The Union Minister for Finance & Corporate Affairs, Smt Nirmala Sitharaman tabled the Union Budget 2023-24 in Parliament on February 01, 2023. Read further to know about the Union Budget 2023 highlights.

The Union Budget of India is the annual financial statement presented by the Finance Minister of India in Parliament. It outlines the government’s receipts and expenditures for the upcoming fiscal year and provides an overview of the country’s financial health.

The budget is closely watched by the public, businesses, and investors, and often includes major policy announcements and tax proposals. The Union Budget plays a crucial role in shaping the country’s economic policies and its impact is felt across the country.

Also read: Crowdfunding – Benefits and Concerns

Introduction

This Budget hopes to build on the foundation laid in the previous Budget, and the blueprint drawn for India@100. The government envision a prosperous and inclusive India, in which the fruits of development reach all regions and citizens, especially our youth, women, farmers, OBCs, Scheduled Castes and Scheduled Tribes.

In the 75th year of our Independence, the world recognised the Indian economy as a ‘bright star’. Our current year’s economic growth is estimated to be at 7 per cent. It is notable that this is the highest among all the major economies.

This is in spite of the massive slowdown globally caused by Covid-19 and the war. The Indian economy is therefore on the right track, and despite a time of challenges, heading towards a bright future.

Today, as Indians stands with their head, held high, and the world appreciates India’s achievements and successes, we are sure that elders who fought for India’s independence, will with joy, bless us in our endeavours going forward.

Seven Key Priorities

The Budget adopts the following seven priorities. They complement each other and act as the ‘Saptarishi’ guiding us through the Amrit Kaal.

- Inclusive Development

- Reaching the Last Mile

- Infrastructure and Investment

- Unleashing the Potential

- Green Growth

- Youth Power

- Financial Sector

Priority 1: Inclusive Development

The Government’s philosophy of Sabka Saath Sabka Vikas has facilitated inclusive development covering in specific, farmers, women, youth, OBCs, Scheduled Castes, Scheduled Tribes, divyangjan and economically weaker sections, and overall priority for the underprivileged (vanchiton ko variyata). There has also been a sustained focus on Jammu & Kashmir, Ladakh and the Northeast. This Budget builds on those efforts.

Agriculture and Cooperation

The following are the important initiatives in this regard

Digital Public Infrastructure for Agriculture

Digital public infrastructure for agriculture will be built as an open source, open standard and interoperable public good. This will enable inclusive, farmer-centric solutions through relevant information services for crop planning and health, improved access to farm inputs, credit, and insurance, help for crop estimation, market intelligence, and support for the growth of the agri-tech industry and start-ups.

Agriculture Accelerator Fund

An Agriculture Accelerator Fund will be set up to encourage Agri startups by young entrepreneurs in rural areas. The Fund will aim at bringing innovative and affordable solutions for challenges faced by farmers. It will also bring in modern technologies to transform agricultural practices and increase productivity and profitability.

Enhancing the productivity of cotton crop

To enhance the productivity of extra-long staple cotton, we will adopt a cluster-based and value chain approach through Public Private

Partnerships (PPP). This will mean collaboration between farmers, the state and industry for input supplies, extension services, and market linkages.

Atmanirbhar Horticulture Clean Plant Program

We will launch an Atmanirbhar Clean Plant Program to boost the availability of disease-free, quality planting material for high value

horticultural crops at an outlay of ` 2,200 crores.

Global Hub for Millets: ‘Shree Anna’

“India is at the forefront of popularizing Millets, whose consumption furthers nutrition, food security and welfare of farmers,” said the Hon’ble Prime Minister.

We are the largest producer and second largest exporter of ‘Shree Anna’ in the world. We grow several types of ‘Shree Anna’ such as jowar, ragi, bajra, kuttu, ramdana, kangni, kutki, kodo, cheena, and sama. These have a number of health benefits and have been an integral part of our food for centuries.

To make India a global hub for ‘Shree Anna’, the Indian Institute of Millet Research, Hyderabad will be supported as the Centre of Excellence for sharing best practices, research and technologies at the international level.

Agriculture Credit

The agriculture credit target will be increased to 20 lakh crore with a focus on animal husbandry, dairy and fisheries.

Fisheries

A new sub-scheme of PM Matsya Sampada Yojana with a targeted investment of 6,000 crores will be launched to further enable activities of fishermen, fish vendors, and micro & small enterprises, improve value chain efficiencies and expand the market.

Health, Education and Skilling

The following are its various constituents

Nursing Colleges

One hundred and fifty-seven new nursing colleges will be established in co-location with the existing 157 medical colleges established

since 2014.

Sickle Cell Anaemia Elimination Mission

A Mission to eliminate Sickle Cell Anaemia by 2047 will be launched. It will entail awareness creation, universal screening of 7 crore people in the age group of 0-40 years in affected tribal areas, and counselling through collaborative efforts of central ministries and state governments.

Medical Research

Facilities in select ICMR Labs will be made available for research by public and private medical college faculty and private sector R&D teams for encouraging collaborative research and innovation.

Pharma Innovation

A new programme to promote research and innovation in pharmaceuticals will be taken up through centres of excellence. We shall also encourage the industry to invest in research and development in specific priority areas. Multidisciplinary courses for medical devices

Teachers’ Training

Teachers’ training will be re-envisioned through innovative pedagogy, curriculum transaction, continuous professional development, dipstick surveys, and ICT implementation. The District Institutes of Education and Training will be developed as vibrant institutes of excellence for this purpose.

National Digital Library for Children and Adolescents

A National Digital Library for children and adolescents will be set up for facilitating the availability of quality books across geographies, languages, genres and levels, and device-agnostic accessibility. States will be encouraged to set up physical libraries for them at panchayat and ward levels and provide infrastructure for accessing the National Digital Library resources.

Priority 2: Reaching the Last Mile

To provide a sharper focus on the objective of ‘reaching the last mile’, the government has formed the ministries of AYUSH, Fisheries, Animal Husbandry and Dairying, Skill Development, Jal Shakti and Cooperation.

Aspirational Districts and Blocks Programme

Building on the success of the Aspirational Districts Programme, the Government has recently launched the Aspirational Blocks Programme covering 500 blocks for saturation of essential government services across multiple domains such as health, nutrition, education, agriculture, water resources, financial inclusion, skill development, and basic infrastructure.

Pradhan Mantri PVTG Development Mission

To improve the socio-economic conditions of the particularly vulnerable tribal groups (PVTGs), Pradhan Mantri PVTG Development Mission will be launched. This will saturate PVTG families and habitations with basic facilities such as safe housing, clean drinking water and sanitation, improved access to education, health and nutrition, road and telecom connectivity, and sustainable livelihood opportunities.

An amount of 15,000 crores will be made available to implement the Mission in the next three years under the Development Action Plan for the Scheduled Tribes.

Eklavya Model Residential Schools

In the next three years, the centre will recruit 38,800 teachers and support staff for the 740 Eklavya Model Residential Schools, serving 3.5 lakh tribal students.

Water for Drought Prone Region

In the drought-prone central region of Karnataka, central assistance of 5,300 crores will be given to Upper Bhadra Project to provide sustainable micro irrigation and filling up of surface tanks for drinking water.

PM Awas Yojana

The outlay for PM Awas Yojana is being enhanced by 66 per cent to over ` 79,000 crores.

Bharat Shared Repository of Inscriptions (Bharat SHRI)

‘Bharat Shared Repository of Inscriptions’ will be set up in a digital epigraphy museum, with the digitization of one lakh ancient inscriptions in the first stage.

Support for poor prisoners

For poor persons who are in prison and unable to afford the penalty or the bail amount, required financial support will be provided.

Priority 3: Infrastructure & Investment

Investments in Infrastructure and productive capacity have a large multiplier impact on growth and employment. After the subdued period of the pandemic, private investments are growing again. The Budget takes the lead once again to ramp up the virtuous cycle of investment and job creation.

Capital Investment as a driver of growth and jobs

Capital investment outlay is being increased steeply for the third year in a row by 33 per cent to ` 10 lakh crore, which would be 3.3 per cent of GDP. This will be almost three times the outlay in 2019-20.

This substantial increase in recent years is central to the government’s efforts to enhance growth potential and job creation, crowding

private investments, and provide a cushion against global headwinds.

Effective Capital Expenditure

The direct capital investment by the Centre is complemented by the provision made for the creation of capital assets through Grants-in-Aid to

States. The ‘Effective Capital Expenditure’ of the Centre is budgeted at 13.7 lakh crore, which will be 4.5 per cent of GDP.

Support to State Governments for Capital Investment

It has been decided to continue the 50-year interest-free loan to state governments for one more year to spur investment in infrastructure and to incentivize them for complementary policy actions, with a significantly enhanced outlay of ` 1.3 lakh crore.

Enhancing opportunities for private investment in Infrastructure

The newly established Infrastructure Finance Secretariat will assist all stakeholders with more private investment in infrastructure, including railways, roads, urban infrastructure and power, which are predominantly dependent on public resources.

Harmonized Master List of Infrastructure

The Harmonized Master List of Infrastructure will be reviewed by an expert committee for recommending the classification and financing

framework suitable for Amrit Kaal.

Railways

A capital outlay of ` 2.40 lakh crore has been provided for the Railways. This highest-ever outlay is about 9 times the outlay made in 2013-

Logistics

One hundred critical transport infrastructure projects, for last and first-mile connectivity for ports, coal, steel, fertilizer, and food grains sectors have been identified. They will be taken up on priority with an investment of 75,000 crores, including ` 15,000 crores from private sources.

Regional Connectivity

Fifty additional airports, heliports, water aerodromes and advanced landing grounds will be revived for improving regional air connectivity.

Sustainable Cities of Tomorrow

States and cities will be encouraged to undertake urban planning reforms and actions to transform our cities into ‘sustainable cities of tomorrow’. This means efficient use of land resources, adequate resources for urban infrastructure, transit-oriented development, enhanced availability and affordability of urban land, and opportunities for all.

Making Cities ready for Municipal Bonds

Through property tax governance reforms and ring-fencing user charges on urban infrastructure, cities will be incentivized to improve their creditworthiness for municipal bonds.

Urban Infrastructure Development Fund

Like the RIDF, an Urban Infrastructure Development Fund (UIDF) will be established through the use of priority sector lending shortfall. This will be managed by the National Housing Bank and will be used by public agencies to create urban infrastructure in Tier 2 and Tier 3 cities. States will be encouraged to leverage resources from the grants of the 15th Finance Commission, as well as existing schemes, to adopt appropriate user charges while accessing the UIDF. We expect to make available ` 10,000 crores per annum for this purpose.

Urban Sanitation

All cities and towns will be enabled for 100 per cent mechanical desludging of septic tanks and sewers to transition from manhole to

machine-hole mode. The enhanced focus will be provided for the scientific management of dry and wet waste.

Priority 4: Unleashing the Potential

“Good Governance is the key to a nation’s progress. Our government is committed to providing a transparent and accountable administration which works for the betterment and welfare of the common citizen,” said the Hon’ble Prime Minister.

Mission Karmayogi

Under Mission Karmayogi, the Centre, States and Union Territories are making and implementing capacity-building plans for civil servants. The government has also launched an integrated online training platform, iGOT Karmayogi, to provide continuous learning opportunities for lakhs of government employees to upgrade their skills and facilitate a people-centric approach.

Centres of Excellence for Artificial Intelligence

For realizing the vision of “Make AI in India and Make AI work for India”, three centres of excellence for Artificial Intelligence will be set up in top educational institutions. Leading industry players will partner in conducting interdisciplinary research, and develop cutting-edge applications and scalable problem solutions in the areas of agriculture, health, and sustainable cities. This will galvanize an effective AI ecosystem and nurture quality human resources in the field.

National Data Governance Policy

To unleash innovation and research by start-ups and academia, a National Data Governance Policy will be brought out. This will enable access to anonymized data.

Simplification of the Know Your Customer (KYC) process

The KYC process will be simplified by adopting a ‘risk-based’ instead of a ‘one size fits all’ approach. The financial sector regulators will also be

encouraged to have a KYC system fully amenable to meet the needs of Digital India.

One-stop solution for identity and address updating

A one-stop solution for reconciliation and updating of identity and address of individuals maintained by various government agencies,

regulators and regulated entities will be established using DigiLocker service and Aadhaar as foundational identity.

Common Business Identifier

For the business establishments required to have a Permanent Account Number (PAN), the PAN will be used as the common identifier for

all digital systems of specified government agencies. This will bring ease of doing business, and it will be facilitated through a legal mandate.

Unified Filing Process

For obviating the need for separate submission of the same information to different government agencies, a system of ‘Unified Filing Process’ will be set up. Such filing of information or return in simplified forms on a common portal will be shared with other agencies as per the filer’s choice.

Vivad se Vishwas I – Relief for MSMEs

In cases of failure by MSMEs to execute contracts during the Covid period, 95 per cent of the forfeited amount relating to bid or performance security, will be returned to them by government and government undertakings. This will provide relief to MSMEs.

Vivad se Vishwas II – Settling Contractual Disputes

To settle contractual disputes of government and government undertakings, a wherein arbitral award is under challenge in a court, a

voluntary settlement scheme with standardized terms will be introduced. This will be done by offering graded settlement terms depending on the pendency level of the dispute.

State Support Mission

The State Support Mission of NITI Aayog will be continued for three years for our collective efforts towards national priorities.

Result Based Financing

To better allocate scarce resources for competing for development needs, the financing of select schemes will be changed, on a pilot basis,

from ‘input-based’ to ‘result-based’.

E-Courts

For efficient administration of justice, Phase 3 of the E-Courts project will be launched with an outlay of 7,000 crore.

Fintech Services

Fintech services in India have been facilitated by our digital public infrastructure including Aadhaar, PM Jan Dhan Yojana, Video KYC, India Stack and UPI. To enable more innovative Fintech services, the scope of documents available in DigiLocker for individuals will be expanded.

Entity DigiLocker

An Entity DigiLocker will be set up for use by MSMEs, large businesses and charitable trusts. This will be towards storing and sharing documents online securely, whenever needed, with various authorities, regulators, banks and other business entities.

5G Services

One hundred labs for developing applications using 5G services will be set up in engineering institutions to realise a new range of opportunities, business models, and employment potential. The labs will cover, among others, applications such as smart classrooms, precision farming, intelligent transport systems, and health care applications.

Lab Grown Diamonds

Lab Grown Diamonds (LGD) is a technology-and innovation-driven emerging sector with high employment potential. These environment-friendly diamonds have optically and chemically the same properties as natural diamonds. To encourage indigenous production of LGD seeds and machines and to reduce import dependency, a research and development grant will be provided to one of the IITs for five years.

To reduce the cost of production, a proposal to review the custom duty rate on LGD seeds will be indicated in Part B of the speech.

Priority 5: Green Growth

Hon’ble Prime Minister has given a vision for “LiFE”, or Lifestyle for Environment, to spur a movement toward an environmentally conscious lifestyle. India is moving forward firmly for the ‘panchamrit’ and net-zero carbon emission by 2070 to usher in a green industrial and economic transition. This Budget builds on our focus on green growth.

Green Hydrogen Mission

The recently launched National Green Hydrogen Mission, with an outlay of ` 19,700 crores, will facilitate the transition of the economy to low

carbon intensity, reduce dependence on fossil fuel imports and make the country assume technology and market leadership in this sunrise sector.

The target is to reach an annual production of 5 MMT by 2030.

Energy Transition

This Budget provides ` 35,000 crores for priority capital investments towards energy transition and net zero objectives and energy security by the Ministry of Petroleum & Natural Gas.

Energy Storage Projects

To steer the economy on the sustainable development path, Battery Energy Storage Systems with a capacity of 4,000 MWH will be supported with Viability Gap Funding. A detailed framework for the Pumped Storage Project will also is formulated.

Renewable Energy Evacuation

The Inter-state transmission system for evacuation and grid integration of 13 GW of renewable energy from Ladakh will be constructed

with an investment of ` 20,700 crores including central support of ` 8,300 crores.

Green Credit Programme

For encouraging behavioural change, a Green Credit Programme will be notified under the Environment (Protection) Act. This will incentivize environmentally sustainable and responsive actions by companies, individuals and local bodies, and help mobilize additional resources for such activities.

PM-PRANAM

“PM Programme for Restoration, Awareness, Nourishment and Amelioration of Mother Earth” will be launched to incentivize States and

Union Territories to promote alternative fertilizers and balanced use of chemical fertilizers.

GOBARdhan scheme

500 new ‘waste to wealth’ plants under GOBARdhan (Galvanizing Organic Bio-Agro Resources Dhan) scheme will be established for promoting a circular economy. These will include 200 compressed biogas (CBG) plants, 75 plants in urban areas, and 300 community or cluster-based plants at a total investment of 10,000 crores.

Bhartiya Prakritik Kheti Bio-Input Resource Centres

Over the next 3 years, we will facilitate 1 crore farmers to adopt natural farming. For this, 10,000 Bio-Input Resource Centres will be set up, creating a national-level distributed micro-fertilizer and pesticide manufacturing network.

MISHTI

Building on India’s success in afforestation, ‘Mangrove Initiative for Shoreline Habitats & Tangible Incomes’, MISHTI, will be taken up for mangrove plantation along the coastline and on salt pan lands, wherever feasible, through convergence between MGNREGS, CAMPA Fund and other sources.

Amrit Dharohar

Wetlands are vital ecosystems which sustain biological diversity. In his latest Mann Ki Baat, the Prime Minister said, “Now the total number of Ramsar sites in our country has increased to 75. Whereas, before 2014, there were only 26…” Local communities have always been at the forefront of conservation efforts.

The government will promote their unique conservation values through Amrit Dharohar, a scheme that will be implemented over the next three years to encourage optimal use of wetlands, and enhance bio-diversity, carbon stock,

eco-tourism opportunities and income generation for local communities.

Coastal Shipping

Coastal shipping will be promoted as the energy-efficient and lower-cost mode of transport, both for passengers and freight, through PPP mode with viability gap funding.

Vehicle Replacement

Replacing old polluting vehicles is an important part of greening our economy. In furtherance of the vehicle scrapping policy mentioned in

Budget 2021-22, I have allocated adequate funds to scrap old vehicles of the Central Government. States will also be supported in replacing old vehicles and ambulances.

Priority 6: Youth Power

To empower our youth and help the ‘Amrit Peedhi’ realize their dreams, we have formulated the National Education Policy, focused on skills, adopted economic policies that facilitate job creation at scale, and supported business opportunities.

Pradhan Mantri Kaushal Vikas Yojana 4.0

Pradhan Mantri Kaushal Vikas Yojana 4.0 will be launched to skill lakhs of youth within the next three years. On-job training, industry partnership, and alignment of courses with the needs of the industry will be emphasized.

The scheme will also cover new-age courses for Industry 4.0 like coding, AI, robotics, mechatronics, IOT, 3D printing, drones, and soft skills. To skill the youth for international opportunities, 30 Skill India International Centres will be set up across different States.Skill India Digital Platform

National Apprenticeship Promotion Scheme

To provide stipend support to 47 lakh youth in three years, Direct Benefit Transfer under a pan-India National Apprenticeship Promotion

The scheme will be rolled out.

Tourism

With an integrated and innovative approach, at least 50 destinations will be selected through challenge mode. In addition to aspects such as physical connectivity, virtual connectivity, tourist guides, high standards for food streets and tourists security, all the relevant aspects would be made available on an App to enhance the tourist experience. Every destination would be developed as a complete package.

Unity Mall

States will be encouraged to set up a Unity Mall in their state capital or most prominent tourism centre or the financial capital for the promotion and sale of their own ODOPs (one district, one product), GI products and other handicraft products, and for providing space for such products of all other states.

Priority 7: Financial Sector

Our reforms in the financial sector and innovative use of technology have led to financial inclusion at scale, better and faster service delivery, ease of access to credit and participation in financial markets. This Budget proposes to further these measures. Credit Guarantee for MSMEs

Financial Sector Regulations

To meet the needs of Amrit Kaal and to facilitate optimum regulation in the financial sector, public consultation, as necessary and feasible, will be brought to the process of regulation-making and issuing subsidiary directions.

To simplify, ease and reduce the cost of compliance, financial sector regulators will be requested to carry out a comprehensive review of existing regulations.

For this, they will consider suggestions from public and regulated entities. Time limits to decide the applications under various regulations will also be laid down.

Data Embassy

For countries looking for digital continuity solutions, we will facilitate the setting up of their Data Embassies in GIFT IFSC. Improving Governance and Investor Protection in Banking Sector

To improve bank governance and enhance investors’ protection, certain amendments to the Banking Regulation Act, the Banking Companies Act and the Reserve Bank of India Act are proposed.

Capacity Building in Securities Market

To build the capacity of functionaries and professionals in the securities market, SEBI will be empowered to develop, regulate, maintain and enforce norms and standards for education in the National Institute of Securities Markets and to recognize awards of degrees, diplomas and certificates.

Central Data Processing Centre

A Central Processing Centre will be set up for faster response to companies through centralized handling of various forms filed with field offices under the Companies Act.

Reclaiming of shares and dividends

For investors to reclaim unclaimed shares and unpaid dividends from the Investor Education and Protection Fund Authority with ease, an integrated IT portal will be established.

Digital Payments

Digital payments continue to find wide acceptance. In 2022, they show an increase of 76 per cent in transactions and 91 per cent in value. Fiscal support for this digital public infrastructure will continue in 2023-24.

Azadi Ka Amrit Mahotsav Mahila Samman Bachat Patra

For commemorating Azadi Ka Amrit Mahotsav, a one-time new small savings scheme, Mahila Samman Savings Certificate, will be made available for a two-year period up to March 2025. This will offer a deposit facility of up to 2 lacks in the name of women or girls for a tenor of 2 years at a fixed interest rate of 7.5 per cent with a partial withdrawal option.

Senior Citizens

The maximum deposit limit for Senior Citizen Savings Scheme will be enhanced from Rs.15 lakh to Rs. 30 lakhs. The maximum deposit limit for Monthly Income Account Scheme will be enhanced from Rs. 4.5 lakh to Rs. 9 lakh for a single account and from ` 9 lakhs to ` 15 lakh for a joint account.

Fiscal Deficit of States

States will be allowed a fiscal deficit of 3.5 per cent of GSDP of which 0.5 per cent will be tied to power sector reforms. Revised Estimates 2022-23

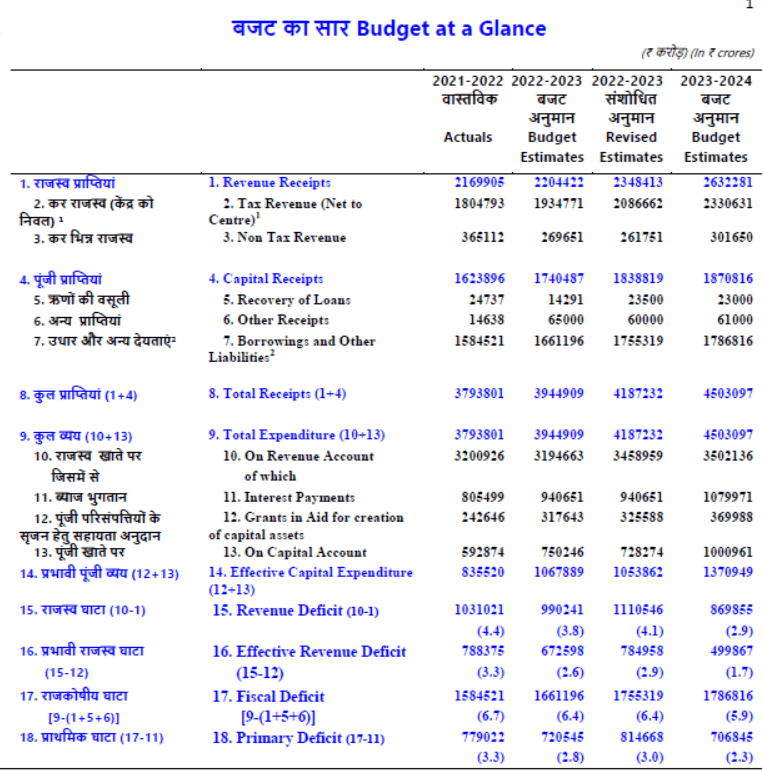

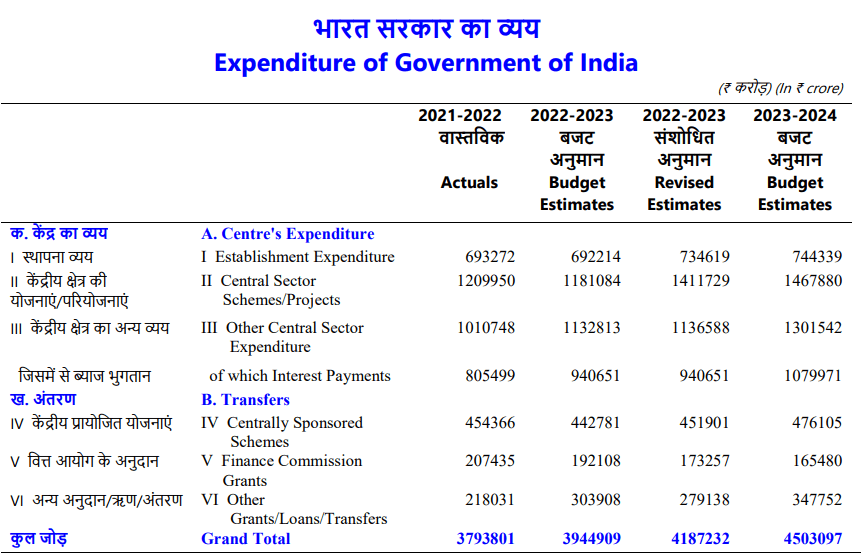

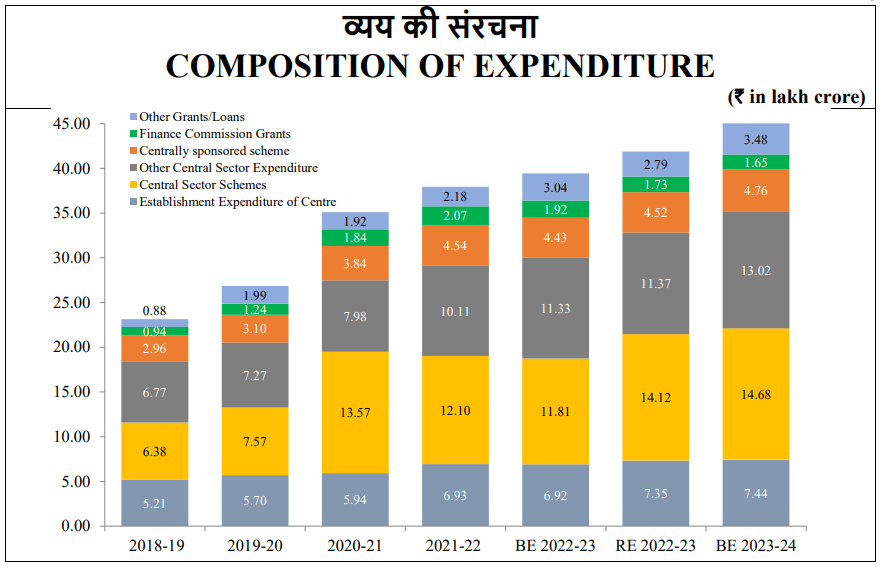

The Revised Estimate of the total receipts other than borrowings is 24.3 lakh crore, of which the net tax receipts

are 20.9 lakh crore. The Revised Estimate of the total expenditure is 41.9 lakh crore, of which the capital expenditure is about ` 7.3 lakh crore.

The Revised Estimate of the fiscal deficit is 6.4 per cent of GDP, adhering to the Budget Estimate.

Also read: Utilization of Public Funds

Revised Estimates 2022-23:

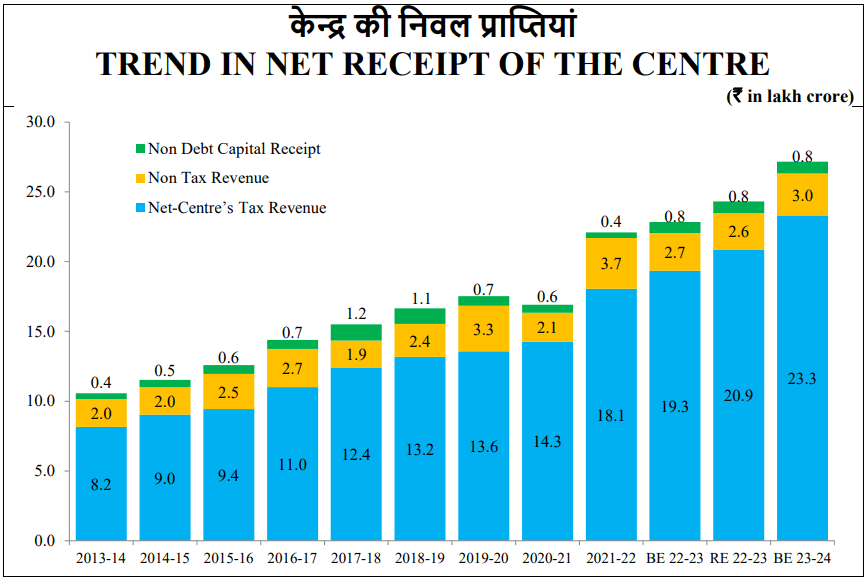

- The total receipts other than borrowings is Rs 24.3 lakh crore, of which the net tax receipts are Rs 20.9 lakh crore.

- The total expenditure is Rs 41.9 lakh crore, of which the capital expenditure is about Rs 7.3 lakh crore.

- The fiscal deficit is 6.4 per cent of GDP, adhering to the Budget Estimate.

Budget Estimates 2023-24:

- The total receipts other than borrowings are estimated at Rs 27.2 lakh crore and the total expenditure is estimated at Rs 45 lakh crore.

- The net tax receipts are estimated at Rs 23.3 lakh crore.

- The fiscal deficit is estimated to be 5.9 per cent of GDP.

- To finance the fiscal deficit in 2023-24, the net market borrowings from dated securities are estimated at Rs 11.8 lakh crore.

- The gross market borrowings are estimated at Rs 15.4 lakh crore.

Budget at a Glance

Direct Taxes

- Direct Tax proposals aim to maintain the continuity and stability of taxation, further simplify and rationalise various provisions to reduce the compliance burden, promote the entrepreneurial spirit and provide tax relief to citizens.

- The constant endeavour of the Income Tax Department to improve Tax Payers Services by making compliance easy and smooth.

- To further improve taxpayer services, a proposal to roll out a next-generation Common IT Return Form for taxpayer convenience, along with plans to strengthen the grievance redressal mechanism.

- The rebate limit of Personal Income Tax is to be increased to Rs. 7 lakh from the current Rs. 5 lakh in the new tax regime. Thus, persons in the new tax regime, with income up to Rs. 7 lakh do not pay any tax.

- Tax structure in the new personal income tax regime, introduced in 2020 with six income slabs, to change by reducing the number of slabs to five and increasing the tax exemption limit to Rs. 3 lakh. Change to provide major relief to all taxpayers in the new regime.

Change in Tax Rates

Total Income (Rs) |

Rate (per cent) |

Up to 3,00,000 |

Nil |

From 3,00,001 to 6,00,000 |

5 |

From 6,00,001 to 9,00,000 |

10 |

From 9,00,001 to 12,00,000 |

15 |

From 12,00,001 to 15,00,000 |

20 |

Above 15,00,000 |

30 |

- Proposal to extend the benefit of standard deduction of Rs. 50,000 to salaried individuals, and deduction from family pensions up to Rs. 15,000, in the new tax regime.

- The highest surcharge rate is to reduce from 37 per cent to 25 per cent in the new tax regime. This to further result in a reduction of the maximum personal income tax rate to 39 per cent.

- The limit for tax exemption on leave encashment on the retirement of non-government salaried employees is to increase to Rs. 25 lakh.

- The new income tax regime is to be made the default tax regime. However, citizens will continue to have the option to avail the benefit of the old tax regime.

- Enhanced limits for micro-enterprises and certain professionals for availing the benefit of presumptive taxation were proposed. Increased limit to apply only in case the amount or aggregate of the amounts received during the year, in cash, does not exceed five per cent of the total gross receipts/turnover.

- Deduction for expenditure incurred on payments made to MSMEs is to be allowed only when payment is actually made in order to support MSMEs in the timely receipt of payments.

- New co-operatives that commence manufacturing activities till 31.3.2024 to get the benefit of a lower tax rate of 15 per cent, as presently available to new manufacturing companies.

- The opportunity provided to sugar co-operatives to claim payments made to sugarcane farmers for the period prior to the assessment year 2016-17 as an expenditure. This is expected to provide them relief of almost Rs. 10,000 crores.

- Provision of a higher limit of Rs. 2 lakh per member for cash deposits to and loans in cash by Primary Agricultural Co-operative Societies (PACS) and Primary Co-operative Agriculture and Rural Development Banks (PCARDBs).

- A higher limit of Rs. 3 crores for TDS on cash withdrawal is to be provided to cooperative societies.

- The date of incorporation for income tax benefits to start-ups is to be extended from 31.03.23 to 31.3.24.

- Proposal to provide the benefit of carrying forward losses on change of shareholding of start-ups from seven years of incorporation to ten years.

- Deduction from capital gains on investment in residential houses under sections 54 and 54F is to be capped at Rs. 10 crores for better targeting of tax concessions and exemptions.

- Proposal to limit income tax exemption from proceeds of insurance policies with very high value. Where aggregate premium for life insurance policies (other than ULIP) issued on or after 1st April 2023 is above Rs. 5 lakh, income from only those policies with aggregate premiums up to Rs. 5 lakh shall be exempt.

- Income of authorities, boards and commissions set up by statutes of the Union or State for the purpose of housing, development of cities, towns and villages, and regulating, or regulating and developing an activity or matter, proposed to be exempted from income tax.

- A minimum threshold of Rs. 10,000/- for TDS to be removed and taxability relating to online gaming to be clarified. Proposal to provide for TDS and taxability on net winnings at the time of withdrawal or at the end of the financial year.

- Conversion of gold into the electronic gold receipt and vice versa is not to be treated as a capital gain.

- TDS rate to be reduced from 30 per cent to 20 per cent on the taxable portion of EPF withdrawal in non-PAN cases.

- Income from Market Linked Debentures to be taxed.

- Deploying about 100 Joint Commissioners for disposal of small appeals to reduce the pendency of appeals at the Commissioner level.

- Increased selectivity in taking up appeal cases for scrutiny of returns already received this year.

- Period of tax benefits to funds relocating to IFSC, GIFT City extended till 31.03.2025.

- Certain acts of omission of liquidators under section 276A of the Income Tax Act will be decriminalised from 1st April 2023.

- Carry forward of losses on strategic disinvestment including that of IDBI Bank to be allowed.

- Agniveer Fund to be provided EEE status. The payment received from the Agniveer Corpus Fund by the Agniveers enrolled in Agnipath Scheme, 2022 proposed to be exempt from taxes. Deduction in the computation of total income is proposed to be allowed to the Agniveer on the contribution made by him or the Central Government to his Seva Nidhi account.

Indirect Taxes

- The number of basic customs duty rates on goods, other than textiles and agriculture, reduced to 13 from 21.

- Minor changes in the basic customs duties, cesses and surcharges on some items including toys, bicycles, automobiles and naphtha.

- Excise duty is exempted on GST-paid compressed biogas contained in blended compressed natural gas.

- Customs Duty on specified capital goods/machinery for the manufacture of the lithium-ion cells for use in batteries of electrically operated vehicles (EVs) extended to 31.03.2024

- Customs duty exempted on vehicles, specified automobile parts/components, sub-systems and tyres when imported by notified testing agencies, for the purpose of testing and certification, subject to conditions.

- Customs duty on the camera lens and its inputs/parts for use in the manufacture of the camera module of cellular mobile phones was reduced to zero and concessional duty on lithium-ion cells for batteries was extended for another year.

- Basic customs duty reduced on parts of open cells of TV panels to 2.5 per cent.

- Basic customs duty on electric kitchen chimneys increased to 15 per cent from 7.5 per cent.

- Essential customs duty on heat coil for the manufacture of electric kitchen chimneys was reduced to 15 per cent from 20 per cent.

- Denatured ethyl alcohol used in the chemical industry is exempted from essential customs duty.

- Basic customs duty reduced on acid grade fluorspar (containing by weight more than 97 per cent of calcium fluoride) to 2.5 per cent from 5 per cent.

- Basic customs duty on crude glycerin for use in the manufacture of epichlorohydrin reduced to 2.5 per cent from 7.5 per cent.

- Duty reduced on key inputs for domestic manufacture of shrimp feed.

- Basic customs duty is reduced on seeds used in the manufacture of lab-grown diamonds.

- Duties on articles made from dore and bars of gold and platinum increased.

- Import duty on silver dore, bars and articles increased.

- Basic Customs Duty exemption on raw materials for the manufacture of CRGO Steel, ferrous scrap and nickel cathode continued.

- Concessional BCD of 2.5 per cent on copper scrap is continued.

- The basic customs duty rate on compounded rubber increased to 25 per cent from 10 per cent or 30 per kg whichever is lower.

- National Calamity Contingent Duty (NCCD) on specified cigarettes was revised upwards by about 16 per cent.

Changes in Custom Laws

- Customs Act, 1962 to be amended to specify a time limit of nine months from the date of filing an application for passing final order by the Settlement Commission.

- Customs Tariff Act is to be amended to clarify the intent and scope of provisions relating to Anti-Dumping Duty (ADD), Countervailing Duty (CVD), and Safeguard Measures.

- CGST Act to be amended

- to raise the minimum threshold of tax amount for launching prosecution under GST from one crore to two crores;

- to reduce the compounding amount from the present range of 50 to 150 per cent of the tax amount to the range of 25 to 100 per cent;

- decriminalise certain offences;

- to restrict the filing of returns/statements to a maximum period of three years from the due date of filing of the relevant return/statement; and

- to enable unregistered suppliers and composition taxpayers to make the intra-state supply of goods through E-Commerce Operators (ECOs)

Conclusion

In conclusion, the Union Budget of India plays a crucial role in shaping the country’s economic and fiscal policies. The budget proposals, tax reforms and allocations for various sectors serve as indicators of the government’s priorities and plans for the coming financial year.

The recent Union Budget of India for 2023 has emphasized the government’s focus on infrastructure development, healthcare, education, and rural empowerment. The budget also seeks to promote self-reliant and inclusive growth, with an emphasis on digital transformation and job creation.

While the budget has received mixed reactions from various stakeholders, its implementation will determine its actual impact on the Indian economy and the common man.

Leave a Reply