In India, even though the RBI Act 1934 allows government control, the convention is that the RBI is allowed autonomy to do what it wants. However, recently there are many media reports about increasing control over the Central Bank of India by the Central Government.

The departure of two eminent governors of RBI – Mr Raghuram Rajan’s and Mr. Urjit Patel – raised eyebrows about increasing government control over the Reserve Bank of India.

The RBI’s announcement of a surplus transfer of 991.22 billion rupees for the 9 months from July 2020 to March 2021 also pointed finger’s at RBI’s independence.

In this article, we will generally touch upon the issue of independence of RBI and specifically focus on the issue of surplus transfer.

Need of independence of institutions/regulatory bodies

According to Montesquieu, Separation of power ensures efficient functioning of key organs of government as no individual organization can garner political monopoly and abuse power.

In the book Why Nations Fail, Acemoğlu and Robinson argue that inclusive economic and political institutions guarantee rule of law and infuse creativity through the plurality of decision making. On the other hand, extractive institutions will lead to the concentration of resources in ruling elites, stifling change and innovation.

Special Case of Reserve Bank of India

The RBI is not constitutionally independent, as the 1934 Act governing its operation gives the government power to direct it. The government appoints the central bank governor and four deputies.

The RBI Act 1934 says that the Central Government may from time to time give such directions to the Bank as it may, after consultation with the Governor of the Bank, consider necessary in the public interest.

Technically, the government is permitted by the Act to supersede the central bank if it believes the RBI has failed to carry out its obligations.

However, in reality, the convention is that the RBI is allowed autonomy to do what it wants.

Since the 1990s, the increasing presence of market and market players disciplined the government and forced Central Banks to remain independent under the pressure of the government. For example, if inflation expectation is high, but the central bank reduces the policy rate under the pressure of the government, the market will penalize such a move.

Need of independence of RBI

- Central banks mainly focus on long-term financial stability and growth. While the government/party in power has short-term growth as their prime focus, since they will be facing elections around the year, be it the central or the states.

- Central banks strive to build credibility through series of difficult choices that reflect sacrificing short-term gains for long-term outcomes such as financial or price stability, which may not be in the liking of the government.

- Most of the domain that is managed by RBI have potential front-loaded benefits for the economy, but the tail risk in form of financial instability.

- Reducing the repo/policy rate will decrease the interest rate in the economy and thereby expanding the money supply. However, it may lead to inflationary pressures in the economy.

- Excessive lowering of interest rates can lead to greater credit creation and semblance of growth in the short term. But it can create an asset price bubble, low-quality lending by banks, etc., thus hampering long-term financial stability.

- Allowing unlimited foreign capital into the economy can increase Foreign Portfolio Investment (FPIs) in G-Sec and corporate bonds. However, it can cause depreciation of the rupee and volatility in the market when these FPIs reverse. Eg: taper tantrum in 2013.

- By regulatory forbearance, the bank balance sheets can be made to look good, but it will cause banking crises like the current NPAs.

- As a regulator of banks, RBI should be seen as independent of government as it regulates both private and public sector banks. Otherwise, the conflict of interest can hinder private players in the banking industry.

- The government will follow the easy route of manipulating RBI than focusing on painful structural reforms.

Diverse Roles Handled by the Reserve Bank of India (RBI)

RBI Act 1934, Banking Regulation Act 1949 gives RBI the necessary operational independence in pursuing its functions.

RBI’s role is not limited to control inflation. It has crucial roles to play in debt management as well as in the control of exchange rates.

(1) Monetary Policy

Post-independence, RBI supported the socialistic economic policies of the government by fixing interest rates on all credits and prescribing sectoral credit allocation.

Post the deregulation of interest rates in the 1990s, RBI adopted a multiple indicator approach for setting interest rates, where monetary policies had many objectives like inflation control, growth, financial stability, etc. However, this policy gave too much discretion in the hand of the RBI governor to decide rates. This allowed government pressure to creep in.

Urjith Patel committee 2014 and the subsequent constitution of the Monetary Policy Committee (MPC) made the monetary policy more transparent.

The committee consists of 3 RBI members and 3 government nominees.

It has an explicit mandate of maintaining inflation at 4% +-2% while paying attention to growth and operational independence to achieve it for RBI.

This reform made monetary policy decision-making transparent, independent, and rule-based.

(2) Debt Management

RBI used to automatically monetize government deficit. In this, RBI purchases government securities (G-secs) directly from the government and finances fiscal deficit.

This was capped by 1994-97 through Ways and Means Advances (WMA). In this, RBI and government together fix the amount that RBI will give as collateral-free advance.

FRBM act 2003 explicitly prohibited RBI from participating in the primary market of G-secs.

Earlier Open Market Operations (OMOs) were conducted to manage G-sec yields. Bond yield is inversely proportional to Bond price. Lower bond yield is favourable for borrowers- in this case, the government. So, RBI will buy G-secs from the market in OMO. This will decrease the supply of bonds and thus increasing their price, which in effect reduces the yields of the bonds.

Now OMO is conducted to provide liquidity in the market – that is as a monetary tool to manage monetary policy.

However, the current Government Security Acquisition Program (G-SAP) is seen as an OMO operation to reduce the borrowing cost of the government than a liquidity measure.

Before the 1990s, CRR and SLR were very high (SLR 38.5% in 1990). This provided a ready channel for financing the government deficit, as under SLR, banks needed to park part of their money in liquid bonds eg: G-secs.

After the 1990s, these rates were rationalized and reduced in line with Basel III norms. (SLR 18% in 2020)

(3) Exchange Rate Management

RBI has the function of managing an impossible trinity – in which it has to maintain price stability, stable G-sec yields, and a stable forex rate.

To reduce inflation, RBI raises interest rates. However, it will lead to rising in the bond yield, thus increases the burden on government borrowing. It will also lead to rupee depreciation. If RBI buys G-secs and reduces yields, it will pump in liquidity, thus causing inflation and rupee depreciation.

With our exchange rate becoming floating from fixed, monetary policy becoming inflation targeting, and automatic monetization of the fiscal deficit being curbed, RBI now can manage exchange rates more independently.

However, the recent G-SAP program to reduce the G-sec yield has increased the money supply and thereby depreciating the rupee.

Methods of undermining the independence

- Appointing government-affiliated officials rather than technocrats to key positions of RBI.

- Setting up parallel regulatory agencies with weak regulatory powers: proposal to separate payment and settlement function and debt management function of RBI.

Result of undermining the independence

- Banks and private institutions will focus on lobbying the government for favourable regulations and policies than on value creation.

- Attrition of human capital from the central bank.

- Systemic risk can creep up in certain financial domains that are carved out of the Central Bank’s purview

Challenges of independence

Financial Sector Assessment Program (FSAP) of IMF and World Bank rates India on central bank independence as materially non-compliant. FSAP mentions three important areas of independence of RBI:

- Regulation of Public Sector Banks (PSBs) – RBI is statutorily limited in taking regulatory actions like replacement of the board, license revocation, etc. of Public Sector Banks, that it can take in case of Private Sector Banks

- Adequate strength of RBI’s balance sheet.

- Regulatory scope – Carving out functions from RBI to other regulators. Eg: proposal to set up a new payment and settlement authority.

Bimal Jalan Committee to determine the Economic Capital Framework (ECF)

The committee was set up by RBI to determine the Economic Capital Framework (ECF) in 2018-19. To appreciate the issue of surplus transfer, we must have a basic idea of RBI’s balance sheet.

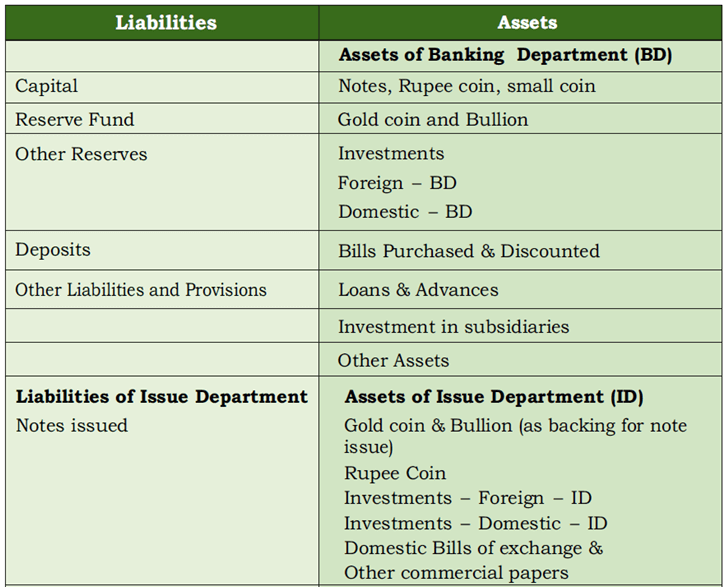

The balance sheet of RBI

RBI balance sheet consists of Assets and Liabilities. The retained earnings of RBI’s operation in a year are represented under the head of other liabilities and provisions. These mainly include:

- Revaluation reserves – revaluation of RBI’s reserves like foreign currencies, securities, gold, etc.

- Currency and Gold Revaluation Account (CGRA)

- Investment Revaluation Account – Rupee Securities (IRA-RS) and Foreign Securities (IRA-FS)

- Foreign Exchange Forward Contracts Valuation Account (FCVA)

- Contingency Fund – Created to meet unexpected and unforeseen contingencies including depreciation in the value of securities, risks arising out of monetary/ exchange rate policy operations, systemic risks, and any risk arising on account of the special responsibilities enjoined upon the central bank.

- Surplus transferable to Govt. of India under Section 47 of RBI Act.

- Asset Development Fund (ADF)

- Provision for payables.

- Bills payable

- Miscellaneous

Recommendations of Bimal Jalan Committee

- Currency and Gold Revaluation Reserve Account represents unrealized gains and hence is not attributable to the government.

- Contingency Reserve (built out of retained earnings) or Contingency Risk Buffer (CRB) should be maintained within a band of 6.5-5.5% of total assets and the surplus can be transferred to the government.

- buffer at 4.5-5.5% for monetary and financial stability risks and 1% for credit and operational risks.

- Specified that the revaluation reserve cannot be used to bridge shortfalls in other reserves.

- Reserves represent the country’s savings for a ‘rainy day’, which is a monetary or financial crisis.

- RBI’s capital framework should be reviewed every five years.

- RBI’s accounting year (July-June) be aligned with the fiscal year that ends on 31 March.

- RBI should pay interim dividends to the government, a practice that started in 2016-17, only under exceptional circumstances.

Thus, after meeting all the expenses and keeping 5.5-6.5% of total assets as contingency buffer, RBI should transfer the surplus to the government.

RBI’s actions

- RBI accepted the committee’s recommendation.

- It Transferred ₹1,76,051 crore to the government, including a sum of ₹52,637 crores from its contingency reserve built over the last several years.

- It also decided to peg the contingency fund ratio at 5.5%.

RBI Annual Report 2020-21

- RBI announced a surplus transfer of 991.22 billion rupees for the 9 months from July 2020 to March 2021 and maintained CRB at 5.5%.

- Made its accounting period from April-March from July-June to match that of government and banks accounting year.

- RBI garnered this much surplus through forex transactions and lower provisions – that is transfer to CRB. Since its balance sheet was contracted this year, on the back of lower-income and expenditure, 5.5% of total assets is lower.

Analysis

- The government as a sovereign owns the RBI and hence there is nothing wrong if it decides to tap the central bank’s reserves.

- Section 47 of the RBI Act provides for this surplus transfer.

- In this financial year, around 20,000 Crore retained as contingency reserve by RBI, which is 5.5% of total assets. Economists like Ila Tripathi argues that this should also be passed to the government because of the following reasons:

- The government could have used this extra non-debt receipt in this extraordinary situation of the pandemic.

- Central Bank is fully backed by the government, so they don’t require so much contingency buffer.

- RBI is the only regulatory body that is not audited by CAG, thus it has no pressure to cap the expenses.

- Other Central Banks don’t keep this much reserve.

- RBI issues cash and generates money by holding government securities. While RBI receives interest in these securities, they don’t have to give interest for cash/money circulation. This interest is not an income of RBI, but only an arrangement between RBI and the government for money creation. So, effectively, RBI should return it to the government.

- On the other hand, former deputy governor of RBI, Rakesh Mohan, argues that:

- Long-term fiscal consequences are the same whether government issues new securities to finance its expenditure or it uses RBI’s surplus.

- The government will go off its fiscal discipline if it gets non-debt easy finance from RBI.

- Central Bank can lose credibility with the financial market and public at large if it has insufficient capital and incurs substantial losses.

- Government, with its stressed fiscal position, may not be able to capitalize the central bank when the need arises.

- Critics also argue that these reserves represent inter-generational equity built up over several years by the RBI. It is morally unacceptable that any government can swallow such funds.

However, exceptional situations demand exceptional solutions, and today India is facing such a scenario. So surplus transfer to the government will free up its hands. However, the government should efficiently use the surplus.

RBI is one of the most powerful Central Banks of the world, both in terms of its statutory powers and the functions it performs. However, there are many criticisms concerning its operational independence. Democracy is not only in elections but also in governing through strong independent institutions.

RBI is the only regulator without an appellate body. The accountability of RBI is many a time questioned in the wake of repetitive failures in its role, like that of its regulatory-supervisory lapses. The government is answerable to parliament and the larger public on the ensuing problems like frauds in banks like PMC, PNB. Hence, the stakes of government are also high.

The need is to have a cooperative understanding between RBI and the government. RBI should acknowledge the political compulsions of the government, and the government should consider RBI as a true friend, as Viral Acharya opines, who can give bitter but apt policy suggestions. Furthermore, in a vibrant democracy, it is always advisable to have healthy debates on policies and their implementation.

Conclusion

For a healthy economy, the Fiscal Policy by the Government and Monetary policy by the Central Bank should be in tandem.

However, is not uncommon to have differences in opinion between the Central Government and the Central Bank. This can happen not only in India but in other countries as well. For example, in the US, Trump’s presidency had skirmishes with the Fed concerning monetary policy and rate hikes.

Issues usually happen when the Government, whose role is to manage the fiscal policy, dictates what is to be there in the monetary policy, which is under the domain of RBI.

In India, even though RBI is bound to accept the Government order as per the law, the convention is to provide the institution sufficient independence.

Too much political pressure on the RBI office is not good for the nation.

Certain countries like the UK has by law granted autonomy to their Central Bank. India should think about whether we need such a law.

Article by Sethu Krishnan M, curated by ClearIAS Team

References: The Hindu, Print, Quest for Restoring Financial Stability in India, Business Line

Very good and informative blog. Thanks for sharing such an amazing post.