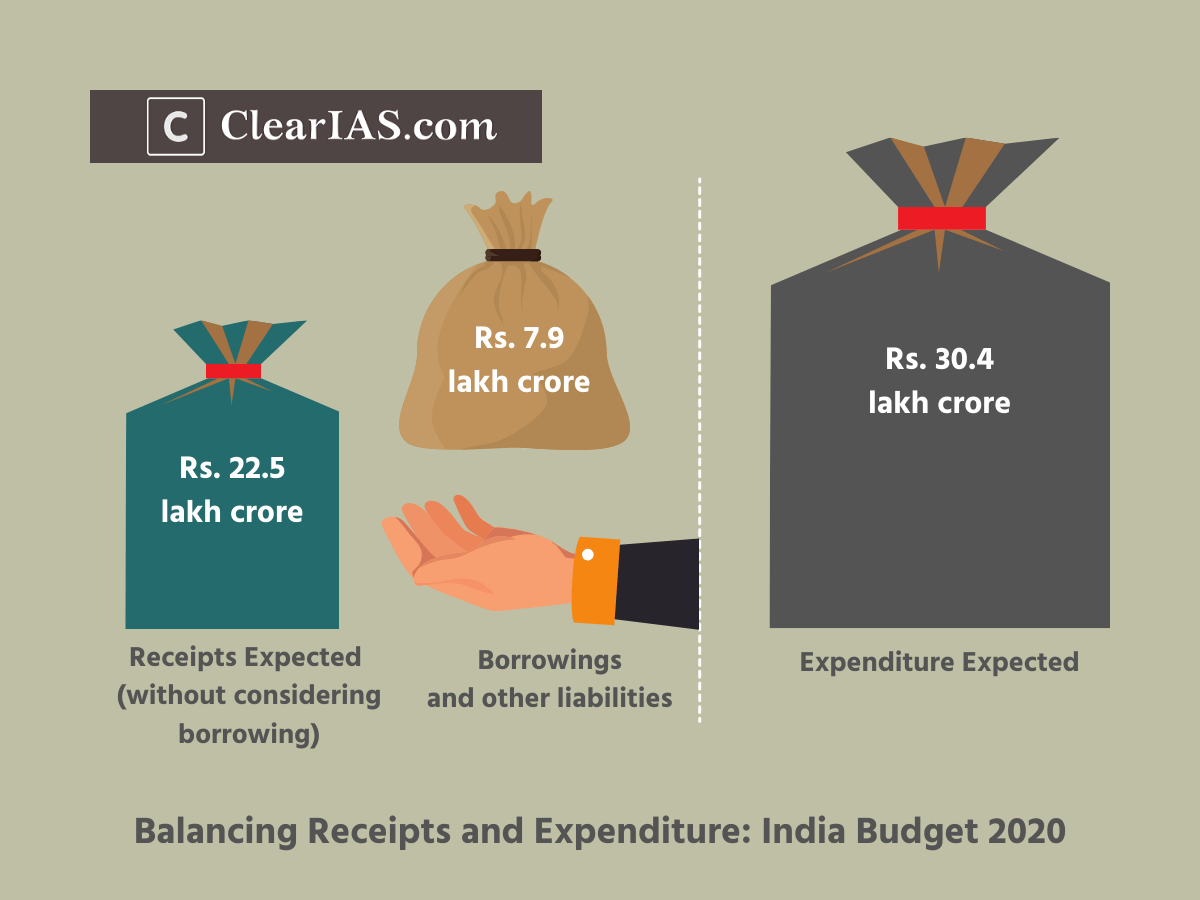

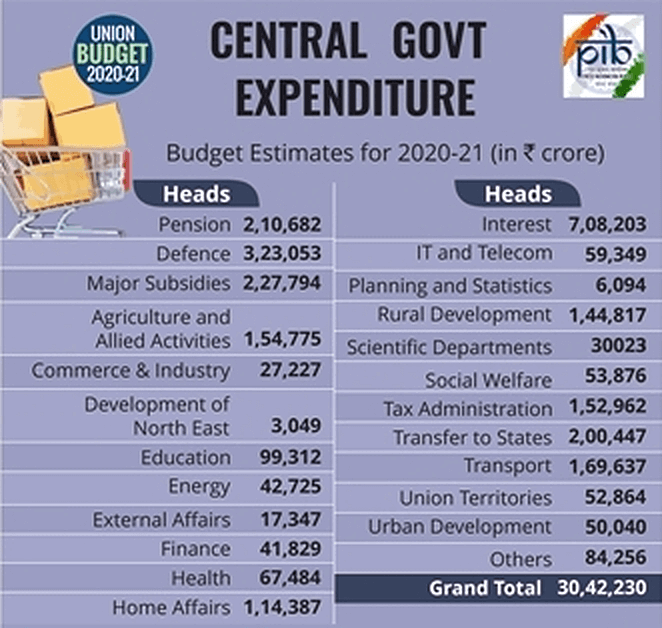

Budget Expenditure: Rs.30,42,230 crores

The Indian Budget 2020 is of 30.42 lakh crore rupees. The expenditure has increased significantly when compared with the Union Budget 2019, where the expenditure figure was 26.98 lakh crore rupees (revised estimates).

Total Receipts (without considering borrowing): Only Rs.22,45,893 crores

The total revenue expected in the financial year 2020-21(without considering borrowing) is only Rs. 22.45 lakh crores. As you can see the expenditure (Rs.30.42 lakh crores) is way higher than the receipts (Rs.22.45 lakh crores).

To balance the expenditure and receipts side of the budget, the government needs to borrow money.

The borrowings and other liabilities: Rs. 7,96,337 crores

The Indian government needs to borrow Rs. 7.96 lakh crore in the financial year 2020-21 to meet its expenditure. Borrowings and other liabilities are known as Fiscal Deficit.

The Indian government needs to borrow Rs. 7.96 lakh crore in the financial year 2020-21 to meet its expenditure. Borrowings and other liabilities are known as Fiscal Deficit.

Do you need a formula for Fiscal Deficit? Here it is:

Fiscal Deficit = Total Expenditure – Total Receipts excluding borrowings.

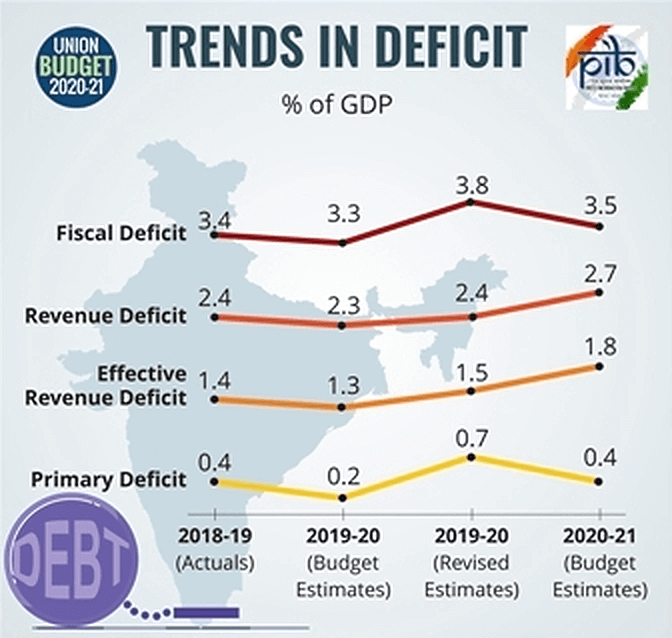

As per budget 2020, Fiscal Deficit is 3.5% of Indian GDP.

Ideally, Fiscal Deficit should be kept below 3% of GDP. The current rate is above the Financial Responsibility and Budget Management Act (FRBM) guidelines. I shall discuss in detail about FRBM in another post.

However, you should note that borrowing is not always a bad idea – if the borrowed money is used for productive purposes. For example, if the borrowed money is used to build capital assets like factories, roads, railways etc – that is productive. We have already seen the National Infrastructure Pipeline. Investments like those in NIP would result in better employment opportunities as well.

However, how does the Indian Finance Minister plan to utilise the borrowings as per Indian Budget 2020?

Interest payments alone are Rs. 7,08,203 crore!

The Indian government had already taken many loans – mainly from the public. The interest payments for the same is above Rs. 7.08 lakh crore. You may note that this is just for interest payments and not for principal repayments.

So how much amount is left for productive investments?

To find this, you need to deduct Interest Payments from Borrowings. It can also be expressed as Fiscal Deficit – Interest Payments.

How much will it be? Rs. 796337 crores – Rs. 708203 crore = Rs. 88134 crores.

This figure is known as Primary Deficit.

The Primary Deficit of India, as per the latest budget is Rs. 88134 crores.

This comes only as 0.4 of GDP. What should you understand from this figure?

The value of primary deficit denotes the borrowing which is not used for interest payments. Out of the borrowed money, only 0.4% of GDP is, in reality, available for productive purposes.

Disinvestment target: Rs.2,10,000 crore

Well, the Finance Minister limited the borrowings (Fiscal Deficit) at Rs.7.96 lakh crores (3.5% of GDP), expecting additional revenue via another route – sale of capital assets.

This government has set an ambitious target of sales of shares of Public Limited Companies – of the value of around Rs.2.1 lakh crores. This includes a probable shocker – to sell shares of Life Insurance Corporation of India (LIC). Previous governments haven’t touched this insurance cash cow, probably reserving it only for emergency situations.

Smt. Nirmala Sitharaman, under the usual disinvestment route, it is targeting Rs.1,20,000 crore. Finance Ministry is also aiming for another Rs. 90,000 crore via the disinvestment of Government stake in Public Sector Banks and Financial Institutions (read the IPO of LIC).

Note: For 2019-20, the target of the government during the budget proposal was Rs.105000 crore. However, it is updated in the revised estimates as Rs.65,000 crore. Even this figure is far from reality, as only Rs. 18,100 crore has been earned through this route in the first 9 months of this financial year.

The amount dedicated to Capital Expenditure: Rs.4,12,085 crore (only 13.5% of total expenditure)

As we mentioned before, for a country to grow, it should invest in productive assets (capital assets). With that perspective in mind, the main figure to look at is capital expenditure. Only this figure would be used to build infrastructure – road, railways etc – which would help in future growth.

Out of the total expenditure of Rs.30.42 lakh crore rupees, only Rs.4.12 lakh crore is allocated for capital expenditure (13.5%).

If the grants in aid given to states for capital asset creation (Rs 2.65 lakh crore) are also included, the total expenditure on the capital asset creation side comes only to 22.25% of the entire union budget. This is not adequate investment, however better than last year.

Tax Revenue: Rs.16,35,909 crore (meets only 53.7% of expenditure)

The Finance minister estimates a tax revenue of Rs.16.35 lakh crore for the financial year 2020-21. It should be noted that this is a lower figure than the last year budget estimates (Rs.16,49,582 crore) which will miss the target by about Rs.1.4 lakh crores as per revised estimates.

Apart from the tax revenue of Rs.16.35 lakh crore, the government also expect to get Rs.3.85 lakh crore as non-tax revenue. This is significantly higher expectations than last year budget.

The total revenue receipts estimated are Rs. 19.77 lakh crore (meets only 66% of total expenditure)

Revenue receipts less than revenue expenditure by Rs. 6,09,219 crore

Spending on the revenue side would not build any new assets. Revenue expenditure is used for day-to-day expenses of running the government machinery like salary, pension, interest payments etc.

Ideally, a government system should be efficient enough to generate surplus income from the resources on which it gives a salary, pension etc so that the additional revenue can be used for capital expenditure. However, in the case of India, the government machinery is not generating enough income to even to meet their salary or pension.

To understand the case better, consider a government project to collect a particular tax. If the salaries, pension, and administrative expenses of the project is Rs.26 crore, and if the project is able to collect only Rs.20 crore as tax, running this project results in a loss of Rs.6 crore rupees. In this case, it’s even better not to collect tax!

That is the reason why, the FRBM act, even in 2003, mandated to eliminate the revenue deficit completely. However, the fundamental problem of revenue deficit still exists in the Indian Budget.

The total revenue receipts estimated are Rs. 20.2 lakh crore while total revenue expenditure is Rs.26.3 lakh crore. The revenue deficit has increased to 2.7 per cent of GDP.

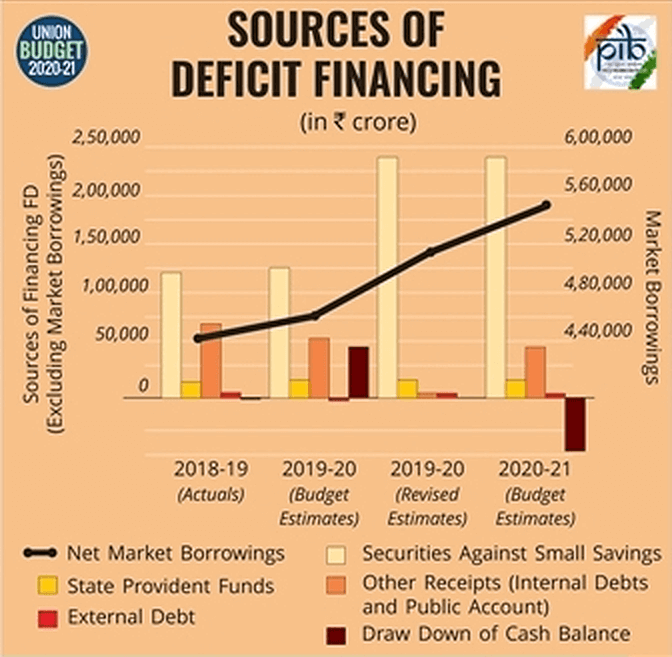

Budget 2020: How the government is planning to finance the fiscal deficit?

There are a few sources to finance the fiscal deficit, the most important one – we have already discussed – is market borrowings.

Higher the fiscal deficit, the higher will be the market borrowings. However, this will result in lower funds for the private sector to borrow.

Apart from market borrowings, other debt receipts like Securities against Small Savings, Other Receipts (Internal Debts and Public Account), Draw Down of Cash Balance etc. are also proposed to be widely used this time.

‘Tax revenue’ vs ‘GDP’ growth

If weaker growth means lower taxes, is the converse also true?

At a time when the Economic Survey estimated 5% real GDP growth for FY 2019-20, and a maximum of 6.5% real GDP growth for FY 2020-21, the budget calculations are based on estimated nominal GDP growth of 10% – which is debatable.

It is yet to be seen if India can grow at that pace in 2020-21 if inflation factor remains at the current level.

At this point in time, when the nominal GDP growth for FY2019-20 is estimated at around 7.5%, tax-revenue growth is only around 2.6%.

Note: There are two personal inferences here. At least one of those should be correct. (1) The growth in GDP is not entirely getting transformed into tax-revenue growth. Tax revenue growth should only be assumed to be 1/3rth of nominal GDP growth. (2) Considering that tax-data as verifiable at ground-level, the nominal GDP growth rate estimates may not be accurate.

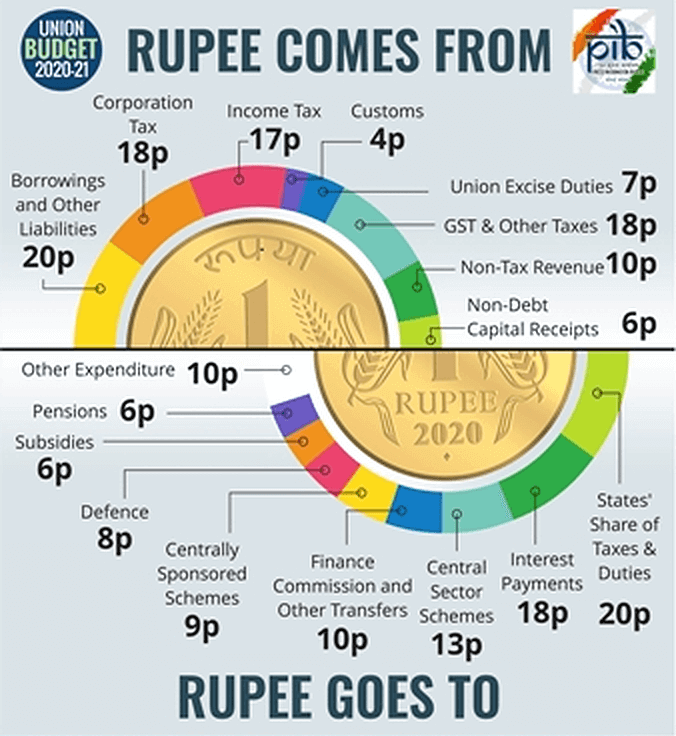

Budget 2020: The Tax Revenue Split

Income Tax is still expected to generate 17% of total receipts. A greater share (18%) is expected from Corporation Tax. Another 18% of receipts is estimated from the major indirect tax – Goods and Service Tax (GST). However, the major share of receipts in Budget 2020 comes from borrowings and other liabilities (20%).

Important announcements in the Union Budget 2020-21

- Wealth creators will be respected in this country, announces Finance Minister while presenting the Annual Financial Statement (budget) in sync with the theme of the Economic Survey 2020.

- The three themes of the Budget 2020 are Aspirational India, Economic development, and Caring society.

- Union Budget 2020-21 has proposed a 16-point action plan to boost agriculture and farmers’ welfare and doubling farmers’ income by 2022.

- Agricultural credit target has been set at 15 lakh crore rupees.

- Twenty lakh farmers will be provided funds for setting up standalone solar pumps.

- Comprehensive measures for 100 water-stressed districts have been proposed in the Budget.

- Jan Aushadhi Kendras in all districts of the country to provide medicines at affordable rates.

- A degree-level full-fledged online education programme will be offered by the top 100 institutions in the country.

- 3.6 lakh crore rupees has been approved for Jal Jeevan Mission.

- 100 more airports will also be developed by 2024 to support the UDAN scheme.

- 1.7 lakh crore rupees will be provided for transport infrastructure in the coming financial year.

- National Mission on Quantum Technologies and applications with an outlay of Rs.8000 crore proposed.

- New Income Tax Regime as an option to the old regime.

- Simplified GST return shall be implemented from 1st April 2020. Refund process to be fully automated.

- Fiscal deficit at 3.8% in 2019-20 (RE) and 3.5% for 2020-21(BE); return path committed to Fiscal Consolidation without compromising on investment.

Download 100 Important MCQs from ES and Budget 2020

Budget 2020: Conclusion

One important clue from this year budget is the falling tax revenue. Even the government has lowered its expectations on tax-revenue when compared to last year. Tax-revenue along with non-tax revenue is only helping to meet 2/3rd of the expenditure.

As the economy is facing a slowdown, the government cannot expect much from the income tax. GST still has many bottlenecks to be fixed. To fill the gap, the government is depending heavily on disinvestments and market borrowings.

To get out of the current economic slowdown, increase in fiscal spending in the priority areas is the right solution. Nevertheless, it is clear that, too much borrowing will widen the Fiscal Deficit. It is also against FRBM guidelines, but the government is now going in that direction.

Another indicator against the FRBM is the Revenue Deficit which increased to 2.7% of GDP (the actual target being 0% of GDP). Instead of increasing spending at the capital assets side, there is an increase in expenditure on the revenue side this year – which will surely create problems in future.

All the government should do now is to promote a good business atmosphere in India so that the tax revenue will increase accordingly. Otherwise, revised budget estimates will show the targets as missed. If that is the case, there won’t be enough funds for development projects and promises will remain only on paper.

Last but not least, overdependence on borrowings and disinvestment is not a sign of a healthy economy. Enlarging deficits just shows that things are not well. Probably these measures can be used a temporary medicine until the economy bounces back. However, we cannot do it year after year.

To conclude, while the vision of the budget is good, the logic of the division of funds under various heads could have been better.

Thank you so much for simple and effective explanation.

@ Rajat – Thank you for the feedback. Great to know that you liked the write-up.

Even though I am a beginner I could easily understand the budget through this explanation

@ Aji – Great to know that. Thank you for the comments.

Easy to understand

@ Aji – Thank you for the feedback.

Nice information in easy way

@Hitesh – Thank you. Happy to hear that.

Very well explained, kudos.

@Avinash – Thank you.

thank u sir u have explained very well and I have got very good knowledge on the budget topic

@ Sandeep – Great. Really happy to know that.

Really very lucid and helpful. Thanks for the efforts and easy to understand write up

@ Mahesh – Thank you for letting us know your thoughts.

please upload core-of-the-core-schemes-budget-2020

Hi, I am a working profession and beginner for UPSC, need someone’s guidance how should I start. Can you please help me out.

I have made below strategy if you can advise:

1. To all the basic concepts including completing books in 8 months, with every weekly and monthly revision.

2. In these 8 months, reading daily current affairs using insight vision and clear IAS.

3. Start writing main answers daily and weekly revision of each subject.