To understand the connection better, I recommend you to understand the following rule first.

Rule: Executive (Government) needs the approval of Legislature (Parliament) for spending!

Yes, the government cannot spend as it wishes!

Even though the government collects money from the public by means of various taxes and fees, for the expenditure of the same, it needs approval from another authority – ie. Legislature.

In the case of the Central government, the Legislature corresponds to the lower house of the Parliament ie. Loksabha.

Where is this rule (mandate) written? Answer: Constitution of India.

Article 266 of the Constitution of India mandates that Parliamentary approval is required to draw money from the Consolidated Fund of India. Besides, Article 114 (3) of the Constitution stipulates that no amount can be withdrawn from the Consolidated Fund without the enactment of a law (appropriation bill).

The Parliamentary Approval takes its time!

The full budget is usually passed only after long discussions. Even though the government (executive) seeks approval of expenditure for the next financial year (April 1 to March 31) in the current financial year itself, the approval from legislature takes its time.

Very often, discussion and voting of demands for grants and passing of Appropriation Bill go beyond the current financial year. This was precisely the case before 2016 when the budget was presented on the last working day of February, and it was difficult to get passed within the same financial year.

But the government needs money for its day to day functions…

Since Parliament is not able to vote the entire budget before the commencement of the new financial year, the necessity to keep enough finance at the disposal of Government.

A special provision is, therefore, made for “Vote on Account” by which Government obtains the Vote of Parliament for a sum sufficient to incur expenditure on various items for a part of the year.

Vote on Account

Vote on Account is a grant in advance to enable the government to carry on until the voting of demands for grants and the passing of the Appropriation Bill and Finance Bill.

This enables the government to fund its expenses for a short period of time or until a full-budget is passed. As a convention, a vote-on-account is treated as a formal matter and passed by Lok Sabha without discussion.

Vote on Account was frequently used until 2016 when the Budget was presented on the last working day of February. However, since 2017, the budget presentation date was advanced to February 1. This helped the executive to use almost 2 months time to get the full-budget passed in the same financial year. So, since 2017, Vote on Account is not usually used as part of the government budgeting process, unless in special cases like an election year.

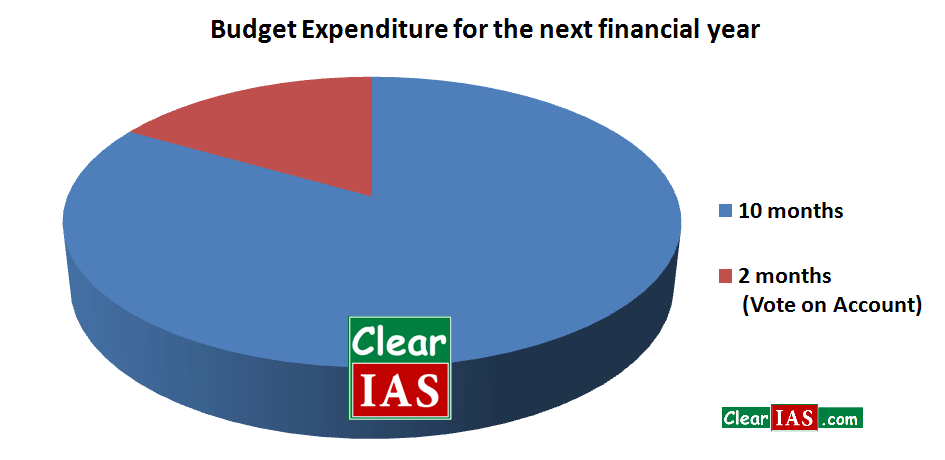

Normally, the Vote on Account is taken for two months only. The sum of the grant would be equivalent to one-sixth of the estimated expenditure for the entire year under various demands for grants.

Can Vote on Account be granted for more than 2 months?

Yes. During election year or when it is anticipated that the main Demands and Appropriation Bill will take longer time than two months, the Vote on Account may be granted for a period exceeding two months.

For example, in 2019, Vote on Account is taken for 4 months.

Difference between Full Budget and Vote on Account

- Full Budget deals with both expenditure and revenue side but Vote-on-account deals only with the expenditure side of the government’s budget.

- The vote-on-account is normally valid for two months but a full budget is valid for 12 months (a financial year).

- As a convention, a vote-on-account is treated as a formal matter and passed by Lok Sabha without discussion. But passing for budget happens only after discussions and voting on demand for grants.

- A vote-on-account cannot alter direct taxes since they need to be passed through a finance bill. Under the regular Budget, fresh taxes may be imposed and old ones may go.

- As a convention, a vote-on-account is treated as a formal matter and passed by the Lok Sabha without discussion. But the full budget is passed only after discussions and voting on demand for grants.

What is an interim budget then?

An interim budget in all practical sense is a full budget but made by the government during the last year of its term – ie. just before the election. An interim Budget is a complete set of accounts, including both expenditure and receipts. But it may not contain big policy proposals.

Is it mandatory for the government to present vote on account instead of a full budget in an election year?

It is not mandatory for the government to present a vote on account in an election year.

Though the convention is to present an interim budget and get the fund required for spending via the vote on account route, the government (if it wishes so) can even go for a Full Budget and get the appropriation bills passed to get the finances.

However, during an election year, the ruling government generally opts for a vote-on-account or interim budget instead of a full budget. While technically, it is not mandatory for the government to present a vote-on-account, but it would be inappropriate to impose policies that may or may not be acceptable to the incoming government taking over in the same year.

Read: Interim Budget 2024

Thanks for Knowlege

Very useful.

I want mock test preparation.

I want book mock test preparation.

If mock test book is available then I can take.

I believe clearing.com.

Helpful

Nice and clear explanation. Thank you

REally Nice notes..thanks for helping us Sit.

why you havent explained budget types….may i know sir except that everything is good

It gives conceptual clarity.

Very good facts thanks.

Thank you for explanation. Its very useful for UPSC

Useful info@clear ias

Sir what is the difference between a Finance Bill and Appropriation Bill, further Sir is it possible to present regular Budget without a longer discussions

Very nice explanation.Thank you

You’re welcome.

Nice sir,

Thanks sir… For crystal clear concepts

Well explained .. all doubts cleared !

Thankyou

Now I have clarity on this topic .Thanks!