Tax buoyancy refers to the responsiveness of tax revenue growth to changes in the Gross Domestic Product (GDP) or national income. Read here to learn more about it.

Tax buoyancy is a measure of how tax revenues increase or decrease in response to the rise or fall in GDP, without altering the tax rates.

It is crucial to understand the effectiveness and efficiency of a tax system in generating revenue under changing economic conditions.

Tax buoyancy in India

Tax buoyancy in India has been a subject of considerable interest and analysis, especially in the context of the country’s dynamic economic environment and tax reforms.

The concept is particularly important for India as it navigates through periods of rapid economic changes, policy reforms, and efforts to enhance tax compliance and widen the tax base.

Concerning the interim budget 2024, the government aims to restrict the fiscal deficit to 5.8 percent of the Gross Domestic Product (GDP) as against 5.9 percent budgeted earlier for the financial year and the push to restrict the fiscal deficit target to below 4.5 percent by 2025-26 rides on the back of a strong buoyancy in tax revenues.

Historical Perspective and Recent Trends

Historically, India’s tax buoyancy has fluctuated due to various factors, including economic cycles, tax policy reforms, and structural changes in the economy.

The introduction of major tax reforms, such as the Goods and Services Tax (GST) in July 2017, aimed to transform the taxation landscape, enhance compliance, and improve revenue collection efficiency, thereby affecting buoyant taxation.

- Pre-GST Era: Before the implementation of GST, India’s tax system was fragmented with a plethora of indirect taxes levied by both the central and state governments. Factors like economic growth, inflation, and tax evasion influenced buoyant taxes during this period. Efforts to reform direct taxes, including moderating tax rates and broadening the base, also impacted the measure.

- Post-GST Implementation: The GST was expected to increase tax buoyancy by simplifying the tax structure, making it more transparent, and reducing the compliance burden on businesses. Initial years post-GST saw mixed results in terms of tax buoyancy, partly due to teething problems, changes in tax rates, and compliance issues. However, as the system stabilized, there was an anticipation of improved tax buoyancy reflecting better compliance and coverage.

Factors Affecting Tax Buoyancy in India

- Economic Growth: India’s economic growth is a critical determinant of tax buoyancy. Periods of high growth have historically been associated with high buoyant taxes, reflecting increased tax collections from corporate and individual income taxes, as well as indirect taxes.

- Tax Administration and Compliance: Efforts to streamline tax administration and enhance compliance, including through digitization (e.g., e-filing of tax returns, GSTN platform) and enforcement activities, impact buoyancy.

- Policy Reforms: Tax policy reforms, including rationalization of tax rates, exemption reductions, and base-broadening measures, play a significant role in determining tax buoyancy. The introduction of the GST is a prime example of such reforms.

- Informal Economy: The size of the informal economy in India poses challenges to tax collection and affects tax buoyancy. Efforts to formalize the economy are expected to improve tax buoyancy over time.

- Global Economic Environment: External factors, including global economic trends and trade dynamics, can influence India’s economy and, consequently, its tax buoyancy, given the impact on exports, imports, and foreign investment.

Significance

- Economic Stability: High tax buoyancy indicates that the tax system can automatically stabilize the economy. During economic expansions, buoyant tax systems ensure that tax revenues increase, potentially limiting overheating. Conversely, during downturns, revenues fall, providing an automatic fiscal stimulus.

- Fiscal Planning: The phenomenon is essential for government fiscal planning and budgeting. Understanding how tax revenues respond to economic growth helps in forecasting revenue and making informed decisions about spending, debt, and investment.

- Policy Evaluation: It helps evaluate the effectiveness of the tax system and tax policy reforms. For instance, changes in tax buoyancy over time can indicate the impact of tax policy reforms on revenue generation capacity.

- Adjusting Tax Policies: A low buoyant tax could prompt governments to adjust tax policies, such as modifying tax rates or broadening the tax base, to ensure adequate revenue generation in line with economic growth.

Factors Affecting Tax Buoyancy

- Economic Structure: The composition of an economy (services vs. manufacturing, informal vs. formal sector) significantly influences the measure.

- Tax Compliance and Administration: Efficient tax administration and high compliance rates can lead to high buoyancy by minimizing tax evasion and avoidance.

- Tax Base Elasticity: The sensitivity of the tax base to economic growth affects buoyancy. For example, income taxes may be more buoyant in an economy where incomes are rapidly growing.

- Tax Rate Structure: Progressive tax systems, where tax rates increase with the tax base, might exhibit higher buoyancy compared to flat or regressive systems.

Challenges

- Volatile Revenues: Highly buoyant tax systems might lead to revenue volatility, complicating fiscal planning, especially in economies prone to frequent booms and busts.

- Equity Concerns: Ensuring that tax buoyancy does not disproportionately impact different income groups is crucial for maintaining fairness in the tax system.

Tax elasticity

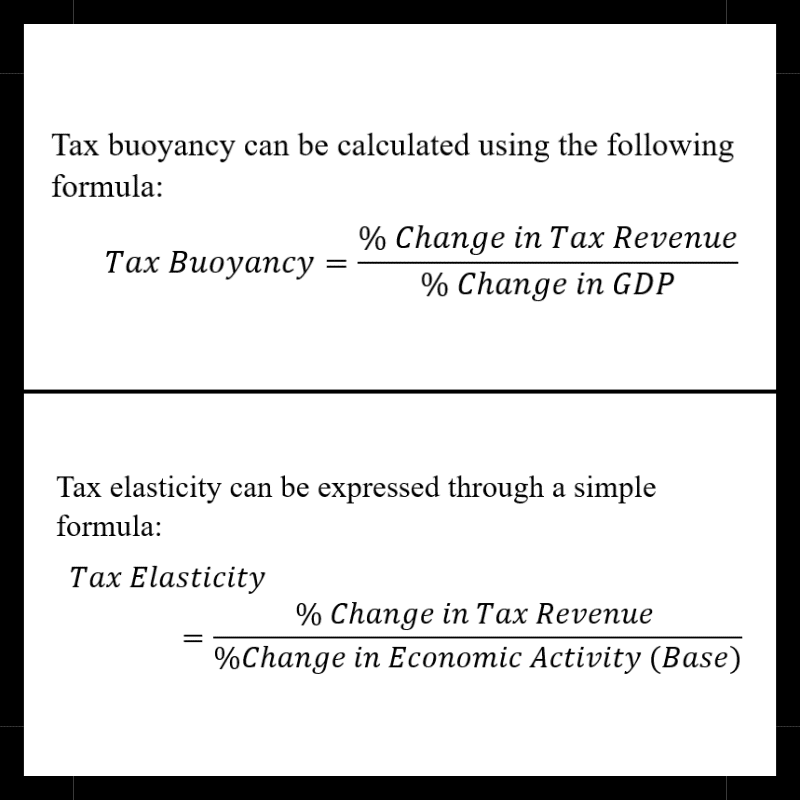

Tax elasticity is a crucial concept in fiscal policy and economics, referring to the responsiveness of tax revenue to changes in the economic base that generates that revenue, without any alteration in tax rates.

- It’s a measure that helps governments and policymakers understand how tax revenues will change in response to economic growth or contraction.

- Unlike tax buoyancy, which accounts for changes in tax rates along with the tax base, tax elasticity focuses purely on the inherent responsiveness of the tax system to economic activity, holding tax laws constant.

Tax Elasticity vs Tax Buoyancy

A tax is considered elastic if it is greater than 1, meaning tax revenues grow faster than the economy.

- Conversely, a tax with an elasticity less than 1 is inelastic, indicating tax revenues grow more slowly than the economy.

- Elastic taxes are sensitive to economic cycles, with revenues significantly increasing during economic booms and decreasing during recessions.

- Inelastic taxes provide a more stable revenue stream across economic cycles.

Formula for Tax Buoyancy

- If it is greater than 1, tax revenues are growing at a faster rate than the economy, indicating a highly responsive tax system.

- If it equals 1, tax revenues are growing at the same rate as the economy.

- If it is less than 1, tax revenues are growing at a slower rate than the economy, suggesting a less responsive tax system.

Conclusion

Tax buoyancy is a vital concept for understanding the dynamics between tax revenue generation and economic growth.

It provides insights into the effectiveness of a tax system in responding to economic changes, assisting policymakers in fiscal planning and policy formulation.

A well-designed tax system should aim for high buoyancy, ensuring stable and sustainable revenue generation aligned with economic growth while maintaining equity and efficiency.

Related articles:

-Article by Swathi Satish

Leave a Reply