The Reserve Bank of India (RBI) releases an annual report on currency and finance, providing insights into the performance of the Indian economy, the status of various financial sectors, and policy measures. The 2023-24 report addresses the aftermath of the pandemic, economic recovery, and prospects for future growth. Read here to know more.

Digitalisation is driving growth in India’s services exports and lowering remittance costs. India’s digital journey is setting a benchmark for peer economies.

The Reserve Bank’s initiatives for internationalisation of home-grown payment modes, cross-border fast payment network linkages and knowledge and experience sharing with peers are energising the transformation of its digital public infrastructure as a global public good.

At the same time, digitalisation also presents challenges related to cybersecurity, data privacy, data bias, vendor and third-party risks, and customer protection. Increased inter-connectedness may lead to systemic risks.

Report on Currency and Finance 2023-24: Key Highlights

- Economic Recovery Post-Pandemic:

- The report indicates a strong rebound in economic activity, driven by robust domestic demand and supportive fiscal and monetary policies.

- GDP growth is projected to be higher than pre-pandemic levels, supported by various government initiatives and private sector investment.

- The digital economy currently accounts for 10% of India’s GDP. By 2026, this figure is expected to double, contributing to 20% of GDP, driven by rapid advancements in digital infrastructure and financial technology.

- Inflation and Monetary Policy:

- Inflation remains a critical focus, with the RBI maintaining a balanced approach to keep inflation within the targeted range.

- The report highlights the challenges posed by global supply chain disruptions and geopolitical tensions, impacting inflation rates.

- Financial Stability:

- The report underscores the stability of the Indian banking system, noting improvements in asset quality and capital adequacy ratios.

- Non-performing assets (NPAs) have declined, and the banking sector is better positioned to support economic growth.

- Digital and Financial Inclusion:

- Emphasis on digital payments and financial inclusion continues, with significant growth in digital transaction volumes.

- Initiatives like the Unified Payments Interface (UPI) and financial literacy programs are highlighted as key drivers of inclusion.

- Over two lakh gram panchayats have been connected through BharatNet in the last decade, enabling the provision of services like e-health, e-education and e-governance in rural areas.

- India’s cost per gigabyte (GB) of data consumed is the lowest globally at an average of Rs. 13.32 per GB.

- External Sector:

- The report discusses the external sector’s performance, including trade balance, foreign exchange reserves, and exchange rate movements.

- India’s export performance has shown resilience, with a diversified export base contributing to overall economic stability.

- Internationalisation of Digital Public Infrastructure:

- Collaborating with other nations to develop digital identity solutions under the Modular Open Source Identity Platform (MOSIP) programme.

- Interlinkage of the UPI with fast payment systems of other nations like Singapore’s PayNow, the United Arab Emirates (UAE) Instant Pay Platform (IPP) and Nepal’s National Payments Interface (NPI) for cost-effective and fast remittances.

- Public Finances:

- Fiscal consolidation is a priority, with the government aiming to reduce the fiscal deficit while ensuring adequate expenditure on infrastructure and social sectors.

- The report outlines the steps taken to improve tax compliance and broaden the tax base.

- Structural Reforms:

- The report details various structural reforms undertaken to enhance productivity and competitiveness, including labour reforms, ease-of-doing business initiatives, and sector-specific policies.

- Agricultural and manufacturing sectors receive particular attention for their role in driving sustainable growth.

Read: India Stack

Policy Recommendations

- Sustained Fiscal and Monetary Support:

- Continued fiscal and monetary support is recommended to ensure a full and inclusive economic recovery.

- Focus on targeted interventions to support vulnerable sectors and populations.

- Inflation Management:

- Vigilance on inflationary pressures with a readiness to adjust monetary policy as needed.

- Enhancing supply chain efficiencies and addressing bottlenecks to control cost-push inflation.

- Financial Sector Reforms:

- Further reforms to strengthen the financial sector, including enhancing regulatory frameworks and promoting innovation.

- Encouragement of consolidation and capitalization in the banking sector to improve resilience.

- Promoting Digital Economy:

- Expanding digital infrastructure and ensuring robust cybersecurity measures to support the growing digital economy.

- Policies to foster innovation and competition in the fintech space.

- Global Integration:

- Strategies to deepen global integration, including trade agreements and investment treaties.

- Measures to attract foreign direct investment (FDI) and enhance export competitiveness.

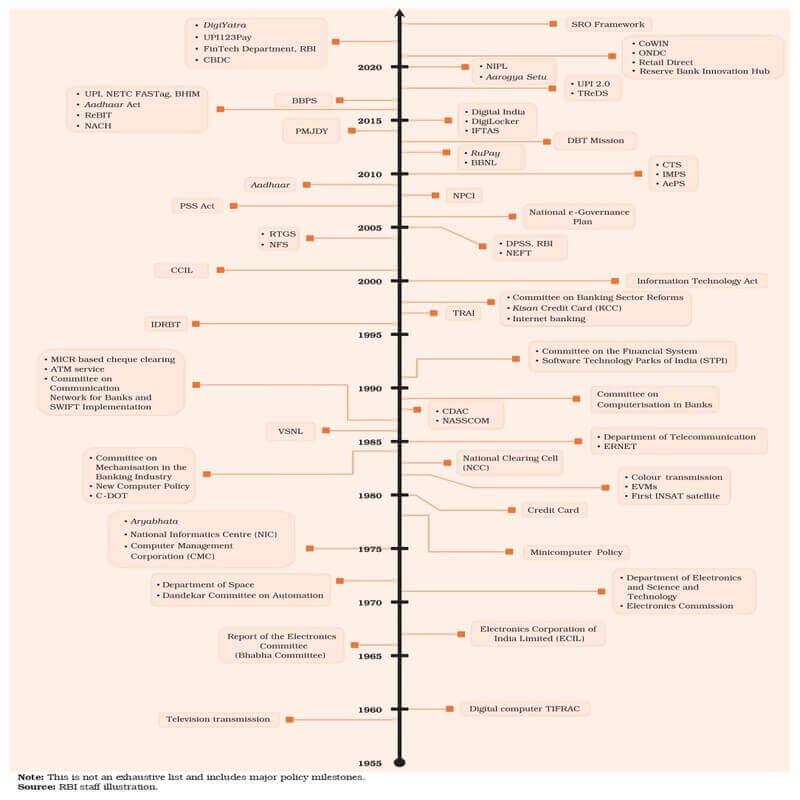

History of India’s digitalisation

Phase I: Digital Awakening (1950s-1980s)

In the 1980s, a significant shift towards computerisation began:

- Committee on Mechanisation in the Banking Industry, 1984 (Chairman: Dr. C. Rangarajan);

- Committee on Communication Network for Banks and SWIFT Implementation, 1987 (Chairman: Shri T.N.A. Iyer) and

- Committee on Computerisation in Banks, 1989 (Chairman: Dr. C. Rangarajan).

These initial efforts paved the way for electronic data processing in banks, the introduction of automated teller machine (ATM) networks and credit cards, and the implementation of BANKNET and Magnetic Ink Character Recognition (MICR)-based systems. Banks progressed from standalone computers to local area networks (LANs) and core banking platforms.

Phase II: Liberalisation and the InfoTech Boom (1990s)

During the 1990s, India underwent advancements in computer and telecommunication technologies, influenced by the emergence of the Internet.

- The establishment of the Centre for Development of Telematics (C-DOT) and industry associations like the National Association of Software and Service Companies (NASSCOM) laid the foundation for further telecom advancements and modern digital banking.

- The granting of statutory recognition to the SEBI, the establishment of the National Stock Exchange (NSE) and the subsequent shift from public outcry systems to the dematerialisation of securities democratised access to capital markets.

- Following the recommendations of the Narasimham Committees and the active support of the Reserve Bank, the decade saw rapid technological modernisation in banking, including the launch of the Indian Financial Network (INFINET) and the adoption of Internet banking during the late 1990s.

Phase III: Building the Institutional and Legal Framework (2000 – 2016)

The Information Technology Act of 2000 set the stage by providing legal recognition to electronic transactions and filings.

Following major advancements in digital payment systems support the rapidly growing payments industry:

- Real Time Gross Settlement (RTGS) in 2004

- National Electronic Funds Transfer (NEFT) in 2005

- Payment and Settlement Systems Act of 2007

The National Payments Corporation of India (NPCI) was established in 2008, which led to the shift towards digitalisation of retail payments which reached a high point with the launch of the UPI in 2016.

The Indian Financial Technology and Allied Services (IFTAS) was set up in 2015 to provide crucial IT services for the Reserve Bank, and other banks and financial institutions.

Supporting these initiatives, the government undertook key initiatives such as:

- Aadhaar project (2009),

- National Telecom Policy (2012),

- Direct Benefit Transfer Scheme (2013) and

- Pradhan Mantri Jan-Dhan Yojana (2014),

- Jan Dhan-Aadhaar-Mobile (JAM) trinity.

- The Digital India Mission (2015) and Startup India Mission (2016) were also launched to enhance digital infrastructure and innovation.

Phase IV: Digital Financial Innovation at Centre Stage (2017 onwards)

- By 2017, India established a robust digital infrastructure, positioning itself as a leader in innovative, large-scale payment systems.

- The launch of Central Bank Digital Currency (CBDC) pilots and initiatives like the Regulatory Sandbox (2019), the Reserve Bank Innovation Hub (2021) and the pilot Public Tech Platform for Frictionless Credit (PTPFC) [2023] fostered FinTech innovations.

- Currently, the internationalisation of home-grown payment modes is also progressing rapidly, enabling cross-border transfers and projection of India’s soft power.

Challenges Posed by Digitalisation

Impact on Financial Markets

- Complex Financial Products and Services:

- Digitalisation has introduced a range of complex financial products and services, which have significantly altered market structures and financial stability.

- The emergence of digital players with unreliable funding models adds to system vulnerabilities, posing challenges to the overall financial stability.

- Market Structure Changes:

- The hyper-diversification of financial services could result in a “barbell” financial structure, where a few dominant multi-product players coexist with numerous niche service providers. This scenario creates a unique set of risks and regulatory challenges.

Fear of Monopolisation

- UPI Dominance:

- The proliferation of Unified Payments Interface (UPI) applications in India has expanded customer choices and increased transaction volumes.

- Despite the variety of applications, a significant share of transactions is dominated by a few applications. This dominance is measured by the Herfindahl-Hirschman Index (HHI), which indicates market concentration and competitiveness.

- Regulatory Measures:

- To mitigate concentration risks, the National Payments Corporation of India (NPCI) has implemented a cap on the market share of single third-party application providers, limiting them to 30% by December 2024. This measure aims to ensure a more competitive and balanced market.

Cyber Security Challenges

- Increase in Cyber Threats:

- The diverse nature of cyber threats targeting digital financial infrastructure is a major concern.

- In India, the number of security incidents reported to the Indian Computer Emergency Response Team (CERT-In) has surged from 53,117 in 2017 to over 1.32 million between January and October 2023. These incidents predominantly involve unauthorized network scanning, probing, and exploitation of vulnerable services.

- Cost of Data Breaches:

- The average cost of a data breach in India in 2023 was USD 2.18 million. While this is lower than the global average, it still represents a significant financial burden and underscores the need for robust cybersecurity measures.

Consumer Protection Issues

- Dark Patterns:

- Digitalisation has led to the emergence of dark patterns, where consumers are manipulated into making decisions against their interests. These deceptive practices erode consumer trust and highlight the need for stringent regulatory oversight.

- Data Protection and Privacy:

- The extensive use of customer data by companies raises significant concerns about data protection and privacy. Ensuring that customer data is handled responsibly and transparently is crucial for maintaining consumer trust in digital financial services.

Conclusion

The RBI’s Report on Currency and Finance 2023-24 provides a comprehensive overview of the Indian economy’s performance and outlines policy measures to sustain growth. It emphasizes the need for balanced and inclusive growth strategies, focusing on digital inclusion, financial stability, and structural reforms.

Frequently Asked Questions (FAQs)

Q. Who publishes the report on Currency and finance?

Ans: The Reserve Bank of India releases the Report on Currency and Finance (RCF).

Q. What is the theme of the RBI report on Currency and Finance 2023-24?

Ans: The theme of the Report is “India’s Digital Revolution”. It focuses on the transformative impact of digitalization across various sectors in India, particularly in the financial industry.

Also read: De-dollarization: BRICS nations mull local currencies for trade

-Article by Swathi Satish

Leave a Reply