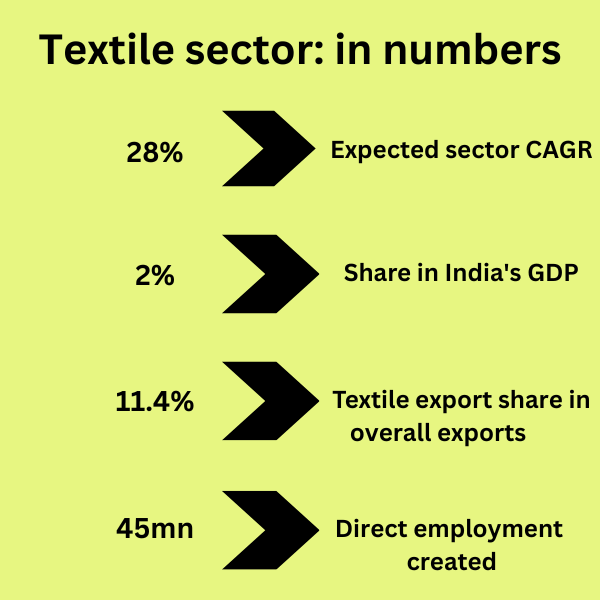

About 2% of India’s GDP, or 7% of industry output in value terms, comes from the domestic garment and textile sector. It is also one of the largest employers in the country. This signifies the importance of the textile sector to the Indian economy.

About 2% of India’s GDP, or 7% of industry output in value terms, comes from the domestic garment and textile sector. It is also one of the largest employers in the country. This signifies the importance of the textile sector to the Indian economy.

What are the challenges faced by the textile sector in India?

What are the major initiatives taken by the government for its development?

To know all these read further.

Industry scenario

From fiber, yarn, and fabric to garments, India’s textile and apparel industry has strengths along the whole value chain. The traditional handloom, handicrafts, wool, and silk items, as well as the organized textile industry in India, make up a large portion of the widely diversified Indian textile and apparel market.

The organized textile sector in India, which encompasses spinning, weaving, processing, and garment production, is characterized by the employment of capital-intensive equipment for the mass production of textile items.

Significance of the sector

- Economical: In 2019–20, the domestic textile and apparel market was worth $150.5 billion.

- Trade: India registered $ 41 bn in textile exports in CY 2021, with a CAGR (2.7) marginally higher than the global average.

- Employment: The second-largest employer in India, the textile and garment sector employs 100 million people in supporting sectors in addition to 45 million workers directly.

- Raw material for other sectors: Technical textiles are useful materials that are used in a variety of fields, such as automotive, civil engineering, healthcare, agricultural, personal protection, and construction.

Growth drivers of the textile sector

- Plenty of raw materials

- Availability of entire value availability of entire value

- Affordable production prices

- Availability of qualified personnel

- Substantial and expanding domestic market

- Rising disposable incomes, increasing per capita income, and brand preferences

- E-Commerce and the organized retail landscape

- Attention on technical textiles has increased as a result of the expansion of end-user industries such as the automotive, healthcare, infrastructure, and oil and petroleum industries

- Under the Atmanirbhar Bharat package, the Production-Linked Incentive (PLI) Scheme in Man-made Fiber and Technical Textiles has a cash expenditure of INR 10,683 Cr.

Major textile manufacturing players

Also read: Distribution of major industries: location factors

Challenges faced by the textile sector

- Highly fragmented: The unorganized sector and small and medium-sized businesses dominate India’s textile industry, which is highly fragmented.

- Outdated Technology: Due to market competition and access issues, the Indian textile sector struggles to keep up with international standards. This is especially true of small-scale businesses.

- Issues with Tax Structure: The GST (Goods and Service Tax) tax structure makes clothing expensive and uncompetitive in both domestic and foreign markets. The threat of growing labor and worker salaries is another.

- Exports Stagnant: For the past six years, the sector’s exports have stayed constant at a level of USD 40 billion.

- Lack of Scale: Bangladesh has at least 500 machines per factory on average, whereas the average size of the textile units in India is only 100, which is significantly smaller.

- Lack of Foreign Investment: One of the concerns is that there is a lack of foreign investment in the textile business because of the issues mentioned above.

Also read: Handloom Sector in India

Government initiatives to promote the growth of the textile sector

- Amended Technology Upgradation Fund Scheme (ATUFS): In order to modernize the textile industry’s technology, the government approved the “Amended Technology Upgradation Fund Scheme (ATUFS)” in 2015.

- The Scheme for Integrated Textile Parks (SITP) aims to help small and medium-sized textile business owners cluster investments in textile parks by providing financial support for the parks’ top-notch infrastructure.

- The SAMARTH (Scheme for Capacity Building in the Textile Sector): The government started the SAMARTH Scheme for Capacity Building in Textile Sector (SCBTS) to alleviate the scarcity of trained people.

- The North East Region Textile Promotion Scheme (NERTPS) is a program that supports all areas of the textile industry with infrastructure, capacity building, and marketing assistance.

- Power-Tex India: It includes innovative power-loom textile research and development, new markets, branding, subsidies, and worker welfare programs.

- The Silk Samagra Scheme seeks to lessen the nation’s reliance on imported silk by enhancing the quality and productivity of domestically produced silk.

- ICARE Jute: This pilot initiative, which was started in 2015, aims to help jute growers overcome their challenges by offering certified seeds at discounted prices and by popularizing many recently developed retting technologies under water-restrictive conditions.

- The National Technical Textile Mission: It seeks to enhance domestic technical textile consumption while establishing the nation as a global leader in the field. By 2024, it hopes to increase the size of the domestic market to between $40 billion and $50 billion USD.

- PM Mega Integrated Textile Region and Apparel (PM MITRA) Parks: It aims to integrate the entire textile value chain from spinning, weaving, processing/dyeing, printing to garment manufacturing at one location.

IndiaTEX

The project ‘Accelerating the Transition of the Indian Textile Sector towards Circularity’ (IndiaTex) is a four-year UNEP project funded by the Ministry of Foreign Affairs of Denmark and implemented in collaboration with the Government of India’s Ministry of Textiles. IndiaTex aims to accelerate the transition of the Indian textile sector towards circularity.

The textile sector is crucial for India’s economy and workforce. In an interconnected global value chain, integrating circular practices will improve the sector’s competitiveness and market access. India’s textile clusters are a particularly effective method to speed India’s transition to circularity.

Project duration: From December 2023 to December 2027

The project will work with the industry at the brand level and in two textile clusters in India:

- Support SMEs in clusters to calculate their Product Environmental Footprint (PEF)

- Support SME brands to implement and communicate about circular business models

With the India Government, the project will:

- Build capacity and support the development and implementation of circular textile policies.

- Create convening opportunities for government, companies, and organizations to coordinate and align on circular textiles ambition at the national, regional, and global levels.

Who is the project targeting?

- Businesses, particularly SMEs, must integrate life cycle approaches into their business practices and implement circular business models if they are to not only stay ahead of increasing environmental regulations but also improve their competitiveness and market access.

- The Indian government has set high ambitions for the competitiveness of its textile sector and its sustainability performance; it is also looking to match this with a suite of policies and instruments that not only encourage a shift towards competitive circularity while take into account the needs of SMEs.

Way forward

The textile industry has a lot of potential, which should be realized by utilizing innovations, cutting-edge technology, and facilities.

India can organize the sector by establishing massive clothing parks and shared textile manufacturing infrastructure. The modernization of outdated equipment and technologies should be the main focus.

India requires a detailed plan for the textile industry. Once something is created, the nation must go into mission mode to accomplish it.

Article written by: Caroline Abraham

Leave a Reply