Piyush Goyal, Minister of Finance, presented the Indian Budget 2019 (Interim Budget 2019-20) on February 1, 2019.

Piyush Goyal, Minister of Finance, presented the Indian Budget 2019 (Interim Budget 2019-20) on February 1, 2019.

In this article, we shall try to understand the key points of the Union Budget 2019.

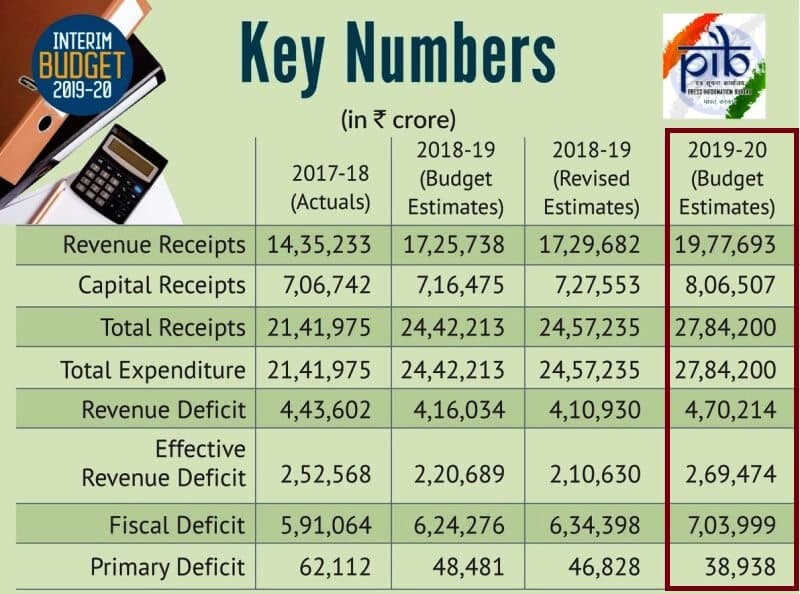

Budget Expenditure is Rs.27,84,200 crores

The Indian Budget 2019 is of 27.84 lakh crore rupees. The expenditure has increased significantly when compared with the Union Budget 2018, where the expenditure figure was 24.42 lakh crore rupees.

Total Receipts (without considering borrowing) is only Rs.20,80,201 crores

The total revenue expected in the financial year 2019-20 (without considering borrowing) is only Rs. 20.80 lakh crores. As you can see the expenditure (Rs.27.84 lakh crores) is way higher than the receipts (Rs.20.80 lakh crores).

To balance the expenditure and receipts side of the budget, the government needs to borrow money.

The borrowings and other liabilities are Rs. 7,03,999 crores

As per budget 2019, Fiscal Deficit is 3.4% of Indian GDP.

Ideally, Fiscal Deficit should be kept below 3% of GDP.

Interest Payments are Rs. 6,65,061 crore!

The Indian government had already taken many loans – mainly from the public. The interest payments for the same is above Rs.6.6 lakh crore. You may note that this is just for interest payments and not for principal repayments.

The value of primary deficit denotes the borrowing which is not used for interest payments. Out of the borrowed money, only 0.2% of GDP is, in reality, available for productive purposes.

Disinvestment target is Rs.90,000 crore

The government also try to meet its expenditure by selling the shares of public limited companies. For 2019, the government hopes to get at least Rs.80,000 crore, though the target mentioned in the budget document is Rs.90,000. In 2017, the government had obtained about Rs.1,00,000 crore via disinvestment route.

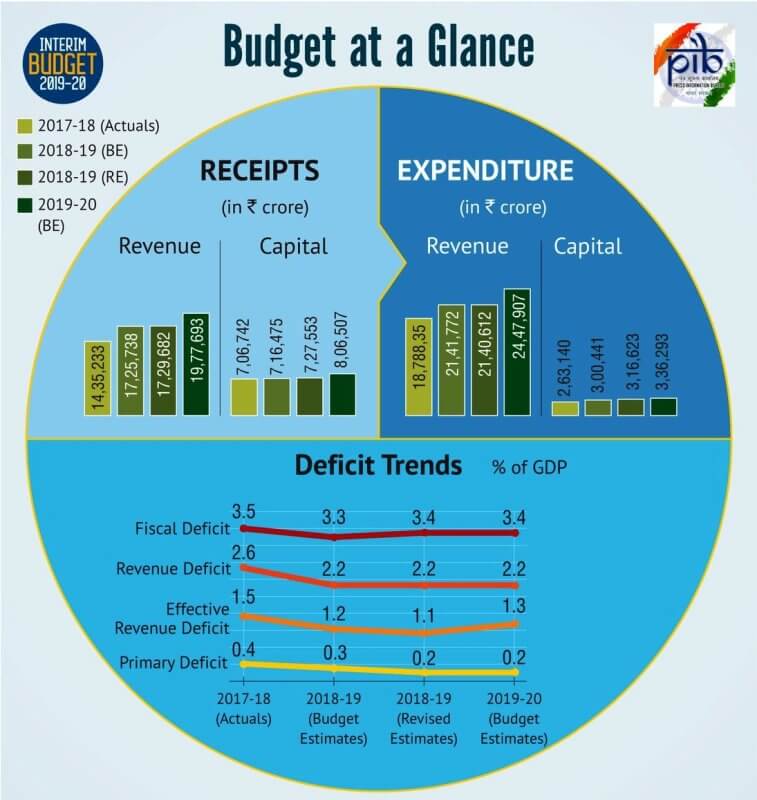

The amount dedicated to Capital Expenditure is only Rs.3,36,293 crore (12%)

Out of the total expenditure of Rs.27.84 lakh crore rupees, only Rs.3.36 lakh crore is allocated for capital expenditure (12%).

If the grants in aid given to states for capital asset creation (Rs 2 lakh crore) are also included, the total expenditure on the capital asset creation side comes only to 20% of the entire union budget.

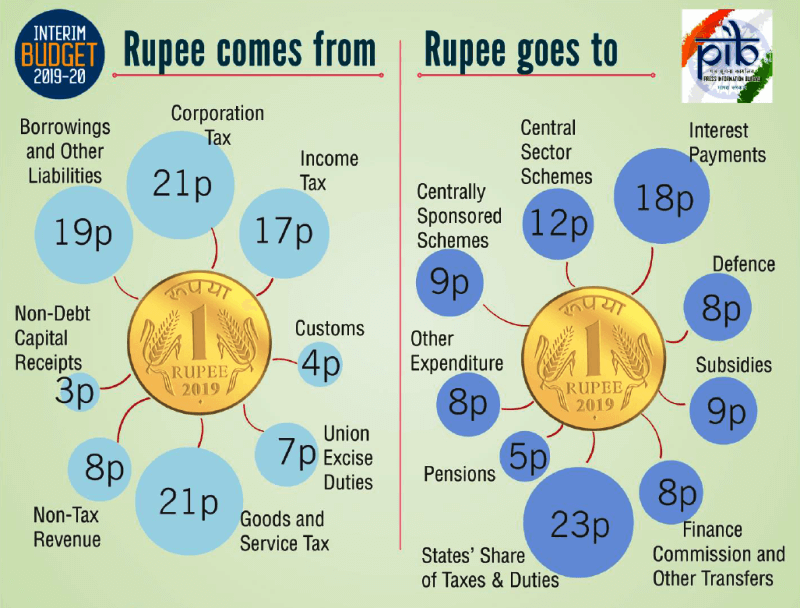

Tax Revenue is Rs.17,05,046 crore (meets only 61% of expenditure)

The Finance minister estimates a tax revenue of Rs.17 lakh crore for the financial year 2019-20. This is much higher expectations than the current year revised estimates of Rs.14.84 lakh crores.

Apart from the tax revenue of Rs.17 lakh crore, the government also expect to get Rs.2.7 lakh crore as non-tax revenue.

The total revenue receipts estimated are Rs. 19.77 lakh crore (meets only 71% of total expenditure)

Revenue receipts less than revenue expenditure by Rs. 4,70,214 crore

The total revenue receipts estimated are Rs. 19.77 lakh crore while total revenue expenditure is Rs.24.47 lakh crore.

Interim Budget 2019 – Other Highlights

- “This isn’t interim budget, this is the roadmap for development”, says Finance Minister.

- 10 point vision for 2030 to realize India’s social-economic potential; 10 trillion dollars economy in 13 years.

- Present Income Tax rates to continue; Full tax rebate up to an income of 5 lakh rupees for individual taxpayers; Standard deduction raised to 50,000, a hike of 10,000 for salaried class.

- Direct tax system simplified; Returns to be processed in 24 hours with immediate refunds.

- 90 per cent GST payers can file quarterly returns; Small and Medium Enterprises to get two per cent interest rebate on an incremental loan of one crore rupees; A Group of Ministers to examine GST burden on home buyers.

- Customs to go for digitalization of export and import transactions.

- Allocations to Defence budget crosses three lakh crore rupees for the first time.

- Allocations to Health care, MGNREGA, SC/ST welfare programmes, Pradhan Mantri Gram Sadak Yojana, Development of infrastructure in North-East hiked substantially.

- Electricity connection to all willing families by next month.

- One lakh more villages to get digital connectivity.

- A National Centre on Artificial Intelligence Centre.

- Rs.6,000 yearly direct support to farmers through PM-KISAN Programme.

- Rs. 3,000 pension for unorganised sector workers earning up to 15,000 rupees through a mega Pension Scheme – Pradhan Mantri Shram- Yogi Maandhan.

- Government e-Marketplace – GeM to be extended to all Central Public Sector Enterprises.

- Over three lakh 38 thousand shell companies deregistered after demonetization.

- A container cargo movement to the North-East through Brahmaputra river; Allocation for infrastructure development in the region hiked by 21 per cent.

- Indigenous development of semi-high speed Vande Bharat Express train.

- A separate Department of Fisheries.

- An All India Institute of Medical Sciences – AIIMS for Haryana.

- Single window clearance for shooting films to be made available to Indian filmmakers.

- Cinematograph Act to be tightened to check piracy.

- A programme for genetic up-gradation of cow – Rashtriya Kamdhenu Aayog.

Read: Interim Budget 2024

I fill great Sir, please guide and motivate continue.. Thanks a lot

Great to know that the explanations helped. All the best for your exams!

You fill what?

Need help for RAS

Although our notes are focussed for UPSC CSE, many of our topic-notes will be useful for RAS as well. We will be publishing more articles in the coming days.

Good information in simple format. Got clarity . Thank you ClearIAS.

Superb! Happy to know that you got clarity regarding the budget. All the best!

Sir

Good information

Thank you

Thank you for your valuable feedback. All the best!

thank you sir for providing us day-to-day updates

You are welcome. Thank you for your feedback. All the best!

Good explanation! When will Economic survey of 2018-19 will available

It’s our pleasure. As per the sources Economic Survey 2018-19 will be delayed. It may be presented only along General Budget 2019, after the elections.

Very helpfull.

Thankyu so much sir

Thank you for the feedback. All the best!

Very helpful

Thank you sir

Happy to know that the article helped you. All the best!

This Rs.3000/- pension to workers of unorganized sector is per month or per annum?

Monthly Pension.

Monthly pension once one will cross the age of 60.

really helpful

Great to know that. Thank you for the comment. All the best!

On behalf of all the students, I thank the team of CLEARIAS. THANKYOU MENTORS!

You’re awesome! Thanks a million!

Thank you…… so much for your great effort sir…….

You are welcome.

Awasome Explanation..thank you Clear IAS

You’re welcome.

I had read more articles about current budget but this is the best one to understand in a clear manner…

now there is no union excise duty,now gst has been implemented.In revenue part of Rs1 -you mentioned 7% goes to Union Excise duty.It is contradicting with GST.

Sir please Provide economy and modern history key notes for group 2 exams

Thanks for your value added materials on multiole subjects and free services sir.

Good Evening sir,

Good information.

Thank you sir 🙏

Sir, Its really helping us a lot. Thank you